Get the free credit app for customer

Show details

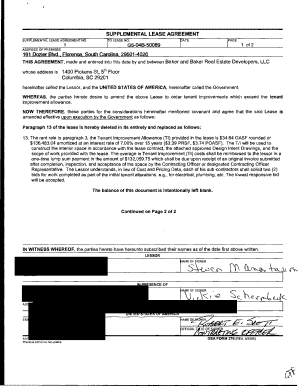

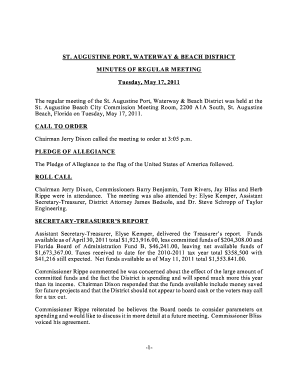

American Metal Products Co. PO Box 14891 Portland, OR 972930891 Phone: (503) 2358375 Fax (503) 2358377 CREDIT APPLICATION FOR A BUSINESS ACCOUNT BUSINESS CONTACT INFORMATION Title: Company name: Phone:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit app for customer

Edit your credit app for customer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit app for customer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit app for customer online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit app for customer. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit app for customer

How to Fill Out a Credit Application for a Customer:

01

Begin by clearly labeling the credit application with the necessary information, such as the company name, contact details, and the purpose of the credit application.

02

Enter the personal information of the customer, including their full name, contact information, date of birth, and social security number or taxpayer identification number.

03

Provide a section for the customer to indicate their current address, including the street address, city, state, and zip code.

04

Ask for the customer's employment details, including their current job title, employer name, contact information, and how long they have been employed in their current position.

05

Inquire about the customer's income sources, such as their salary, bonuses, dividends, or any other sources of income they have. Also, request information on their monthly expenses, including rent or mortgage payments, utilities, and other bills.

06

Include a section for the customer to list their current debts, such as outstanding loans or credit card balances, along with the corresponding monthly payment amounts.

07

Request personal references from the customer, including their full name, relationship, contact information, and how long they have known the individual.

08

Include a section where the customer can provide any additional comments or explanations regarding their creditworthiness or special circumstances.

09

At the end of the credit application, include a disclaimer that the provided information is accurate and that the customer authorizes the company to verify their creditworthiness.

10

Once the credit application is completed, review it for accuracy and make sure all necessary information has been included. Store the credit application securely.

Who Needs a Credit Application for a Customer:

01

Businesses that extend credit to customers, such as financial institutions, retailers, suppliers, or service providers, may require a credit application to assess the customer's creditworthiness.

02

Landlords may use credit applications to screen potential tenants and evaluate their ability to pay rent on time.

03

Some utility companies or subscription-based services may require credit applications to determine if customers need to pay a security deposit or establish credit terms.

04

Employers handling financial transactions, such as payroll advances or installment plans for employees, may require credit applications to assess their ability to repay.

05

Creditors or collection agencies may use credit applications to collect outstanding debts or verify a debtor's financial situation before issuing repayment plans.

Please note that specific requirements may vary depending on the industry, jurisdiction, and individual company policies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit app for customer?

A credit app for customer is a form used to gather financial information from customers applying for credit.

Who is required to file credit app for customer?

Both the customer applying for credit and the company extending credit are required to file a credit app.

How to fill out credit app for customer?

To fill out a credit app for a customer, the customer must provide necessary financial information such as personal details, income, expenses, and credit history.

What is the purpose of credit app for customer?

The purpose of a credit app for a customer is to assess the creditworthiness of the customer and determine whether to approve or deny credit.

What information must be reported on credit app for customer?

The information required on a credit app for a customer typically includes personal details, financial information, employment status, and credit history.

How do I execute credit app for customer online?

With pdfFiller, you may easily complete and sign credit app for customer online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make changes in credit app for customer?

With pdfFiller, it's easy to make changes. Open your credit app for customer in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How can I edit credit app for customer on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing credit app for customer, you need to install and log in to the app.

Fill out your credit app for customer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit App For Customer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.