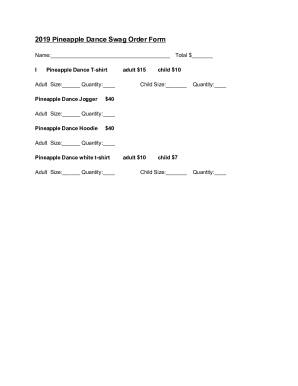

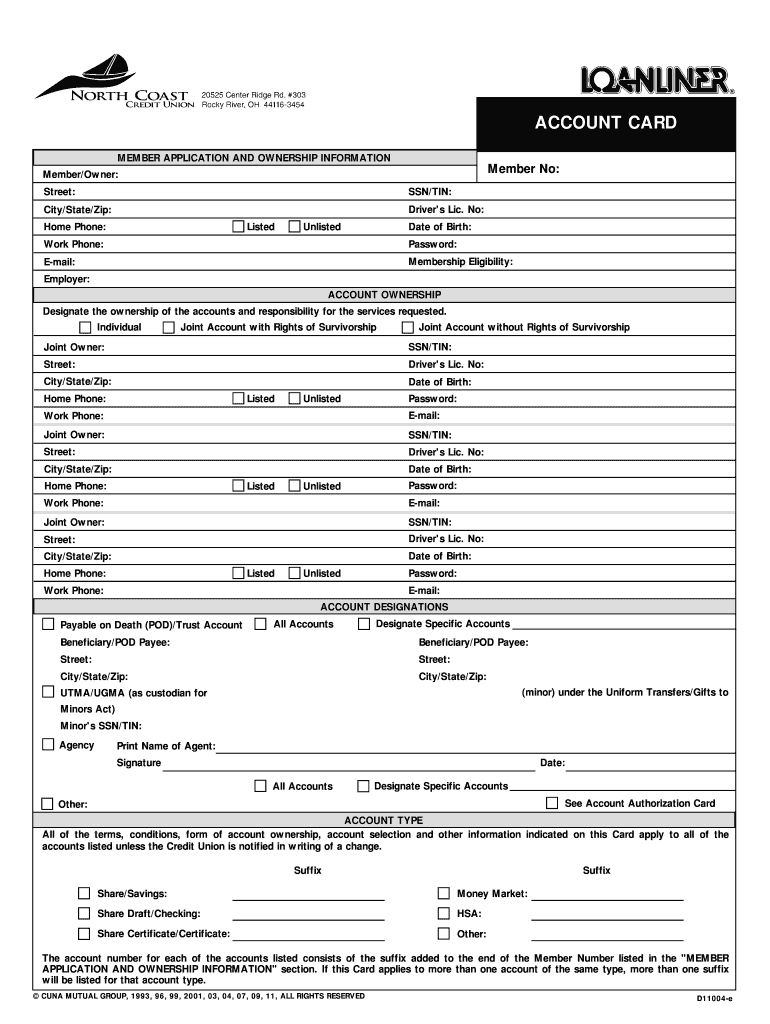

Get the free Individual Joint Account with Rights of Survivorship Joint Account without Rights of...

