Get the free APPLICATION FOR RESORT TAX FUNDS - parkcounty

Show details

This document is a request for applications for Resort Tax Funds distributed by the Park County Clerk and Recorder's Office, detailing the application process and submission guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for resort tax

Edit your application for resort tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for resort tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for resort tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for resort tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

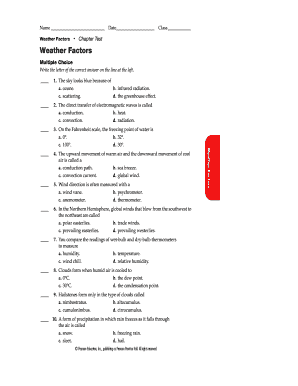

How to fill out application for resort tax

How to fill out APPLICATION FOR RESORT TAX FUNDS

01

Obtain the APPLICATION FOR RESORT TAX FUNDS form from the relevant authority or website.

02

Read the instructions carefully to understand the eligibility and requirements.

03

Fill out your organization's name, address, and contact information in the designated fields.

04

Provide a detailed description of the project or program for which you are requesting funds.

05

Include a budget outlining the total costs and how the funds will be allocated.

06

Attach any required documentation such as financial statements or proof of past projects.

07

Review your application for accuracy and completeness before submission.

08

Submit the application by the specified deadline either online or by mailing it to the appropriate office.

Who needs APPLICATION FOR RESORT TAX FUNDS?

01

Local governments and municipalities seeking funding for tourist-related projects.

02

Non-profit organizations involved in promoting local tourism.

03

Businesses that are planning events or projects that boost local tourism.

04

Community groups that aim to improve local amenities for visitors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR RESORT TAX FUNDS?

APPLICATION FOR RESORT TAX FUNDS is a formal request submitted to local government or relevant authorities seeking financial assistance from taxes collected on resort-related activities to support tourism development and infrastructure.

Who is required to file APPLICATION FOR RESORT TAX FUNDS?

Organizations, businesses, or municipalities that provide or promote tourism services and wish to receive funding from resort tax revenues are typically required to file the APPLICATION FOR RESORT TAX FUNDS.

How to fill out APPLICATION FOR RESORT TAX FUNDS?

To fill out the APPLICATION FOR RESORT TAX FUNDS, applicants must carefully complete all required sections, including organizational information, proposed project details, budget estimates, and intended outcomes, ensuring accuracy and clarity throughout.

What is the purpose of APPLICATION FOR RESORT TAX FUNDS?

The purpose of APPLICATION FOR RESORT TAX FUNDS is to facilitate the allocation of tax revenues designated for tourism and resort-related projects that enhance community resources, promote economic growth, and improve visitor experiences.

What information must be reported on APPLICATION FOR RESORT TAX FUNDS?

The information that must be reported on APPLICATION FOR RESORT TAX FUNDS typically includes the applicant's contact details, project description, timeline, funding needs, expected benefits, and any supporting documentation relevant to the request.

Fill out your application for resort tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Resort Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.