Get the free Application For Special Fuel Tax License

Show details

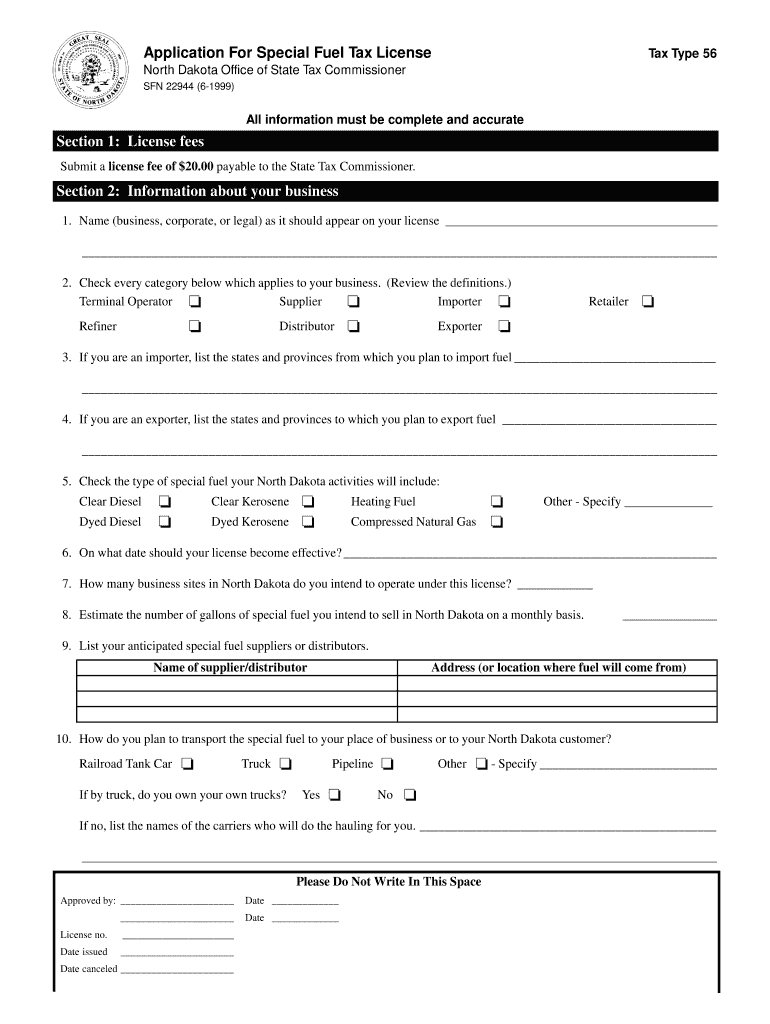

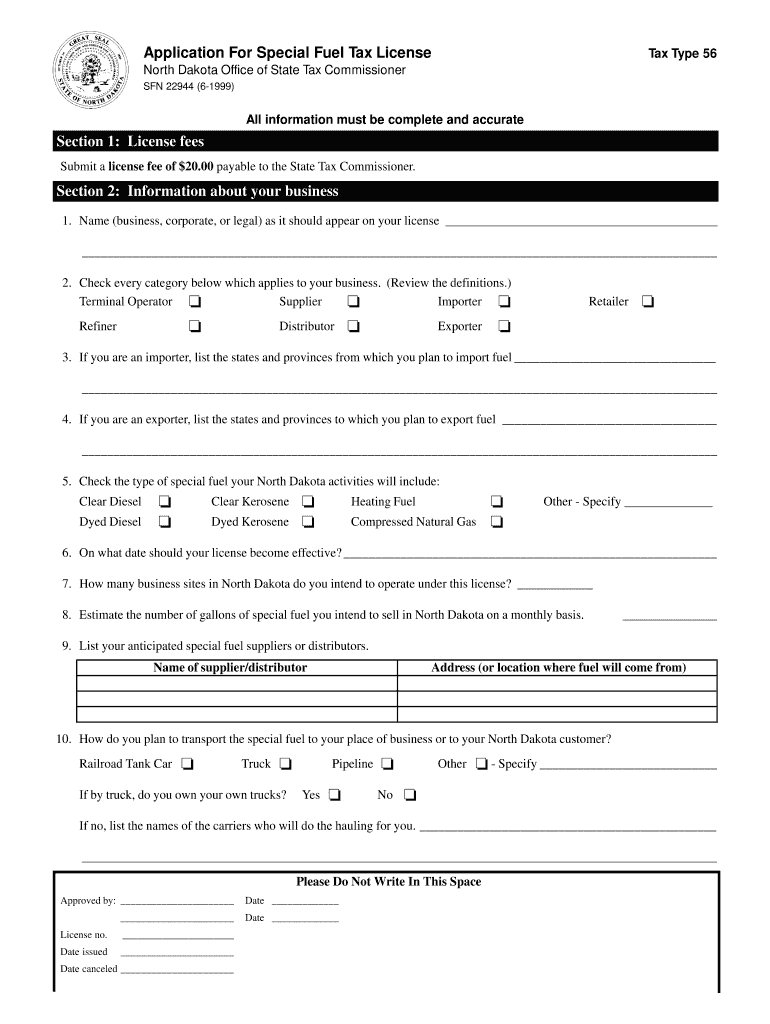

This application is for businesses seeking a special fuel tax license in North Dakota, including details on license fees, business information, special fuel types, security requirements, and authorized

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for special fuel

Edit your application for special fuel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for special fuel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for special fuel online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for special fuel. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for special fuel

How to fill out Application For Special Fuel Tax License

01

Gather the necessary documents, including identification and proof of business.

02

Obtain the Application for Special Fuel Tax License form from the relevant government website or office.

03

Fill out the form with accurate and complete information, including your business name, address, and tax identification number.

04

Indicate the type of fuel you will be using and whether you will be operating a commercial vehicle or not.

05

Review your application to ensure all information is correct and no fields are left blank.

06

Sign and date the application where indicated.

07

Submit the completed application form along with any required fees to the appropriate tax authority.

Who needs Application For Special Fuel Tax License?

01

Businesses that operate vehicles powered by special fuels.

02

Companies involved in the distribution, sale, or delivery of special fuels.

03

Individuals or entities that wish to claim exemptions from certain fuel taxes.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of fuel tax?

A fuel tax (also known as a petrol, gasoline or gas tax, or as a fuel duty) is an excise tax imposed on the sale of fuel. In most countries, the fuel tax is imposed on fuels which are intended for transportation.

What is the purpose of a fuel surcharge?

A Fuel Surcharge is an additional fee imposed by transportation companies to cover the fluctuating costs of fuel. It is typically linked to an index that tracks fuel prices, ensuring that charges adjust in response to changes in the cost of diesel, gasoline, or other fuels.

What is the purpose of a fuel tax?