Show details

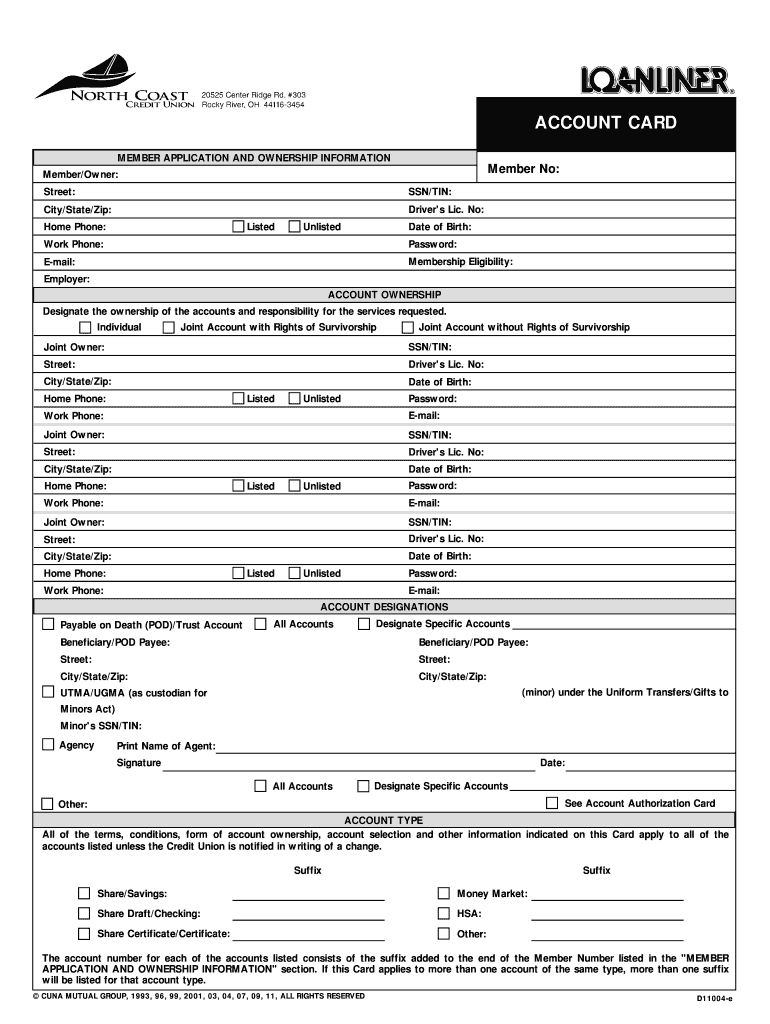

(minor) under the Uniform Transfers/Gifts to. Minor#39’s SSN/TIN: Signature. Other: Date: See Account Authorization Card.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual joint account with

Edit your individual joint account with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual joint account with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual joint account with online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit individual joint account with. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual joint account with

How to fill out an individual joint account with:

01

First, gather all the necessary documentation and information. This may include identification documents, social security numbers, and proof of address for all account holders.

02

Choose a financial institution that offers individual joint accounts. Research different banks and credit unions to find one that meets your needs in terms of fees, accessibility, and services.

03

Visit the chosen financial institution's website or branch to begin the account opening process. Look for an option to open an individual joint account or speak with a representative directly.

04

Complete the necessary forms and provide the required information. This typically includes providing personal details such as your name, address, date of birth, and contact information. You will also need to provide details for all other account holders.

05

Consider the type of joint account you want to open. There are different options, such as joint checking accounts or joint savings accounts. Choose the one that aligns with your financial goals and needs.

06

Determine the account's ownership structure. In this case, it would be an individual joint account, which means that each account holder has equal ownership and access to the funds.

07

Decide how you want to manage the account. Some joint accounts require both account holders to authorize transactions, while others allow either account holder to perform transactions independently. Clarify this with your chosen financial institution.

08

Review and sign all the necessary documents. Make sure you understand the terms and conditions of the account, including any fees, withdrawal limits, or other restrictions.

09

Fund the account. Decide how much money you would like to deposit into the joint account, and transfer the funds from another account or make a cash deposit.

10

Once the account is open and funded, you can begin using it for various financial transactions, such as making deposits, writing checks, using a debit card, or transferring money.

Who needs an individual joint account with:

01

Couples: Married or unmarried couples often choose to open individual joint accounts to manage shared expenses, such as household bills, mortgage payments, or vacations.

02

Parents and Children: Parents may open individual joint accounts with their children to teach them about money management or provide financial support. This can be useful for monitoring spending and saving habits.

03

Business Partners: Individuals engaged in a business partnership might opt for an individual joint account for managing shared business expenses, tracking revenues, and handling financial transactions.

04

Roommates: Individuals living together, such as friends or co-workers, might find it convenient to open an individual joint account to split utility bills or manage rent payments.

05

Family Members: Other family members, such as siblings or parents and adult children, may choose to open individual joint accounts to facilitate financial support and manage shared expenses.

Note: Opening an individual joint account requires trust and good communication among the account holders. It's essential to establish clear guidelines and expectations regarding the account's purpose, contributions, and withdrawals to avoid potential conflicts or misunderstandings in the future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit individual joint account with online?

With pdfFiller, it's easy to make changes. Open your individual joint account with in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for the individual joint account with in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your individual joint account with in seconds.

How do I complete individual joint account with on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your individual joint account with. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is individual joint account with?

An individual joint account is typically a bank or investment account held by two or more individuals.

Who is required to file individual joint account with?

All individuals who have a joint account are required to file individually for tax purposes.

How to fill out individual joint account with?

To fill out an individual joint account, each account holder must report their share of the income and expenses on their own tax return.

What is the purpose of individual joint account with?

The purpose of having an individual joint account is to share ownership and responsibility of managing the account with other individuals.

What information must be reported on individual joint account with?

Income, expenses, gains, and losses related to the joint account must be reported on individual tax returns.

Fill out your individual joint account with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Joint Account With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.