Get the free 2013 Form 8865 (Schedule K-1). Partner's Share of Income, Deductions, Credits, etc.

Show details

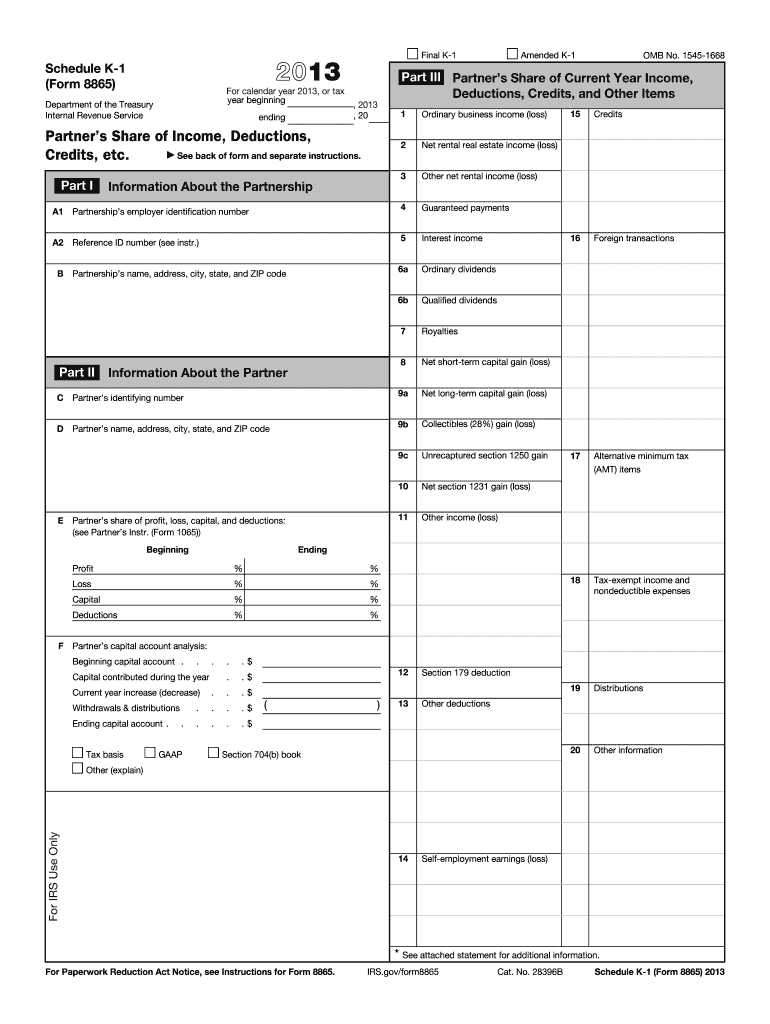

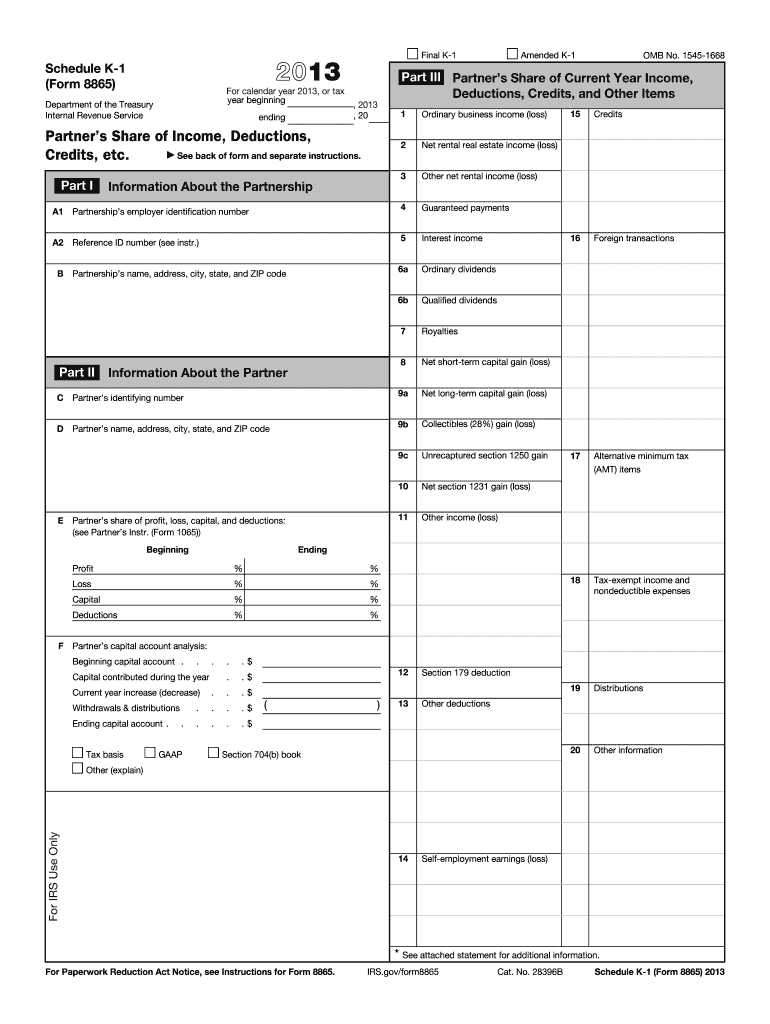

Final K-1 2013 Schedule K-1 (Form 8865) For calendar year 2013, or tax year beginning Department of the Treasury Internal Revenue Service, 2013, 20 OMB No. 1545-1668 Part III Partner’s Share of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 form 8865 schedule

