Get the free 51a105

Show details

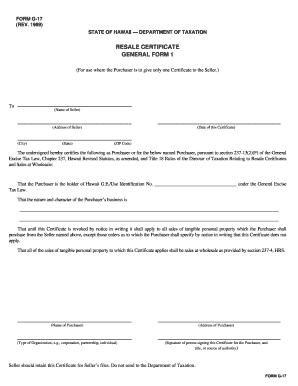

Important? Certificate is not valid unless completed. RESALE CERTIFICATE Check Applicable Block Blanket ? Single Purchase ? I hereby certify that Name of Business????????????????????????????? Address

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 51a105

Edit your 51a105 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 51a105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 51a105 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 51a105. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 51a105

How to fill out the KY resale certificate:

01

Obtain the KY resale certificate form from the Kentucky Department of Revenue website or request a copy from their office.

02

Provide your business name, address, and tax identification number at the top of the form.

03

Indicate the type of business you operate and the merchandise or services you sell.

04

Include the start date of your business and the reason for applying for the resale certificate.

05

Enter the signature and title of the authorized person completing the form.

06

Attach any necessary supporting documents as required by the Kentucky Department of Revenue.

07

Double-check all the information provided, ensuring it is accurate and complete.

08

Submit the completed KY resale certificate to the Kentucky Department of Revenue as instructed.

Who needs a KY resale certificate:

01

Businesses engaged in retail sales of tangible personal property in Kentucky.

02

Wholesalers, distributors, or manufacturers who sell products for resale to other businesses.

03

Service providers who purchase tangible personal property to incorporate into the services they offer to customers.

04

Any business that wants to avoid paying sales tax on items they will resell or incorporate into products or services.

Note: It is advisable to consult the Kentucky Department of Revenue or a tax professional to ensure compliance with all relevant laws and regulations regarding the use of a resale certificate.

Fill

form

: Try Risk Free

People Also Ask about

How long is a resale certificate good for in Kentucky?

Does a Kentucky Resale Certificate Expire? The Department of Revenue recommends updating the resale certificate every four years.

Does Kentucky resale certificate expire?

How long is my Kentucky sales tax exemption certificate good for? While the Kentucky Department of Revenue does recommend that all certificates should updated every four years, it is not required. Any industry exemption certificate is project-specific.

How much is a resale license in Florida?

Florida does not charge a fee for applying for a seller's permit, and your license won't expire unless you don't use it for more than a year. If your Florida seller's permit has been canceled for any reason, you need to obtain a new one before resuming sales in the state.

How do I get a resale certificate in Kentucky?

You can register for your Kentucky sales tax license online at the Kentucky Business One Stop Portal. Or file by paper using the Kentucky 10A100 form. You can also register for a sales tax permit when you register your business.

How do I get a resale certificate?

But how do you get a resale certificate? You can apply for a resale certificate through your state's tax department. Be sure to apply to the state tax department in the state you physically have an address—not the state in which you are incorporated, if it's different.

How do I verify a KY resale certificate?

Verify that the purchaser has a Kentucky (or other state) resale certificate and Tax ID– Verify the validity of your buyer's sales tax ID on the Kentucky Department of Revenue website or with the issuing state's department of revenue. You can find links to verify resale certificates in every state here.

How much is a resale license in NY?

There are no fees associated with obtaining a certificate of authority or using a resale certificate. New York takes operating without a certificate of authority seriously: violations could result in a penalty of up to $10,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 51a105 online?

pdfFiller has made it easy to fill out and sign 51a105. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete 51a105 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your 51a105, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete 51a105 on an Android device?

Use the pdfFiller Android app to finish your 51a105 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is 51a105?

Form 51a105 is a financial document used for reporting certain income, deductions, or other tax-related information as required by tax authorities.

Who is required to file 51a105?

Individuals or entities who meet specific income thresholds or criteria as defined by tax regulations are required to file Form 51a105.

How to fill out 51a105?

To fill out Form 51a105, provide accurate information on income, deductions, and any relevant financial details as prompted in the form's sections, ensuring all required fields are completed.

What is the purpose of 51a105?

The purpose of Form 51a105 is to ensure compliance with tax reporting obligations and gather necessary information for tax assessment and auditing.

What information must be reported on 51a105?

Form 51a105 requires reporting information such as total income, eligible deductions, credits claimed, and other pertinent financial details as outlined in the form instructions.

Fill out your 51a105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

51A105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.