Petrol and LPG carry a tax imposed by the Government called fuel excise duty (FED). This money is allocated to the National Land Transport Fund, which pays for the National Land Transport Programme.

What is the purpose of the fuel levy?

The fuel levy also seeks to internalise the negative externality costs of climate change, local air pollution, congestion and other environmental externalities to ensure that these costs are more fully reflected in fuel prices and contribute towards environmental goals.

What is the fuel tax exemption in Indiana?

The sale of biodiesel, blended biodiesel, and natural gas used to power an internal combustion engine or motor is exempt from state gross retail tax. See all Indiana Laws and Incentives.

Do Americans pay tax on petrol?

Since 1993, the US federal gasoline tax has been unchanged (and not adjusted for inflation of nearly 113 percent through 2023) at 18.4¢/gal (4.86¢/L).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application For Special Fuel Tax License?

The Application For Special Fuel Tax License is a document that individuals or businesses must submit to obtain a license to operate vehicles that use special fuels, enabling them to comply with state tax regulations.

Who is required to file Application For Special Fuel Tax License?

Individuals or businesses that operate vehicles powered by special fuels, such as diesel or propane, and wish to legally fulfill their tax obligations are required to file this application.

How to fill out Application For Special Fuel Tax License?

To fill out the Application For Special Fuel Tax License, applicants must provide personal and business information, vehicle details, and any relevant tax identification numbers, and submit the completed form to the appropriate state agency.

What is the purpose of Application For Special Fuel Tax License?

The purpose of the Application For Special Fuel Tax License is to ensure that individuals and businesses comply with state fuel tax regulations and to monitor the use of special fuels for taxation purposes.

What information must be reported on Application For Special Fuel Tax License?

The information that must be reported includes the applicant's name and address, business entity type, fuel type used, vehicle identification numbers, and any federal or state tax identification numbers.

Fill out your application for special fuel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Special Fuel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.