Get the free Application for Commercial Activity Tax Refund

Show details

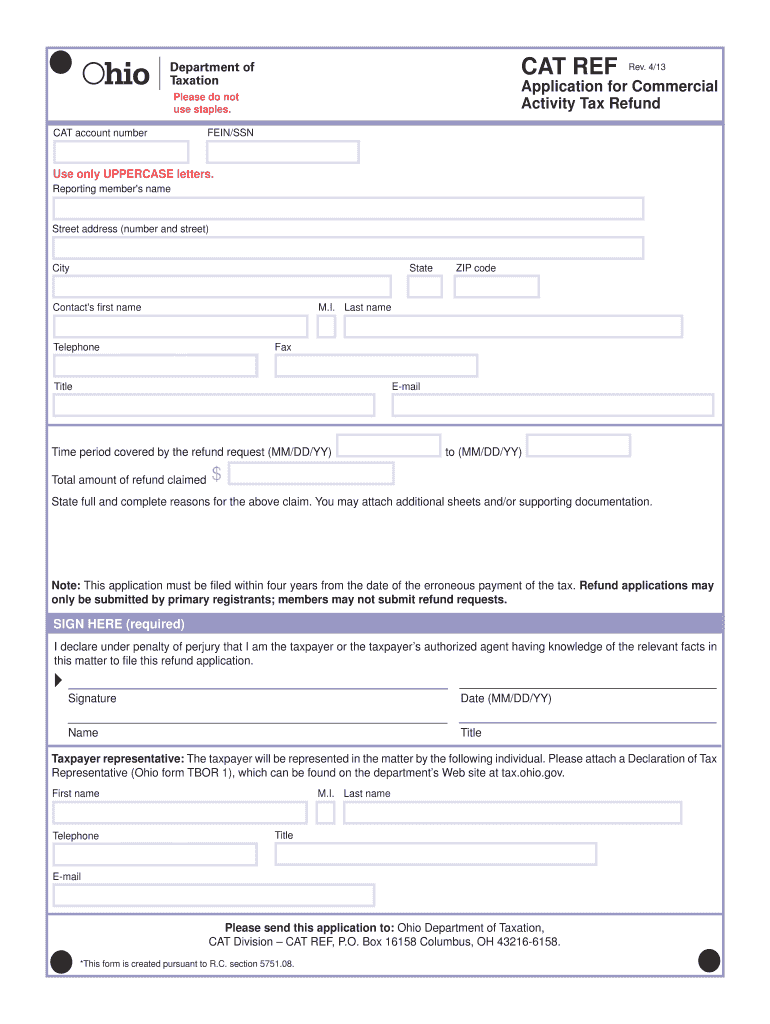

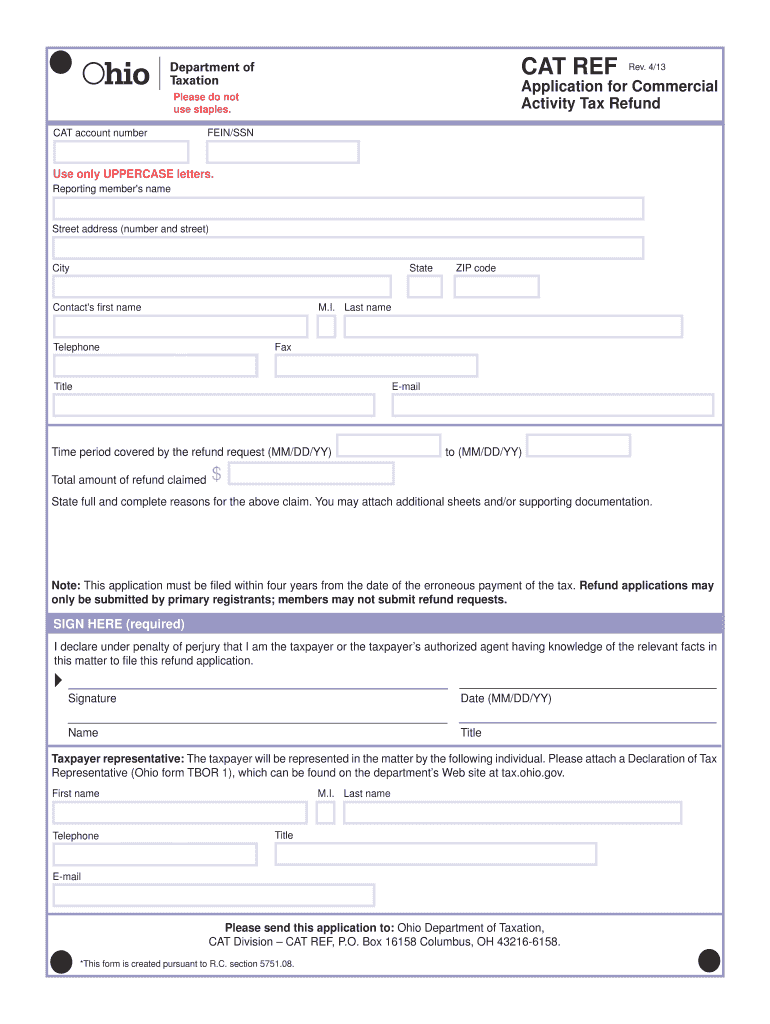

This document is an application for a refund of commercial activity taxes that have been overpaid, paid illegally, or erroneously, and provides necessary details for the refund process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for commercial activity

Edit your application for commercial activity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for commercial activity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for commercial activity online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for commercial activity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for commercial activity

How to fill out Application for Commercial Activity Tax Refund

01

Obtain the Application for Commercial Activity Tax Refund form from the official website or relevant tax authority.

02

Fill in your business details including name, address, and tax identification number.

03

Indicate the reason for the refund request clearly.

04

Provide details of the commercial activities conducted, including dates and amounts.

05

Attach supporting documentation such as receipts, invoices, or previous tax returns.

06

Review the application for accuracy and completeness.

07

Sign and date the application form.

08

Submit the completed application to the designated tax authority, either via mail or online, if applicable.

Who needs Application for Commercial Activity Tax Refund?

01

Businesses that have overpaid their commercial activity tax.

02

Companies seeking a refund due to tax exemptions that apply to their activities.

03

Any entity that has temporarily ceased operations and is entitled to a tax refund.

Fill

form

: Try Risk Free

People Also Ask about

What is a CDTFA 230 form?

The California Resale Certificate (CDTFA-230) is used by sellers to certify their intent to resell purchased items. This form allows businesses to purchase tangible personal property without paying sales tax upfront. Proper completion of this certificate is essential for compliance with California tax regulations.

Who qualifies for sales tax exemption in California?

Some customers are exempt from paying sales tax under California law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

What is the CDTFA 230 form?

The California Resale Certificate (CDTFA-230) is used by sellers to certify their intent to resell purchased items. This form allows businesses to purchase tangible personal property without paying sales tax upfront. Proper completion of this certificate is essential for compliance with California tax regulations.

