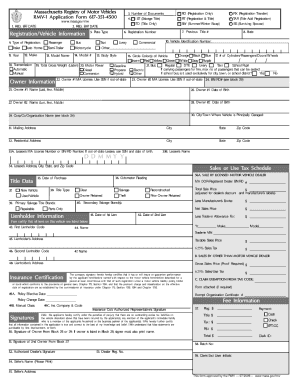

Get the free mass rmv sales tax exemption form

Show details

An exemption from the sales or use tax for transfers to disabled per- sons under certain conditions is provided for by the Massachusetts regulations and statutes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mass rmv sales tax

Edit your mass rmv sales tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mass rmv sales tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mass rmv sales tax online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mass rmv sales tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mass rmv sales tax

How to fill out 33 affidavit in support:

01

Start by clearly labeling the document as "33 Affidavit in Support" at the top.

02

Begin by providing your personal information, including your full name, address, and contact information.

03

State the purpose of the affidavit, explaining why you are filing it and what it supports. Be concise and specific.

04

Include a statement of your qualifications or expertise that make you a credible source of information in relation to the matter at hand.

05

Clearly outline the facts that you are affirming or supporting in your affidavit. Present them in a clear and organized manner, using numbered paragraphs for each point.

06

Provide any supporting evidence or documentation that backs up the facts you have stated. This can include photographs, documents, or other relevant materials.

07

If applicable, include any statements from witnesses or other individuals who can corroborate the facts presented in your affidavit. Make sure to include their full names and contact information.

08

Sign the affidavit at the bottom, in the presence of a notary public or authorized individual who can administer oaths. Ensure that the notary or authorized individual also signs and stamps or seals the document.

09

Make copies of the completed affidavit for your records and any relevant parties involved in the matter.

Who needs 33 affidavit in support:

01

Individuals or parties involved in legal proceedings may need a 33 affidavit in support. This can include plaintiffs, defendants, witnesses, or third parties who have valuable information or evidence to offer in support of a case.

02

Professionals in various fields, such as doctors, experts, or consultants, may require a 33 affidavit in support to provide their professional opinions or expertise in a legal matter.

03

Government agencies or organizations may require individuals to submit a 33 affidavit in support as part of an application or request process.

04

Individuals who want to provide sworn statements or support for personal matters, such as character references, property ownership, or financial status, may also need a 33 affidavit in support.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the mass rmv sales tax in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your mass rmv sales tax directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit mass rmv sales tax straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing mass rmv sales tax, you can start right away.

How can I fill out mass rmv sales tax on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your mass rmv sales tax, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is 33 affidavit in support?

33 affidavit in support refers to a legal document that provides sworn statements or evidence supporting a specific claim or motion in a court case.

Who is required to file 33 affidavit in support?

The individuals or parties involved in a court case who wish to present supporting evidence or statements to bolster their claim or motion are required to file 33 affidavit in support.

How to fill out 33 affidavit in support?

To fill out a 33 affidavit in support, one must include their personal information, such as name, address, and contact details. They should also provide a detailed explanation or evidence supporting their claim or motion, all while ensuring they adhere to any specific formatting or submission requirements of the court.

What is the purpose of 33 affidavit in support?

The purpose of a 33 affidavit in support is to present additional evidence or statements that strengthen a party's claim or motion in a court case. It helps provide credibility and support to the argument being made.

What information must be reported on 33 affidavit in support?

A 33 affidavit in support typically requires the following information: 1) Personal details of the affiant, such as name, address, and contact information. 2) Sworn statements or evidence supporting the claim or motion being made. 3) Any other information or documentation relevant to the case, as directed by the court.

Fill out your mass rmv sales tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mass Rmv Sales Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.