Get the free TOTAL AVERAGE QUALIFIED PAID &

Show details

BUSINESS PUBLICATION

PUBLISHERS STATEMENT

Subject to Audit

For the 6-month period ending

June 30, 2012

Field Served:

Professional Salon Industry.

This is an independent publication not directly related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign total average qualified paid

Edit your total average qualified paid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your total average qualified paid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing total average qualified paid online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit total average qualified paid. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out total average qualified paid

Instructions for filling out total average qualified paid:

01

Begin by gathering all relevant data related to the total average qualified paid. This may include information such as employee salaries, hours worked, and any additional earnings or benefits.

02

Calculate the total earnings of each employee for the specified period. This can be done by adding up all the wages or salaries earned during that time frame.

03

Determine the total number of employees included in the calculation. This could be the entire workforce or a specific department or group of employees.

04

Divide the total earnings by the number of employees to calculate the average qualified paid per employee. This will give you an idea of the average amount paid to each employee for the given period.

05

Ensure that all relevant expenses or deductions are taken into account while calculating the total average qualified paid. This might include taxes, benefits, or any other withholdings.

06

Double-check your calculations to ensure accuracy. Mistakes in the calculations could lead to incorrect average figures.

Who needs total average qualified paid?

01

Employers or business owners: They need total average qualified paid to monitor and assess the financial aspect of their organization. It helps them understand the overall wage distribution and evaluate the level of compensation provided to employees.

02

HR and payroll departments: These departments require total average qualified paid to accurately process payroll, manage employee benefits, and ensure compliance with industry standards or legal requirements.

03

Managers and supervisors: They utilize total average qualified paid to evaluate the performance and efficiency of their teams. By comparing the average pay of employees, they can identify disparities and potential areas for improvement.

04

Financial analysts or consultants: These professionals may rely on total average qualified paid to assess the financial health of an organization. It provides insights into labor costs and assists in making strategic decisions related to budgeting or forecasting.

05

Government agencies or labor authorities: These entities may request total average qualified paid data to conduct audits, monitor labor market trends, or enforce labor regulations.

In summary, understanding how to fill out total average qualified paid is essential for accurately evaluating employee compensation and assessing financial aspects within an organization. It is required by various stakeholders such as employers, HR departments, managers, financial analysts, and government agencies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get total average qualified paid?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the total average qualified paid in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out total average qualified paid using my mobile device?

Use the pdfFiller mobile app to fill out and sign total average qualified paid on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out total average qualified paid on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your total average qualified paid, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

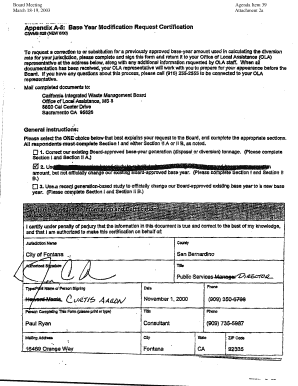

What is total average qualified paid?

Total average qualified paid is the sum of all qualified payments divided by the total number of payments.

Who is required to file total average qualified paid?

Employers and businesses who have made qualified payments are required to file total average qualified paid.

How to fill out total average qualified paid?

Total average qualified paid can be filled out by calculating the total amount of qualified payments and dividing it by the total number of payments made.

What is the purpose of total average qualified paid?

The purpose of total average qualified paid is to track and report the average amount of qualified payments made by a business.

What information must be reported on total average qualified paid?

The total amount of qualified payments and the total number of payments made must be reported on total average qualified paid.

Fill out your total average qualified paid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Total Average Qualified Paid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.