Get the free SEBI Guideline for KYC - Sankalp Share Brokers Private Limited

Show details

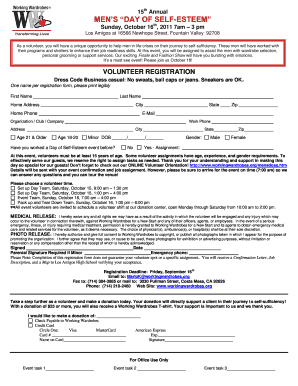

To The Investors, Dear Sir / Madam Subject : Addendum to Stock Broker and Client Agreement In an effort to bring further transparency and uniformly in dealings between trading clients and the stockbrokers,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sebi guideline for kyc

Edit your sebi guideline for kyc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sebi guideline for kyc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sebi guideline for kyc online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sebi guideline for kyc. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sebi guideline for kyc

How to fill out SEBI guideline for KYC:

01

Obtain KYC form: The first step is to obtain the KYC form from the appropriate source. This can typically be done by visiting the SEBI website or contacting a registered intermediary.

02

Fill in personal information: Start by filling in your personal information accurately. This includes your full name, date of birth, gender, address, and contact details. Make sure to provide all the necessary details as required.

03

Mention identification details: Next, provide the necessary identification details. This may include providing your PAN (Permanent Account Number) card or other recognized identification documents. Make sure to attach copies of the required documents as mentioned in the guidelines.

04

Disclose employment details: Provide information about your current occupation, employer, and monthly income. This helps establish your financial background and is an essential part of the KYC process.

05

Provide financial details: Fill in details regarding your financial status, such as your investment experience, annual income, and net worth. This information is crucial for assessing your risk profile and ensuring compliance with SEBI guidelines.

06

Mention any additional information: If there is any additional information that may be required or relevant to your KYC application, make sure to disclose it accurately. This may include details about your investment objectives, risk tolerance, or any specific instructions.

Who needs SEBI guideline for KYC:

01

Individuals: Any individual who wishes to participate or engage in investment activities in the Indian securities market needs to comply with the SEBI guideline for KYC. This includes individuals who want to open a new trading or demat account, invest in mutual funds, or engage in any capital market transactions.

02

Corporate entities: Apart from individuals, corporate entities like companies, partnerships, trusts, or LLPs (Limited Liability Partnerships) are also required to follow the SEBI guideline for KYC. This ensures transparency, accountability, and adherence to regulatory norms in the securities market.

03

Registered intermediaries: Registered intermediaries, such as stockbrokers, mutual fund distributors, investment advisors, portfolio managers, or wealth management firms, also need to comply with the SEBI guideline for KYC. They play a crucial role in collecting and verifying the KYC information of their clients to ensure compliance with regulatory requirements.

In summary, individuals, corporate entities, and registered intermediaries all need to adhere to the SEBI guideline for KYC. By following the step-by-step process mentioned above, individuals can effectively fill out the necessary forms, while understanding who needs to comply with these guidelines ensures that the securities market operates in a transparent and compliant manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sebi guideline for kyc?

SEBI guidelines for KYC (Know Your Customer) are requirements imposed by the Securities and Exchange Board of India for financial institutions to verify the identity of their clients.

Who is required to file sebi guideline for kyc?

Any entity regulated by SEBI such as stockbrokers, mutual funds, portfolio managers, etc., are required to comply with SEBI guidelines for KYC.

How to fill out sebi guideline for kyc?

SEBI guidelines for KYC require collecting documents such as identity proof, address proof, and photograph of the client, in accordance with the specified formats.

What is the purpose of sebi guideline for kyc?

The purpose of SEBI guidelines for KYC is to prevent money laundering, terrorist financing, and other illegal activities through the financial system by ensuring the identification of clients.

What information must be reported on sebi guideline for kyc?

SEBI guidelines for KYC require reporting basic client information such as name, address, PAN card number, and details of financial transactions.

How do I execute sebi guideline for kyc online?

With pdfFiller, you may easily complete and sign sebi guideline for kyc online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit sebi guideline for kyc in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your sebi guideline for kyc, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I edit sebi guideline for kyc on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing sebi guideline for kyc right away.

Fill out your sebi guideline for kyc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sebi Guideline For Kyc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.