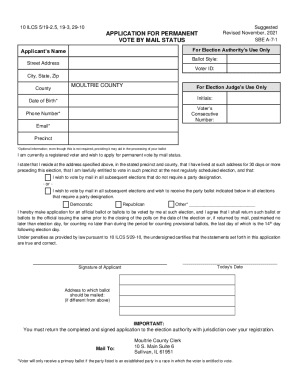

Get the free ET-411

Show details

This form is used to compute the estate tax credit for agricultural exemption for estates of decedents who died after May 25, 1990. It involves calculations regarding the value of qualifying property

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign et-411

Edit your et-411 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your et-411 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing et-411 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit et-411. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

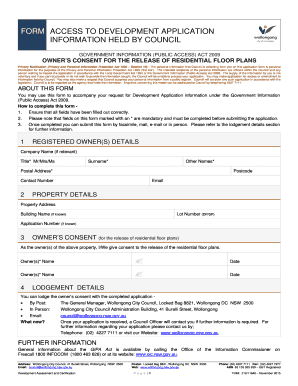

How to fill out et-411

How to fill out ET-411

01

Obtain a copy of the ET-411 form from the appropriate taxing authority's website.

02

Fill in your personal information at the top of the form, including your name, address, and any relevant identification numbers.

03

Provide details about your business, including the name and type of entity.

04

List all applicable taxes that you are required to report.

05

Complete any additional sections as required, ensuring accuracy in calculations.

06

Review all information filled out on the form for completeness and correctness.

07

Sign and date the form where indicated.

08

Submit the form as instructed, either online or via postal mail.

Who needs ET-411?

01

Individuals and businesses that are required to report specific tax information to the state's department of revenue.

02

Accountants and tax professionals preparing business tax filings.

03

Any entity operating within the jurisdiction that collects or remits taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is English 201 about?

At this grade level, students are working with universal themes and archetypes. They are also continuing to build their facility with rhetoric, the craft of using language in writing and speaking, using classic literature, essays, and speeches as mentor texts.

Is English 101 the same as English 102?

Grade 10 English II Course Outline (1.0 Credit) To expose students to a variety of literary genres to further their appreciation of literature. To develop students' vocabulary-building skills through the use of context clues and word origin/structure analysis.

What is English 202?

English 202 is a faster-paced college preparatory English class designed for students to move, in one semester, into English 1, and includes in-class time to practice college-level reading and writing. Course and Student Expectations. Expect to spend time in and out of class: Reading and writing about full-length books.

What is taught in English 2?

ENGL 201 - Advanced Composition and Critical Thinking In the course, students learn classical critical thinking concepts and decision-making and problem-solving skills applicable to real-world scenarios by engaging with current issues using argumentative and research techniques.

What does English 2 focus on?

Another variation has 101 devoted to research papers, and 102 to literature. The idea here is to develop the skills of argumentation first, and then to make arguments about literature in the second course. The reading material is basically split into nonfiction for 101 and fiction for 102.

What is english 242?

This course introduces the student to fiction from the 20th and 21st centuries, with an emphasis on the relation between art and life.

What does English Comp 2 consist of?

English II promotes the development of advanced writing competencies. Students will learn about argumentative essays, literary analysis, research papers, and narrative writing. Special attention is placed on crafting compelling arguments, using evidence effectively, and developing a distinctive personal writing style.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ET-411?

ET-411 is a tax form used in certain jurisdictions for reporting specific tax-related information, often relating to employee withholding or contributions.

Who is required to file ET-411?

Employers or businesses that withhold taxes from employee wages or make contributions on behalf of employees are typically required to file ET-411.

How to fill out ET-411?

To fill out ET-411, follow the provided instructions carefully, entering required information such as employer details, employee wages, and the amounts withheld for taxes accurately.

What is the purpose of ET-411?

The purpose of ET-411 is to ensure proper reporting and compliance with tax regulations regarding employee income tax withholding, enabling the taxation authority to track and collect owed taxes.

What information must be reported on ET-411?

ET-411 must report details including employer identification, employee information, wages paid, total taxes withheld, and any other applicable deductions or contributions.

Fill out your et-411 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Et-411 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.