Get the free Long Term Care Insurance Proposal Request Form - ISG - isgi

Show details

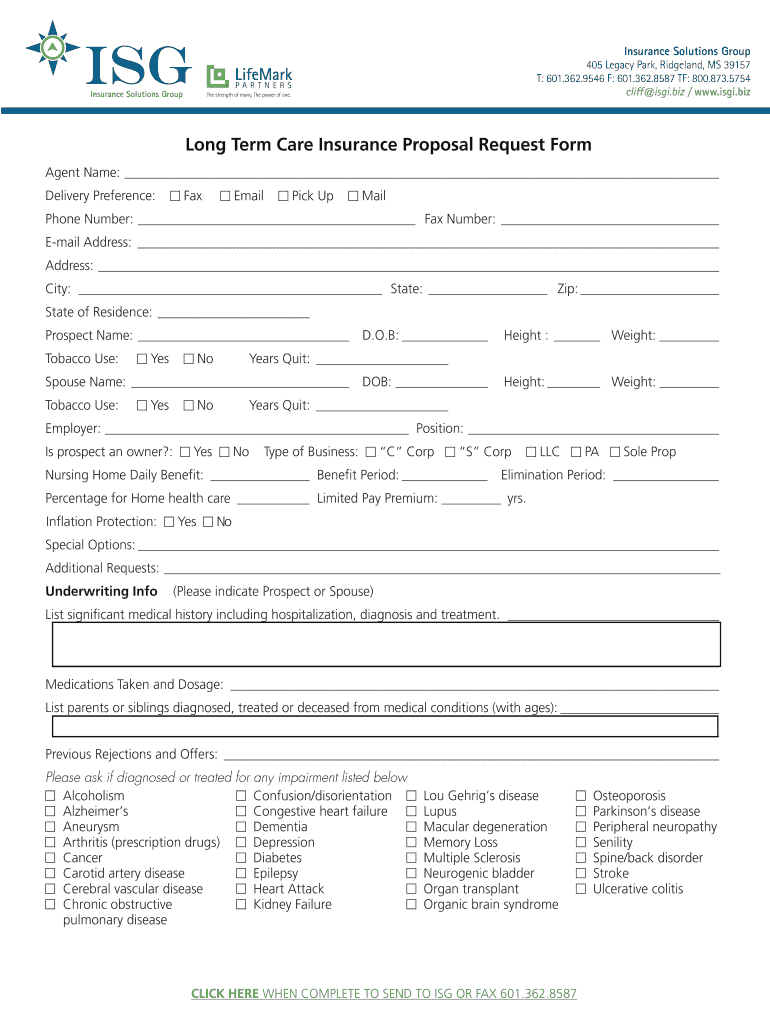

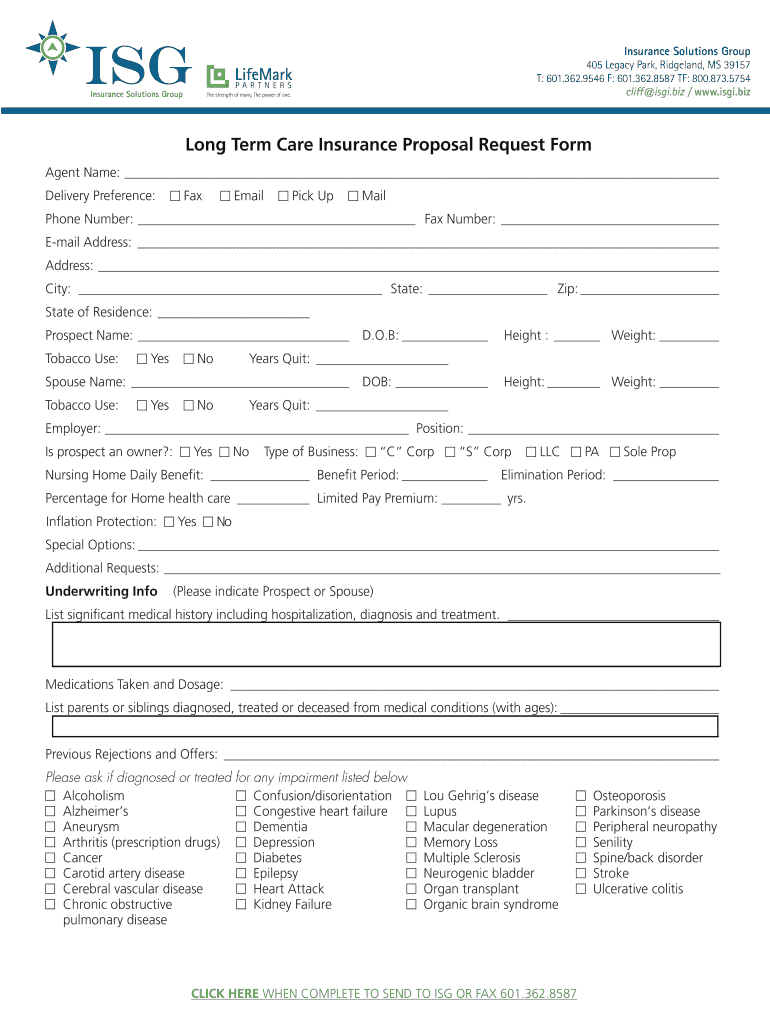

Insurance Solutions Group 405 Legacy Park, Ridgeland, MS 39157 T: 601.362.9546 F: 601.362.8587 TF: 800.873.5754 cliff SGI.biz / www.isgi.biz Life Mark PARTNERS Insurance Solutions Group The strength

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long term care insurance

Edit your long term care insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long term care insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit long term care insurance online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long term care insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long term care insurance

How to fill out long term care insurance:

01

Start by gathering all relevant information, including personal and contact details, date of birth, and current health status.

02

Research different insurance providers and policies to find the best fit for your specific needs and budget.

03

Fill out the application form accurately and provide all the necessary information, including any pre-existing conditions or medical history.

04

Review the policy terms and conditions carefully, paying attention to coverage limits, waiting periods, and any exclusions or limitations.

05

Consider seeking professional help or consulting with an insurance agent or financial advisor for guidance in understanding the policy and making informed decisions.

06

Submit the completed application along with any required supporting documents, such as medical records or financial statements.

07

Follow up with the insurance provider to ensure your application has been received and processed.

08

Once approved, make sure to understand the payment terms and schedule, and set up automatic payments if possible to avoid any lapses in coverage.

Who needs long term care insurance:

01

Individuals who want to ensure they have financial protection in the event of a long-term illness, disability, or injury that requires extended care.

02

Those who have a family history of chronic illnesses or conditions that may require long-term care.

03

Individuals who want to protect their assets and avoid depleting their savings or burdening their loved ones with the high costs of long-term care.

04

People who do not have a reliable support system or family members available to provide care in case of need.

