Get the free Multi Level Marketer’s Sales/Use Tax Licensing Application

Show details

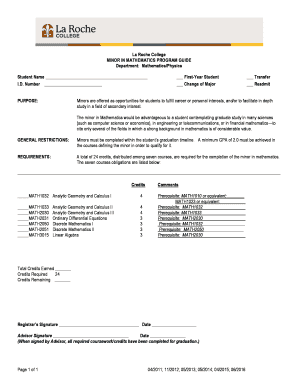

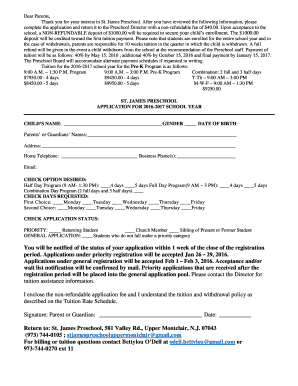

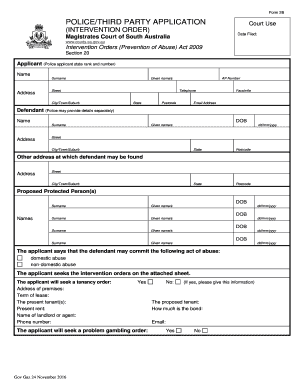

This document serves as an application for entities wishing to obtain a Multi Level Marketer's Sales Tax License in Wyoming. It outlines eligibility, tax requirements, and necessary information for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multi level marketers salesuse

Edit your multi level marketers salesuse form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multi level marketers salesuse form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit multi level marketers salesuse online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit multi level marketers salesuse. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

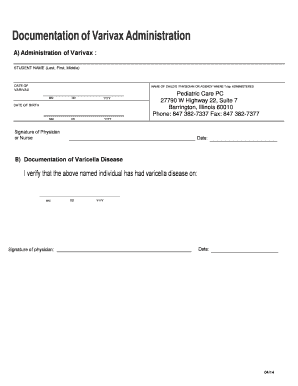

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multi level marketers salesuse

How to fill out Multi Level Marketer’s Sales/Use Tax Licensing Application

01

Obtain the Multi Level Marketer’s Sales/Use Tax Licensing Application form from your state's taxation department website.

02

Read the instructions carefully to understand the requirements and details needed.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide information about your business, such as the name, address, and type of sales conducted.

05

Detail your business structure (e.g., sole proprietorship, partnership, corporation) and the date business commenced.

06

Indicate your estimated sales and the types of products sold within the application.

07

Attach any required supporting documents such as your Articles of Incorporation or business registration.

08

Review your application for accuracy and completeness before submission.

09

Submit the application via the prescribed method (online, by mail, or in-person) along with any applicable fees.

10

Keep a copy of your submitted application and any correspondence for your records.

Who needs Multi Level Marketer’s Sales/Use Tax Licensing Application?

01

Individuals or businesses engaged in multi-level marketing (MLM) activities.

02

Sales representatives working under an MLM structure who make sales or recruit others.

03

Businesses selling tangible personal property or taxable services in states requiring a sales/use tax license.

Fill

form

: Try Risk Free

People Also Ask about

Are online sales subject to local sales tax?

If your business has a physical presence, or “nexus”, in a state, you are typically required to collect applicable sales taxes from online customers in that state. If you do not have a physical presence, you generally do not have to collect sales tax for online sales.

Do I need to collect local sales tax for selling online?

Online sellers are generally required to collect sales tax if you have a physical presence, or 'nexus', in a state, which includes having a storefront, office, or warehouse there.

Do you pay sales tax on online purchases in the US?

A wholesaler charges VAT to a retailer who then also charges VAT to the customer. Businesses collect VAT on sales (output tax) and deduct VAT paid on purchases (input tax), remitting the difference to the tax authority. U.S. sales tax is only charged to the final consumer at the physical or online checkout.

What items are exempt from MA sales tax?

What is Exempt from Sales Tax in Massachusetts? Exempt Item CategoryExamples Clothing Items priced at $175 or less (only the amount over $175 is taxable). Prescription and OTC Drugs Medications such as antibiotics, pain relievers, and . Medical Equipment Wheelchairs, hearing aids, and other prescribed medical devices.6 more rows

What are the taxes for MLM?

As a self-employed individual, MLM entrepreneurs are responsible for paying self-employment taxes. This includes both the employee and employer portions of Social Security and Medicare taxes, totaling 15.3% of net earnings.

What is MA sales tax?

Sales tax. The Massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property (including gas, electricity, and steam) and telecommunications services1 sold or rented in Massachusetts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Multi Level Marketer’s Sales/Use Tax Licensing Application?

The Multi Level Marketer’s Sales/Use Tax Licensing Application is a formal request submitted to state tax authorities by businesses engaged in multi-level marketing to obtain the necessary licenses for collecting and remitting sales tax on products sold through their network of distributors.

Who is required to file Multi Level Marketer’s Sales/Use Tax Licensing Application?

Businesses involved in multi-level marketing that sell goods or services and are responsible for collecting sales tax from their customers are required to file the Multi Level Marketer’s Sales/Use Tax Licensing Application.

How to fill out Multi Level Marketer’s Sales/Use Tax Licensing Application?

To fill out the application, provide detailed information about your business, including the business name, address, type of products sold, estimated sales, and the names of distributors. Ensure all required fields are complete and accurate before submission.

What is the purpose of Multi Level Marketer’s Sales/Use Tax Licensing Application?

The purpose of the Multi Level Marketer’s Sales/Use Tax Licensing Application is to ensure compliance with state tax laws, enabling the tax authority to collect the appropriate sales tax on products sold and maintain a record of businesses operating within the multi-level marketing framework.

What information must be reported on Multi Level Marketer’s Sales/Use Tax Licensing Application?

The application must report the business name, contact information, type of products or services sold, sales projections, number of distributors, and any prior sales tax licenses held, among other required details stipulated by the state tax authority.

Fill out your multi level marketers salesuse online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multi Level Marketers Salesuse is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.