How do I claim tax refund in USA for tourists?

The United States Government does not refund sales tax to foreign visitors. The foreign country in which you paid the Value Added Tax (VAT) is responsible for refunding the tax. Some countries won't refund after the fact, so check with the Foreign Embassies & Consulates office of the country you visited.

What is the purpose of the tax exemption certificate?

Answer: Sales Tax Exemption Certificates can be used by exempt institutions to purchase property or services without having to pay a sales tax. Exempt organizations often include charities, non-profits, educational, or religious institutions.

How often do you have to file commercial activity taxes in Ohio?

Filing resources Taxpayers with taxable gross receipts in excess of $6 million are required to file and pay on a quarterly basis.

What is the purpose of the CDTFA?

The California Department of Tax and Fee Administration (CDTFA) administers California's sales and use, fuel, tobacco, alcohol, and cannabis taxes, as well as a variety of other taxes and fees that fund specific state programs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Commercial Activity Tax Refund?

The Application for Commercial Activity Tax Refund is a formal request submitted by businesses to recover amounts overpaid or mistakenly paid in commercial activity taxes.

Who is required to file Application for Commercial Activity Tax Refund?

Any business that has paid commercial activity taxes and believes it has overpaid or is eligible for a refund should file this application.

How to fill out Application for Commercial Activity Tax Refund?

To fill out the application, businesses should obtain the appropriate form from the tax authority's website, complete all required fields accurately, including tax identification and details of the overpayment, and submit it along with any supporting documents.

What is the purpose of Application for Commercial Activity Tax Refund?

The purpose is to provide a mechanism for businesses to reclaim funds that were overpaid or erroneously paid in commercial activity taxes, ensuring fairness in taxation processes.

What information must be reported on Application for Commercial Activity Tax Refund?

The application must include the business's tax identification number, the amount of tax being refunded, the reason for the refund request, and any relevant supporting documentation to substantiate the claim.

Fill out your application for commercial activity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Commercial Activity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.