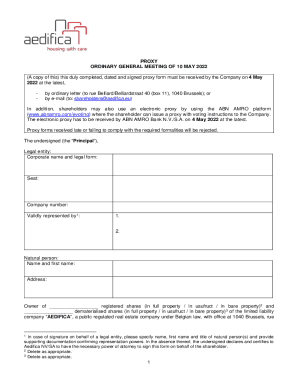

Get the free 2013 Form M2, Income Tax Return for Estates and Trusts

Show details

This form is used to report income tax for estates and trusts in the state of Minnesota for the tax year 2013.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 form m2 income

Edit your 2013 form m2 income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 form m2 income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 form m2 income online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013 form m2 income. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 form m2 income

How to fill out 2013 Form M2, Income Tax Return for Estates and Trusts

01

Obtain a copy of the 2013 Form M2, Income Tax Return for Estates and Trusts.

02

Gather all necessary financial documents including income statements, expenses, and any other pertinent information regarding the estate or trust.

03

Complete the top section of the form with the estate or trust's name, address, and identification number.

04

Fill out the income section with reported income, including dividends, interest, and other sources.

05

Deductions must be calculated and entered in the appropriate section of the form.

06

Complete any additional schedules that apply to the estate or trust's income or deductions.

07

Carefully review all entries for accuracy and completeness, ensuring all necessary signatures are included.

08

Submit the completed form by the due date, either electronically or via mail.

Who needs 2013 Form M2, Income Tax Return for Estates and Trusts?

01

Estates and trusts that have a taxable income or are required to file under state tax laws.

02

Trustees or executors of estates managing assets that generate income.

03

Any entity classified as a trust for tax purposes that is not exempt from taxation.

Fill

form

: Try Risk Free

People Also Ask about

What is m2 on a tax return?

Schedule M-2 serves as a critical component of your corporate tax filing strategy. This essential document tracks the movement of your corporation's retained earnings throughout the tax year, providing transparency for both your business and the Internal Revenue Service (IRS).

What is the M2 on a tax return?

Purpose and Importance of Schedule M-2 Provides a full picture of equity movement: The IRS uses Schedule M-2 to track how partner capital or shareholder retained earnings changed during the tax year.

How are trusts taxed in MN?

Minnesota taxes resident trusts on all their income or gains from intangible property, such as stocks and bonds. A trust must have minimum connections to Minnesota to be taxed as a resident trust.

What is the schedule M2 tax return?

Schedule 2 (Form 1040), Additional Taxes Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an excess advance premium tax credit repayment.

How to file a trust income tax return?

In case the Trust is required to file income tax return mandatorily under Sections 139(4A) or139(4B) or 139(4C) or 139(4D) or 139(4E) or139(4F) of the Income Tax Act, then ITR 7 must be filed. It is mandatory for all trusts to e-file income tax return.

What is the difference between 1041 and 706?

An estate and trust planning advisor can provide support, helping to ease the process and ensure compliance with federal tax laws. Form 706 ensures that estate taxes are adequately assessed for larger estates, while Form 1041 helps report the estate's income during the settlement process.

What does M2 mean on taxes?

Schedule M-2 is the IRS's big accounting page for watching the capital accounts of owners as the year rolls on. You'll be recording: Contributions of capital that partners or shareholders pump into the business. Distributions that flow back out to those same owners.

What is filing status M2?

M2. Married filing jointly or Qualifying Surviving Spouse, 2 spouses have earned income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2013 Form M2, Income Tax Return for Estates and Trusts?

2013 Form M2 is a tax return specifically designed for estates and trusts to report income, deductions, and tax liabilities to the state.

Who is required to file 2013 Form M2, Income Tax Return for Estates and Trusts?

Estates and trusts that have income, meet certain thresholds, or are required to pay state income tax are mandated to file the 2013 Form M2.

How to fill out 2013 Form M2, Income Tax Return for Estates and Trusts?

To fill out the 2013 Form M2, taxpayers should gather financial documentation, complete the applicable sections detailing income and deductions, and ensure that all calculations are correct before submission.

What is the purpose of 2013 Form M2, Income Tax Return for Estates and Trusts?

The purpose of the 2013 Form M2 is to provide the state with a detailed account of the income and expenses of an estate or trust, allowing for the accurate assessment of tax obligations.

What information must be reported on 2013 Form M2, Income Tax Return for Estates and Trusts?

The 2013 Form M2 requires reporting of income earned, deductions taken, payments made, and any applicable credits for the estate or trust during the tax year.

Fill out your 2013 form m2 income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Form m2 Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.