Edit your 2013 form 8865 schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 form 8865 schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2013 form 8865 schedule online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2013 form 8865 schedule. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 form 8865 schedule

How to fill out 2013 form 8865 schedule:

01

Start by entering the name and address of the foreign partnership or controlled foreign corporation (CFC) at the top of the form.

02

Provide the employer identification number (EIN) or taxpayer identification number (TIN) of the foreign partnership or CFC.

03

If there are any changes in the ownership percentage or profit/loss sharing percentage, provide the necessary details in Part I of the form.

04

If there are any changes in the entity classification for federal tax purposes, indicate the changes in Part II of the form.

05

Fill out Part III of the form to report any transfers of property or contributions between the filer and the foreign partnership or CFC.

06

If there were any distributions or withdrawals from the foreign partnership or CFC during the tax year, report them in Part IV of the form.

07

Provide the reconciliation of income or loss in Part V of the form, including any adjustments or differences between the U.S. tax rules and the tax rules of the foreign country.

08

If the foreign partnership or CFC filed a tax return in the foreign country, complete Part VI of the form to provide information on the year of the foreign tax return and the competent authority agreement, if applicable.

09

Don't forget to sign and date the form before submitting it to the IRS.

Who needs 2013 form 8865 schedule:

01

U.S. persons who have an interest in a foreign partnership or controlled foreign corporation need to file the 2013 form 8865 schedule.

02

If you are a partner or a shareholder in a foreign partnership or CFC and meet certain ownership or control thresholds, you are required to file this form.

03

The purpose of this form is to report information about the foreign partnership or CFC and any transactions or activities that may have an impact on your U.S. tax liability.

Note: Please consult with a tax professional or refer to the official IRS instructions for Form 8865 and Schedule O for detailed guidance on filling out the form.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file form 8865?

Who Needs to File Form 8865? Any US person with at least 10% interest in a controlled foreign partnership must file Form 8865.

What is the purpose of form 8865?

Purpose of Form Use Form 8865 to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038B (reporting of transfers to foreign partnerships), or section 6046A (reporting of acquisitions, dispositions, and changes in foreign partnership interests).

What is Schedule K-1 partners share of income?

K-1s are provided to the IRS with the partnership's tax return and also to each partner so that they can add the information to their own tax returns. For example, if a business earns $100,000 of taxable income and has four equal partners, each partner should receive a K-1 with $25,000 of income on it.

What is Schedule K-1 partner's share of income deductions credits?

The purpose of Schedule K-1 is to report each partner's share of the partnership's earnings, losses, deductions, and credits. It serves a similar purpose for tax reporting as one of the various Forms 1099, which report dividend or interest income from securities or income from the sale of securities.

What is form 8865 used for?

Form 8865 is filed for the foreign partnership by another Category 1 filer under the multiple Category 1 filers exception. To qualify for the constructive ownership filing exception, the indirect partner must file with its income tax return a statement entitled “Controlled Foreign Partnership Reporting.”

What is Schedule K-1 form 8865?

If you own at least 10% of a controlled foreign partnership, you may be required to file Form 8865. Form 8865 is used to report the activities of a controlled foreign partnership and must be filed with your individual income tax return (Form 1040).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2013 form 8865 schedule directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your 2013 form 8865 schedule along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an electronic signature for the 2013 form 8865 schedule in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 2013 form 8865 schedule and you'll be done in minutes.

How do I complete 2013 form 8865 schedule on an Android device?

Use the pdfFiller mobile app and complete your 2013 form 8865 schedule and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is form 8865 schedule k-1?

Form 8865 Schedule K-1 is a form used to report a partner's share of income, deductions, and credits from a foreign partnership. It is filed by U.S. taxpayers who have an interest in a controlled foreign partnership.

Who is required to file form 8865 schedule k-1?

U.S. taxpayers who have an interest in a controlled foreign partnership are required to file Form 8865 Schedule K-1.

How to fill out form 8865 schedule k-1?

To fill out Form 8865 Schedule K-1, the taxpayer must provide information about the partnership, including its name, address, and Employer Identification Number (EIN). They must also report their share of income, deductions, and credits from the partnership.

What is the purpose of form 8865 schedule k-1?

The purpose of Form 8865 Schedule K-1 is to provide the IRS with information about a taxpayer's share of income, deductions, and credits from a foreign partnership.

What information must be reported on form 8865 schedule k-1?

Form 8865 Schedule K-1 requires the reporting of the partnership's name, address, and EIN, as well as the taxpayer's share of income, deductions, and credits from the partnership.

Fill out your 2013 form 8865 schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Form 8865 Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.