Get the free MET 2 ADJ

Show details

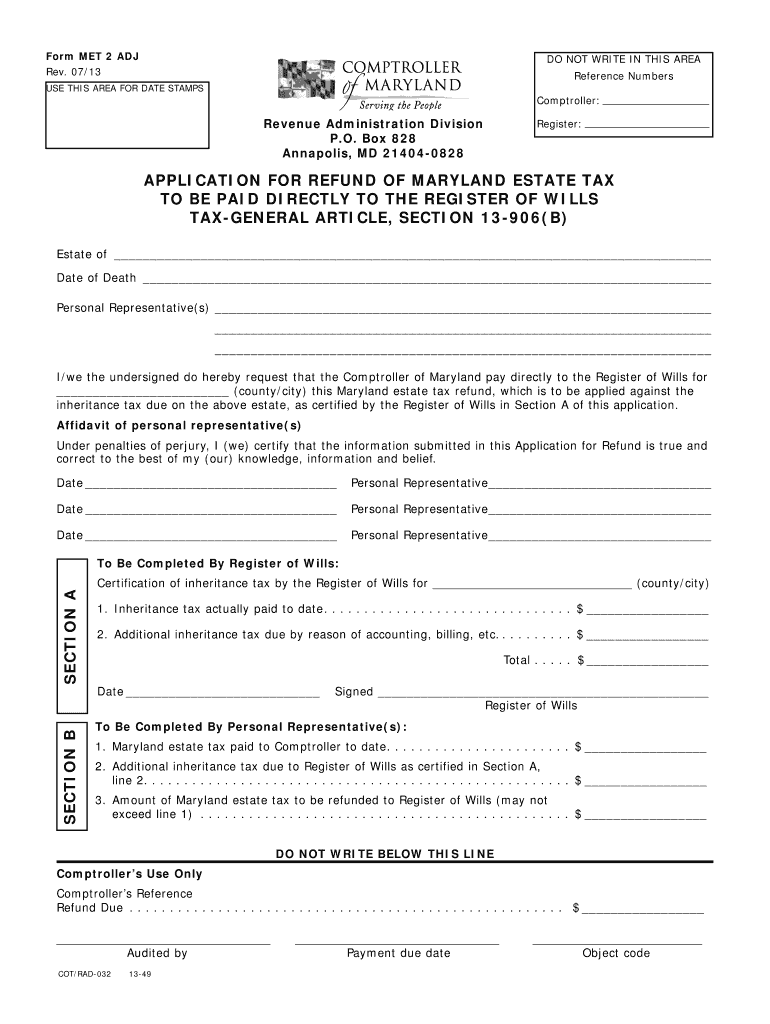

This form is used to apply for a refund of Maryland estate tax, which is to be paid directly to the Register of Wills to offset the inheritance tax due on an estate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign met 2 adj

Edit your met 2 adj form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your met 2 adj form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing met 2 adj online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit met 2 adj. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out met 2 adj

How to fill out MET 2 ADJ

01

Gather necessary personal information, including your name, address, and identification details.

02

Review the instructions provided on the MET 2 ADJ form to understand the sections required.

03

Fill in the personal information section accurately and clearly.

04

Provide details of the adjustment you are requesting, including any relevant dates and figures.

05

Attach any required supporting documents that substantiate your request.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to validate it.

08

Submit the form as directed in the instructions, whether online, by mail, or in person.

Who needs MET 2 ADJ?

01

Individuals or entities seeking an adjustment to their existing MET (Metropolitan Employment Tax) filing.

02

Taxpayers who have experienced changes in income or residency status affecting their MET obligations.

03

Those who believe they have overpaid or incorrectly reported their MET in previous filings.

Fill

form

: Try Risk Free

People Also Ask about

What does "meet" mean as a verb?

Meet is a verb that means to come into the presence or company of someone, especially by arrangement or by chance. It also can mean to encounter or experience something.

What is the adjective of meet?

meetable, adj. 1868– meet-and-greet, adj.

What are common uses of "meet"?

: to come into the presence of for the first time : to be introduced to or become acquainted with. I'm pleased to meet you. Where did you two meet each other? I met him in college. We met her through a mutual friend.

Is met a verb or adjective?

verb. simple past tense and past participle of meet.

Is meet an adjective?

Examples include words like enormous, doglike, silly, yellow, fun, and fast. Adjectives have three forms: absolute (describing one thing, like messy), comparative (comparing two things, like messier), and superlative (indicating the highest degree, like messiest).

What are 5 examples of adjectives?

verb. simple past tense and past participle of meet.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MET 2 ADJ?

MET 2 ADJ is a form used for reporting adjustments related to the Modified Exempt Tax (MET) for certain taxpayers.

Who is required to file MET 2 ADJ?

Taxpayers who have made adjustments to their MET filings must file MET 2 ADJ to correct or update their tax records.

How to fill out MET 2 ADJ?

To fill out MET 2 ADJ, taxpayers should provide necessary information such as taxpayer identification, the nature of the adjustments, and any supporting documentation required.

What is the purpose of MET 2 ADJ?

The purpose of MET 2 ADJ is to ensure accurate reporting of adjustments to the Modified Exempt Tax, allowing for proper tax assessment and compliance.

What information must be reported on MET 2 ADJ?

The MET 2 ADJ must report taxpayer identification details, the type of adjustment being made, previous and current amounts, and any relevant dates or documentation.

Fill out your met 2 adj online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Met 2 Adj is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.