Get the free 504D

Show details

This form is used to remit any estimated payment due for fiduciary income tax in Maryland for the year 2013, along with guidelines for filing, estimating tax, and payment instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 504d

Edit your 504d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 504d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 504d online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 504d. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 504d

How to fill out 504D

01

Obtain a copy of the 504D form from the appropriate authority or website.

02

Read the instructions carefully to understand the requirements of the form.

03

Fill out personal information such as name, address, and contact details in the designated fields.

04

Provide relevant details related to the disability or condition for which the 504D is being submitted.

05

Include any necessary supporting documentation that specifies the need for accommodations or services.

06

Double-check all information for accuracy and completeness before submitting the form.

07

Submit the completed form as per the instructions provided, either online, by mail, or in person.

Who needs 504D?

01

Students with disabilities who require accommodations in educational settings.

02

Parents or guardians of students who are seeking support for their child's educational needs.

03

Educational institutions that need to ensure compliance with disability regulations.

04

Individuals looking for assistance in filling out the form or understanding eligibility criteria.

Fill

form

: Try Risk Free

People Also Ask about

Does gloom mean sad?

Gloom is a feeling of sadness and lack of hope. the deepening gloom over the economy. Synonyms: depression, despair, misery, sadness More Synonyms of gloom.

What is Kapotham in English?

Explanation: Dove, pigeon, sparrow or bird.

What is the meaning of gloome?

: a dark or shadowy place. 2. a. : lowness of spirits : dejection.

What does "gloomy" mean?

: partially or totally dark. especially : dismally and depressingly dark. gloomy weather. b. : having a frowning or scowling appearance : forbidding.

What does gloome mean in English?

gloom noun [U] (WITHOUT HOPE) feelings of great unhappiness and loss of hope: Bergman's films are often full of gloom and despair. gloom and doom There is widespread gloom and doom about the company's future. SMART Vocabulary: related words and phrases. Sadness and regret.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

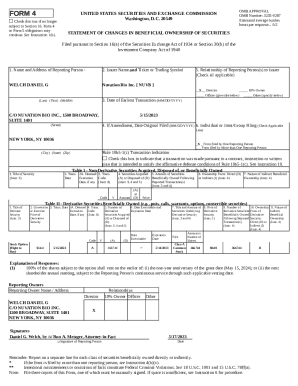

What is 504D?

504D is a form used for reporting specific financial and operational information by certain businesses and organizations, typically in relation to federal grant agreements.

Who is required to file 504D?

Entities that receive federal grants or funding that mandates the reporting of financial data must file 504D. This often includes non-profit organizations, educational institutions, and some governmental entities.

How to fill out 504D?

To fill out 504D, organizations must provide accurate financial data as instructed, including revenue, expenditures, and other relevant operational information. Detailed guidance and examples are usually provided along with the form.

What is the purpose of 504D?

The purpose of 504D is to ensure transparency and accountability in the use of federal funds, enabling oversight and assessment of how these funds are utilized by the recipient organizations.

What information must be reported on 504D?

The information required on 504D typically includes financial details like total revenues, expenses, and specific uses of the grant funding, as well as any required metrics relevant to the grant.

Fill out your 504d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

504d is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.