Get the free Gift of mutual funds - Rackcdn.com

Show details

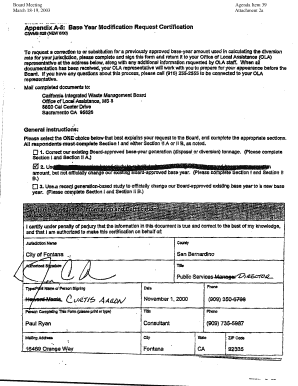

GIFT OF MUTUAL FUNDS This form cannot be used to transfer mutual funds. Please give this original form to your broker and copy to WCC. Donor Information Donor Name(s): Street Address: City: State:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift of mutual funds

Edit your gift of mutual funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift of mutual funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift of mutual funds online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gift of mutual funds. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift of mutual funds

How to fill out a gift of mutual funds:

01

Determine the mutual fund: Research and choose the specific mutual fund that you would like to gift. Consider factors such as the fund's performance, risk level, and investment objectives.

02

Contact the mutual fund company: Reach out to the mutual fund company to inquire about their specific process for gifting shares. They will provide you with the necessary forms and instructions.

03

Provide the recipient's information: Fill out the required forms, providing the recipient's name, social security number, and any other requested details. This ensures the shares are properly transferred to the intended person.

04

Choose the gift amount or number of shares: Indicate the desired gift amount or the number of shares you wish to transfer. Some mutual fund companies may have minimum or maximum gift requirements.

05

Specify the gift type: Decide whether you want to make an outright gift or establish a gift trust. Outright gifts transfer ownership immediately, while gift trusts allow for more control over the funds and potential tax advantages.

06

Consider tax implications: Consult with a tax advisor to understand the potential tax consequences of gifting mutual funds. Depending on the value of the gift and the recipient's personal circumstances, there may be tax implications to consider.

Who needs gift of mutual funds:

01

Individuals seeking to financially assist loved ones: A gift of mutual funds can be a thoughtful and practical way to help friends or family members achieve their financial goals, such as saving for education, retirement, or purchasing a home.

02

Individuals interested in investment diversification: Mutual funds provide an opportunity to diversify investments across various asset classes, sectors, and geographic regions. For those looking to expand their investment portfolio, gifting mutual funds can be a way to introduce diversification.

03

Individuals interested in long-term financial growth: Mutual funds have the potential for long-term capital appreciation. By gifting mutual funds, individuals can help others build their wealth over time and potentially benefit from compounding returns.

04

Individuals seeking to teach financial responsibility: Gifting mutual funds can be an educational tool to teach financial responsibility to younger individuals or those new to investing. It can help them learn about investment strategies, monitor their funds' performance, and develop a long-term savings mindset.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gift of mutual funds directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your gift of mutual funds along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make edits in gift of mutual funds without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your gift of mutual funds, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit gift of mutual funds on an iOS device?

Create, edit, and share gift of mutual funds from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is gift of mutual funds?

A gift of mutual funds is a transfer of ownership of mutual fund shares from one person to another as a gift.

Who is required to file gift of mutual funds?

The recipient of the mutual fund gift is required to file a gift tax return if the value of the gift exceeds the annual exclusion amount set by the IRS.

How to fill out gift of mutual funds?

To fill out a gift of mutual funds, one must report the details of the gift, including the value of the mutual funds transferred and any relevant information about the giver and recipient.

What is the purpose of gift of mutual funds?

The purpose of a gift of mutual funds is to transfer ownership of mutual fund shares as a gift without incurring a taxable event for the giver.

What information must be reported on gift of mutual funds?

The information that must be reported on a gift of mutual funds includes the value of the mutual funds at the time of the gift, the date of the gift, and the relevant personal information of the giver and recipient.

Fill out your gift of mutual funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Of Mutual Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.