Get the free Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)

Show details

This affidavit is used by sellers to confirm they are not foreign persons under Section 1445 of the Internal Revenue Code, specifically for property transfers in Oregon. It includes sections for tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-foreign affidavit under internal

Edit your non-foreign affidavit under internal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-foreign affidavit under internal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-foreign affidavit under internal online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit non-foreign affidavit under internal. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-foreign affidavit under internal

How to fill out Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)

01

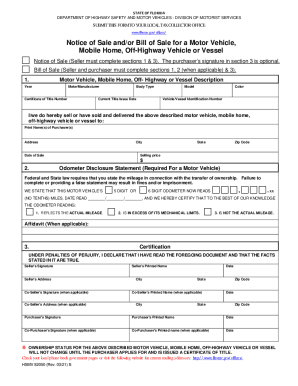

Begin by obtaining the Non-Foreign Affidavit form, typically available from the IRS or your real estate agent.

02

Enter the date on which you are filling out the affidavit at the top of the form.

03

Provide your name as the seller of the property along with your signature.

04

Include your taxpayer identification number (TIN) or Social Security number.

05

Enter the address of the property you are selling.

06

Confirm that you are a U.S. citizen or resident by checking the appropriate box.

07

Include information about any co-sellers, if applicable, and provide their details as required.

08

Review the affidavit for accuracy and completeness.

09

Sign and date the form in the designated section.

Who needs Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)?

01

Individuals or entities selling U.S. real estate who wish to certify to the buyer that they are not a foreign person under the Internal Revenue Code, thus ensuring compliance with U.S. tax laws.

Fill

form

: Try Risk Free

People Also Ask about

How can I avoid paying FIRPTA?

If the seller is a U.S. person – FIRPTA only applies to foreign sellers. If the seller can provide legal documentation showing that they are a U.S. citizen or U.S. tax resident, then the sale is not subject to FIRPTA withholding.

What is the purpose of the FIRPTA certificate?

FIRPTA Certificate In order to ensure foreign sellers pay any necessary tax, the Internal Revenue Service implemented FIRPTA withholding. The main FIRPTA form is the Foreign Investment in Real Property Act. The purpose of this law is to facilitate accurate withholding and compliance for U.S. tax purposes.

What is an example of a FIRPTA statement?

By this Affidavit, the undersigned hereby gives sworn representation that it, as seller(s) of a United States real property interest, is not a foreign person as defined in the Internal Revenue Code Section 1445, thus permitting the transferee of the property to waive the ten (10%) percent withholding requirement in

What is a section 1445 affidavit?

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

What does IRS notice 1445 mean?

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The buyer (transferee) of the U.S. real property interest is the withholding agent. The transferee must determine if the transferor is a foreign person.

What is a 1445 form?

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

What is required for a FIRPTA affidavit?

Required Information The FIRPTA affidavit requires specific information to verify the seller's status. Key details include: Seller Identification: Full name, address, and taxpayer identification number. Property Description: Legal description of the real estate property being sold.

What is Section 1445 of the IRS Code?

A domestic or foreign partnership, the trustee of a domestic or foreign trust, or the executor of a domestic or foreign estate shall be required to deduct and withhold under subsection (a) a tax equal to 15 percent of the fair market value (as of the time of the taxable distribution) of any United States real property

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)?

The Non-Foreign Affidavit under Internal Revenue Code Section 1445(b)(2) is a document that certifies a seller's status as a non-foreign person, thereby exempting the buyer from withholding tax on the sale of U.S. real property.

Who is required to file Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)?

The seller of real property in the United States is required to file the Non-Foreign Affidavit to confirm their status as a non-foreign entity or individual.

How to fill out Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)?

To fill out the Non-Foreign Affidavit, the seller must provide their name, address, and taxpayer identification number, and include a declaration stating they are not a foreign person as defined under U.S. tax law.

What is the purpose of Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)?

The purpose of the Non-Foreign Affidavit is to protect the buyer from potential withholding taxes that would otherwise apply if the seller were a foreign individual or entity.

What information must be reported on Non-Foreign Affidavit Under Internal Revenue Code Section 1445(b)(2)?

The information that must be reported includes the seller's name, address, taxpayer identification number, and a statement confirming the seller's non-foreign status.

Fill out your non-foreign affidavit under internal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Foreign Affidavit Under Internal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.