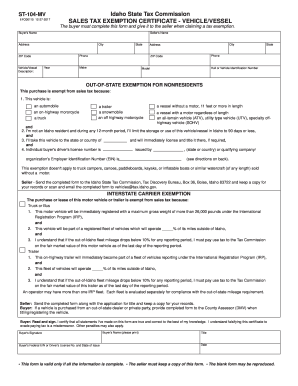

ID ST-104-MV 2013 free printable template

Show details

Jun 18, 2013 ... I am not an Idaho resident and during any 12-month period, I will limit the ... this form and give it to the seller when claiming a tax exemption.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ID ST-104-MV

Edit your ID ST-104-MV form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ID ST-104-MV form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ID ST-104-MV online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ID ST-104-MV. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ID ST-104-MV Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ID ST-104-MV

How to fill out ID ST-104-MV

01

Obtain the ID ST-104-MV form from the appropriate state department website or office.

02

Fill in the required personal information including your name, address, and contact details.

03

Specify the type of vehicle you are registering or renewing.

04

Provide details about the vehicle such as the make, model, year, and VIN (Vehicle Identification Number).

05

Indicate the purpose for filing the form, such as registration, renewal, or particularly for recreational use.

06

If applicable, complete any additional sections for exemptions or special circumstances.

07

Review all filled information for accuracy.

08

Sign and date the form.

09

Submit the form along with any required fees to the designated office or online as instructed.

Who needs ID ST-104-MV?

01

Individuals registering a new vehicle in their name.

02

Owners renewing their vehicle registration.

03

People applying for a vehicle title transfer.

04

Residents seeking exemptions related to vehicle taxes.

05

Anyone needing to report changes to their vehicle information.

Fill

form

: Try Risk Free

People Also Ask about

What are considered capital improvements to a home?

A capital improvement is a permanent structural alteration or repair to a property that improves it substantially, thereby increasing its overall value. That may come with updating the property to suit new needs or extending its life. However, basic maintenance and repair are not considered capital improvements.

What does the IRS consider capital improvements on home?

The IRS indicates what constitutes a real property capital improvement as follows: Fixing a defect or design flaw. Creating an addition, physical enlargement or expansion. Creating an increase in capacity, productivity or efficiency.

Is roof repair a capital improvement?

In most cases, a new roof will fall under a capital improvement. However, the tax treatment for a new roof is different from a minor roof repair.

What are capital improvements examples?

Capital Improvements additions, such as a deck, pool, additional room, etc. renovating an entire room (for example, kitchen) installing central air conditioning, a new plumbing system, etc. replacing 30% or more of a building component (for example, roof, windows, floors, electrical system, HVAC, etc.)

Is replacing a toilet a capital improvement?

Answer: That's a capital improvement.

Is flooring replacement a capital improvement?

Better known as capital expenditures or improvements, these can include big-deal undertakings like carpet replacement, major lighting or landscape projects, pool deck refurbishment, security system upgrades or replacements, exterior painting, painting of garages, stairways, or hallways, and many more.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ID ST-104-MV directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your ID ST-104-MV along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I edit ID ST-104-MV from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your ID ST-104-MV into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find ID ST-104-MV?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ID ST-104-MV in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is ID ST-104-MV?

ID ST-104-MV is a tax form used in certain jurisdictions for reporting sales and use tax related to motor vehicles.

Who is required to file ID ST-104-MV?

Individuals and businesses that purchase or lease motor vehicles and are liable for sales tax in the relevant jurisdiction are required to file ID ST-104-MV.

How to fill out ID ST-104-MV?

To fill out ID ST-104-MV, you need to provide personal and vehicle information, including the buyer's details, vehicle identification number (VIN), purchase price, and any applicable taxes.

What is the purpose of ID ST-104-MV?

The purpose of ID ST-104-MV is to report the sale or lease of a motor vehicle and to calculate and remit the appropriate sales tax owed to the state.

What information must be reported on ID ST-104-MV?

The form requires reporting information such as the buyer's name and address, vehicle details (make, model, VIN), purchase price, date of sale, and any taxes applicable.

Fill out your ID ST-104-MV online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ID ST-104-MV is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.