Get the free Sales Tax Electronic Filing Waiver Request

Show details

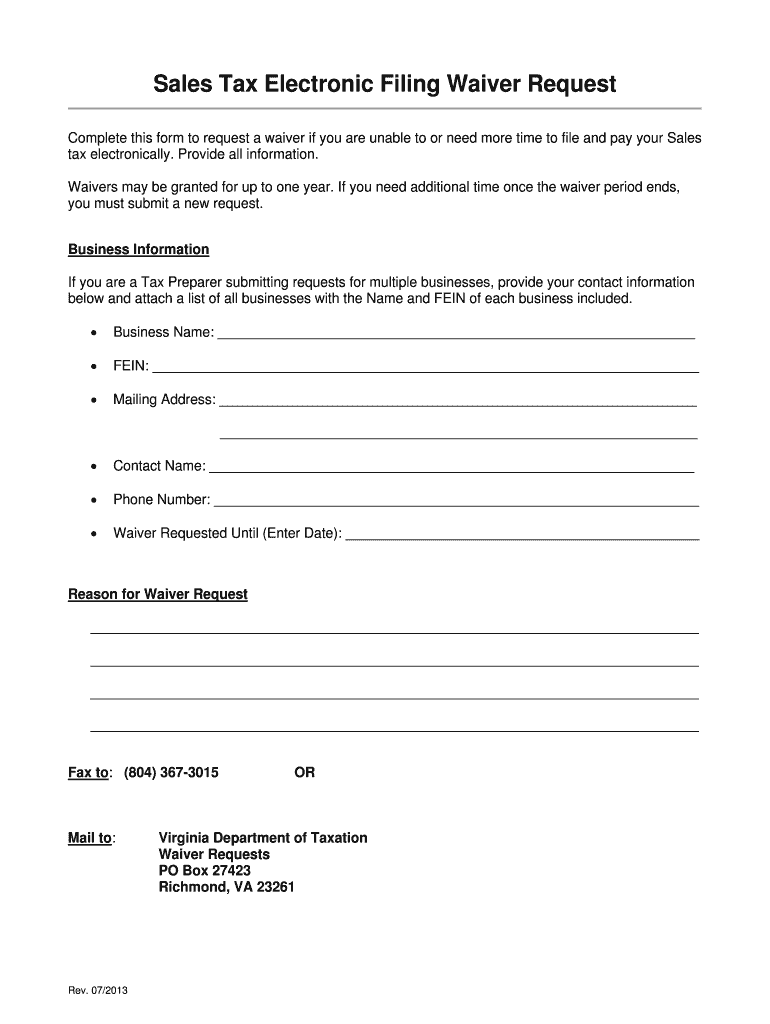

Complete this form to request a waiver if you are unable to or need more time to file and pay your Sales tax electronically. Waivers may be granted for up to one year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales tax electronic filing

Edit your sales tax electronic filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax electronic filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales tax electronic filing online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sales tax electronic filing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax electronic filing

How to fill out Sales Tax Electronic Filing Waiver Request

01

Start by downloading the Sales Tax Electronic Filing Waiver Request form from the official state tax website.

02

Fill in your business name and contact information in the designated fields.

03

Specify the reason for requesting the waiver in the provided section, ensuring you provide a clear and concise explanation.

04

Include any necessary supporting documentation that justifies your request.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed form according to the instructions provided, either by mail or electronically.

Who needs Sales Tax Electronic Filing Waiver Request?

01

Businesses that have difficulty or are unable to file their sales tax electronically due to specific reasons, such as lack of internet access or software issues.

02

Small businesses that may not meet the technical requirements for electronic filing.

03

Entities experiencing temporary hardships that affect their ability to comply with electronic filing mandates.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between Form 8809 and Form 15397?

Unlike IRS Form 8809 — which extends the deadline for filing with the IRS — Form 15397 only applies to furnishing copies to recipients.

What is the form to opt out of efile?

Opt out of e-filing a return - Form 8948. Use Form 8948 to explain why a particular return is being filed on paper. to select the reason for not e-filing the return.

How to write a penalty waiver request letter?

How to Write a Penalty Waiver Request Letter? Explain the circumstances that led to the penalty. Demonstrate why you believe the penalty should be waived. Mention any relevant IRS policies or guidelines, such as the First Time Abate policy.

What is the form to opt out of electronic filing?

Opt out of e-filing a return - Form 8948. Use Form 8948 to explain why a particular return is being filed on paper. to select the reason for not e-filing the return.

What is the 8948 form used for?

Form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. A specified tax return preparer may be required by law to electronically file (e-file) certain covered returns (defined below).

What is the difference between form 8809 and form 15397?

Unlike IRS Form 8809 — which extends the deadline for filing with the IRS — Form 15397 only applies to furnishing copies to recipients.

What is a good reason for penalty waiver?

Failure-to-pay penalties serious illness impacting your ability to pay. death or serious illness of an immediate family member. fires, natural disasters, or civil disturbances that prevent you from making a tax payment. inability to determine the amount of tax due for reasons beyond your control.

What is form 8508?

Form 8508. (November 2023) Department of the Treasury - Internal Revenue Service. Application for a Waiver from. Electronic Filing of Information Returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sales Tax Electronic Filing Waiver Request?

The Sales Tax Electronic Filing Waiver Request is a formal application submitted by taxpayers seeking permission to file their sales tax returns using a method other than electronic submission, typically due to certain circumstances that make electronic filing impractical.

Who is required to file Sales Tax Electronic Filing Waiver Request?

Taxpayers who are mandated to file sales tax returns electronically but have valid reasons for not doing so, such as hardships or technological limitations, are required to file this waiver request.

How to fill out Sales Tax Electronic Filing Waiver Request?

To fill out the Sales Tax Electronic Filing Waiver Request, taxpayers need to complete the required form, providing necessary details such as their identification information, the basis for the waiver, and any supporting documentation to demonstrate their circumstances.

What is the purpose of Sales Tax Electronic Filing Waiver Request?

The purpose of the Sales Tax Electronic Filing Waiver Request is to allow taxpayers who face challenges with electronic filing to obtain permission to file their sales tax returns using an alternative method, ensuring compliance with tax regulations while accommodating their situations.

What information must be reported on Sales Tax Electronic Filing Waiver Request?

The information that must be reported on the Sales Tax Electronic Filing Waiver Request typically includes the taxpayer's name, address, tax identification number, the reason for the waiver request, and any relevant documentation supporting their request.

Fill out your sales tax electronic filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales Tax Electronic Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.