05

Individuals who want to have more control and flexibility in choosing the type and location of care they receive.

06

Those who want to have peace of mind knowing that their long-term care needs will be covered, allowing them to focus on their health and well-being.

07

Younger individuals who want to secure coverage at a lower cost and avoid potential future rate increases based on age or health changes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my long term care insurance directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your long term care insurance and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find long term care insurance?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the long term care insurance in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete long term care insurance online?

With pdfFiller, you may easily complete and sign long term care insurance online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

What is long term care insurance?

Long term care insurance is a type of insurance coverage that provides for the cost of long-term services and supports for individuals who need assistance with daily activities due to chronic illness, disability, or cognitive impairment.

Who is required to file long term care insurance?

Long term care insurance is typically purchased by individuals who want to protect themselves from the high costs of long-term care services that are not covered by traditional health insurance or Medicare.

How to fill out long term care insurance?

To fill out long term care insurance, individuals must contact an insurance provider or agent to discuss coverage options, premiums, and any specific requirements for the application process.

What is the purpose of long term care insurance?

The purpose of long term care insurance is to provide financial protection and peace of mind to individuals who may require long-term care services in the future, helping them avoid depleting their savings or assets.

What information must be reported on long term care insurance?

Information that must be reported on long term care insurance typically includes personal details, medical history, desired coverage amounts, and any additional riders or benefits.

Fill out your long term care insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long Term Care Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.