Get the free Motor Fuel Refund Claim

Show details

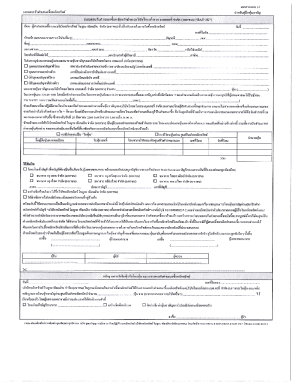

This document is a claim form for refunds on motor fuel taxes paid in Missouri. It is to be completed by the claimant providing their details, fuel usage details, and refund calculations based on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor fuel refund claim

Edit your motor fuel refund claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor fuel refund claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing motor fuel refund claim online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit motor fuel refund claim. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor fuel refund claim

How to fill out Motor Fuel Refund Claim

01

Obtain the Motor Fuel Refund Claim form from your state’s Department of Revenue website.

02

Fill in your personal information, including name, address, and contact details.

03

Provide details about the fuel purchased, including dates, type of fuel, and the amount spent.

04

Gather and attach any required receipts or documentation proving your fuel purchases.

05

Complete any additional sections required for specific exemptions or qualifications.

06

Review the completed form for accuracy and completeness.

07

Submit the form and attachments to the designated address provided on the form, either by mail or electronically if allowed.

Who needs Motor Fuel Refund Claim?

01

Individuals or businesses that operate vehicles primarily for services such as farming, nonprofit operations, or other exempt uses.

02

Those who have purchased fuel but did not use it for taxable purposes.

03

Organizations seeking to recover fuel taxes due to specific exemptions according to state laws.

Fill

form

: Try Risk Free

People Also Ask about

What is meant by refund of tax?

A tax refund is an amount of money that the government reimburses taxpayers who pay more than they owe in taxes. In general, it's a good idea to calculate the taxes that you'll owe as precisely as possible so that you don't overpay throughout the year.

Who is exempt from motor fuel tax in Texas?

Certain entities are exempt from the diesel fuel tax such as the United States Government, Texas public school districts, Texas counties, certain exporters and others (162.204). Certain entities may obtain refunds such as interstate truckers and transit authorities.

How do I claim motor fuel for refund in Minnesota?

To claim a refund, complete Form PDR-1, Minnesota Motor Fuel Claim for Refund and attach the Form PDR-1 PTO, Power Takeoff Worksheet. Use the Power Takeoff Worksheet to calculate the PTO gallons claimed on the claim. Claims must be filed within one year of the date of purchase to qualify.

How to record fuel tax credits?

If your business receives fuel tax credits, you can record the amount using a journal entry. The journal entry would involve two categories: A 4-XXXX or 8-XXXX Income category which would be credited. This increases income which amounts to decreasing expense.

Can I get a refund on sales tax in Texas?

To request a refund from the Comptroller's office, you must: submit a claim in writing that states fully and in detail each reason or ground on which the claim is founded. Download Form 00-957-Texas Claim for Refund (PDF); identify the period during which the claimed overpayment was made; and.

How do I claim for refund of gasoline or diesel fuel taxes in Texas?

Gasoline and Diesel Fuel Refund Claims When requesting a refund directly from the Comptroller, claimants who are not licensed for motor fuels must submit Form 06-106, Texas Claim for Refund of Gasoline or Diesel Fuel Taxes (PDF).

Can tourists get tax refunds in Texas?

International Visitors qualify for a Texas Sales Tax refund when the following documentation are presented to the TaxFree Shopping representative: Passport. I-94 (White or Green card in your passport) U.S. Visa (If required for your country) or foreign voter picture identification card.

How to get a refund of tax paid?

In accordance with the Income Tax Act 1961, taxpayers will have to file their return within the 31st July of an assessment year to claim the refund. Applying for an IT refund requires filling up the income tax refund form, as well as submitting necessary documents like utility forms and pre-filled ITR.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Motor Fuel Refund Claim?

A Motor Fuel Refund Claim is a request submitted by eligible individuals or entities to receive a refund for the taxes paid on fuel that is used for specific purposes, such as off-road use or non-taxable use.

Who is required to file Motor Fuel Refund Claim?

Individuals or businesses that have paid fuel taxes on fuel used for exempt purposes, such as agricultural, commercial, or off-road usage, are required to file a Motor Fuel Refund Claim.

How to fill out Motor Fuel Refund Claim?

To fill out a Motor Fuel Refund Claim, you typically need to provide details such as your personal information, vehicle information, fuel purchase details, and the purpose for which the fuel was used, along with any required documentation.

What is the purpose of Motor Fuel Refund Claim?

The purpose of the Motor Fuel Refund Claim is to allow eligible taxpayers to reclaim taxes they have paid on fuel that was not used for taxable purposes, helping to reduce their fuel costs.

What information must be reported on Motor Fuel Refund Claim?

The information that must be reported includes the claimant's name and address, details of the fuel used, the quantity of fuel purchased, dates of purchase, and the purpose of fuel use, along with any supporting documents.

Fill out your motor fuel refund claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Fuel Refund Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.