Get the free Form 561F

Show details

This form is used to calculate the Oklahoma capital gain deduction for trusts and estates based on qualifying capital gains and losses as reported on Federal tax forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 561f

Edit your form 561f form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 561f form via URL. You can also download, print, or export forms to your preferred cloud storage service.

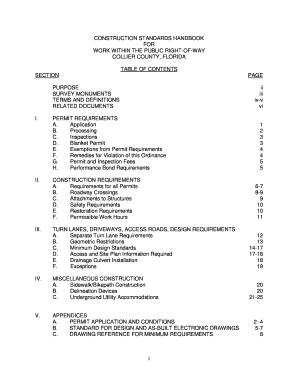

Editing form 561f online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 561f. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 561f

How to fill out Form 561F

01

Begin by downloading Form 561F from the relevant official website.

02

Fill out the header section with your full name, address, and any required identification numbers.

03

Carefully read the instructions provided with the form to understand any specific requirements.

04

Complete each section of the form as required, ensuring to provide accurate and truthful information.

05

Review all entered information for any errors or omissions before final submission.

06

Sign and date the form where prompted.

07

Submit the completed form via the method specified in the instructions, either electronically or by mailing it to the appropriate address.

Who needs Form 561F?

01

Individuals or entities seeking to apply for a specific financial aid or benefit program may need Form 561F.

02

Organizations involved in a specific type of funding or subsidy related to the program specified by Form 561F.

Fill

form

: Try Risk Free

People Also Ask about

What makes you exempt from capital gains tax?

Key Takeaways You can sell your primary residence and be exempt from capital gains taxes on the first $250,000 if you're single and $500,000 if married filing jointly. This exemption is only allowable once every two years.

What deductions can be made from capital gains tax?

You normally work out your gain by taking the proceeds (or in some cases, the market value on the date of disposal) and then deducting all of the following: original cost (or in some cases, market value when acquired) incidental costs of purchase. costs incurred in improving the asset.

How to write verb forms in English?

Verb forms are the various ways verbs can be used to show tense, number, gender, voice, and mood. In English, there are five main verb forms: V1 (base form), V2 (past simple), V3 (past participle), V4 (present participle/gerund), and V5 (simple present third person).

What qualifies for Oklahoma capital gain deduction?

Sale of real or tangible personal property located in Oklahoma: The capital gain must arise from the sale of real estate or tangible personal property within Oklahoma. The property must have been owned by the taxpayer for at least five uninterrupted years prior to the sale.

What is the Oklahoma capital gain deduction?

Oklahoma offers a unique tax benefit: the Oklahoma capital gain deduction, which allows taxpayers to exclude 100% of qualifying net capital gains from state taxable income.

What are the deductions allowed for income from capital gain?

The cost of the new asset or Long term capital gains whichever is lesser, but the exemption amount is up to ₹10 crore. Cost of the new asset or long-term capital gains whichever is lower. To sum up, there are multiple ways through which you can claim a deduction or exemption on your capital gains.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 561F?

Form 561F is a tax form used by certain individuals and organizations to report specific financial information required by the tax authorities.

Who is required to file Form 561F?

Typically, individuals and entities that meet certain income thresholds or have specific types of financial transactions are required to file Form 561F.

How to fill out Form 561F?

To fill out Form 561F, you need to gather the required financial information, complete each section of the form accurately, and submit it according to the guidelines provided by the tax authority.

What is the purpose of Form 561F?

The purpose of Form 561F is to ensure compliance with tax regulations by collecting necessary data on financial activities from individuals and businesses.

What information must be reported on Form 561F?

Form 561F requires reporting of various financial details including income, deductions, and other financial transactions as indicated in the form's instructions.

Fill out your form 561f online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 561f is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.