Get the free form r 5604

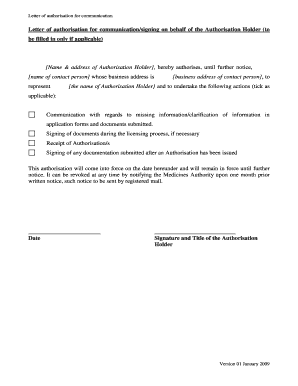

Get, Create, Make and Sign form r 5604

Editing form r 5604 online

Uncompromising security for your PDF editing and eSignature needs

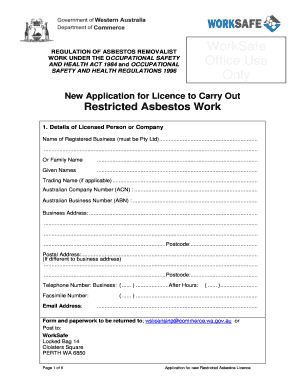

How to fill out form r 5604

How to fill out form r 5604:

Who needs form r 5604:

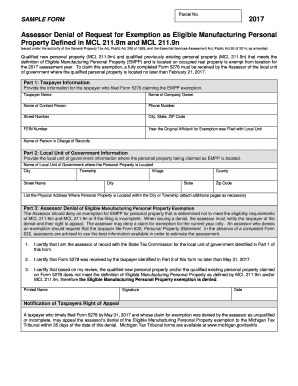

Instructions and Help about form r 5604

Hey folks the new year means one thing tax time is fast approaching everybody so when it comes to taxes what do you think of first that's right the refund did you all didn't waste no time saying that we're here to share some filing tips that will maximize that refund is CPA with Turbo Tax Lisa green Lewis hi Lisa can everyone get back money at tax time yes most people can get back a refund Steve oh hey you come talk to some people of Max's if you have a refund coming you need to get every dollar you deserve and there are many ways to do that and give more money back in your pocket, and I'm here to share some tips with you today now Lisa everybody has got a quiz to test your tax IQ we're going to all take it together right now okay so here's the first question approximately what percentage of taxpayers actually receive a tax refund last year was it twenty-seven percent fifty-one percent or seventy-three percent what all right Lisa was the audience closed um it's 73 percent believe it or not last pack season 73 percent attack players did receive a refund and the average refund was about $2,700 that's a lot of money for many people that's the biggest paycheck they get all year, and you know you just have to file your taxes in order to get that and a lot of people are hesitant because they're afraid of how much is going to cost to get their taxes prepared, but I'm here to share two free options with you the first one you can go online with IRS gov and do the Free File Alliance second if you're one of the 60 million taxpayers that have a fairly straightforward tax return, so that's a 1040a or 1040ez you can go online with Turbo Tax and file your federal and state return for absolutely zero dollars today let's move on to the next question here it is right here true or false audience you may be able to get almost four thousand dollars in tax deductions for your friend who's been crashing on your couch this year true or false, false true split Lisa true or false it's absolutely true Steve you can get a deduction and I know many of you have probably experienced this already and didn't know about this you can get up to four thousand dollars in a tax deduction if you've been providing over half their support, and they meet a few other conditions and this just shows you this is just an example of there are so many tax deductions that people don't know about that are overlooked you know you could have traveled to go for a job interview that can be a tax deduction you may have sent your kids to summer day camp that's a tax deduction sending your kids off to college you can get a tax deduction for that as well all right let's move on to the last question all for the first time ever you must report what on your taxes this year how would I even give you the options didn't get that your health insurers your pets oh, oh you wait that's that's your money back now hey I get this wait on this tax return I get me somebody our audience what is it everybody thanks God...

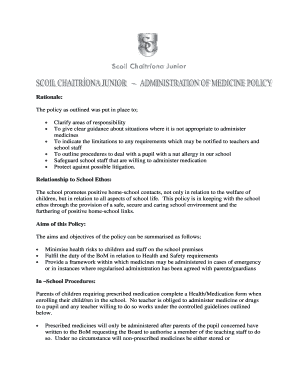

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form r 5604?

Who is required to file form r 5604?

How to fill out form r 5604?

What is the purpose of form r 5604?

What information must be reported on form r 5604?

How can I manage my form r 5604 directly from Gmail?

Can I create an electronic signature for the form r 5604 in Chrome?

How do I edit form r 5604 on an iOS device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.