Get the free commercialcreditapplication

Show details

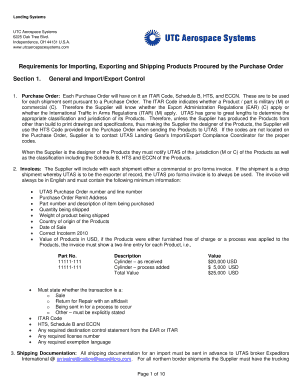

FRANKLIN BUSINESS CENTER 20 Canal Street, Suite 200, Franklin, NH 03235 Phone 6039342000 www.NHoffice.com COMMERCIAL CREDIT APPLICATION I. BUSINESS INFORMATION Business Name Address Telephone Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercialcreditapplication

Edit your commercialcreditapplication form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercialcreditapplication form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit commercialcreditapplication online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commercialcreditapplication. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercialcreditapplication

How to fill out a commercial credit application:

01

Begin by gathering all the necessary information and documents. This typically includes your business's legal name, address, phone number, and tax identification number. You may also need to provide information about your business structure, such as whether it is a sole proprietorship, partnership, or corporation.

02

Make sure to have financial documents on hand, such as your business's financial statements, bank statements, and tax returns. These documents will help the lender assess your creditworthiness and determine the amount of credit they can offer you.

03

Carefully read through the commercial credit application form. Understand each section and what information is being asked for. It is important to provide accurate and complete information to avoid any delays or complications in the application process.

04

Fill in the required fields of the application form. This may include providing details about your business's ownership, management, and financial history. Be prepared to disclose any outstanding debts or legal issues that may affect your creditworthiness.

05

Double-check all the information you have entered to ensure accuracy. Mistakes or missing information can cause delays in the processing of your application.

06

If any sections of the application are not applicable to your business or if you encounter any difficulties, consult the lender or seek professional assistance. It is important to provide all the necessary information requested by the lender to increase your chances of approval.

07

Once you have completed the application form, review it one last time to ensure everything is accurate and complete. Attach any supporting documents as requested.

Who needs a commercial credit application?

01

Businesses seeking financing: Any business that requires financial assistance, whether it is to expand operations, purchase equipment, or manage cash flow, may need to fill out a commercial credit application. This includes both startups and established businesses.

02

Suppliers and vendors: Suppliers and vendors often require their customers to fill out a commercial credit application to assess their creditworthiness. This helps them set credit limits and payment terms for their customers.

03

Lenders and financial institutions: Lenders and financial institutions use commercial credit applications to evaluate the creditworthiness of businesses applying for credit or loans. By assessing an applicant's financial history, income statements, and other relevant information, lenders can determine the level of risk involved in extending credit and make informed decisions.

In conclusion, filling out a commercial credit application involves gathering necessary documents, providing accurate information, and understanding the lender's requirements. It is important for businesses seeking financing, suppliers and vendors, as well as lenders and financial institutions in the evaluation process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get commercialcreditapplication?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific commercialcreditapplication and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit commercialcreditapplication in Chrome?

commercialcreditapplication can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit commercialcreditapplication on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign commercialcreditapplication right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is commercialcreditapplication?

Commercial credit application is a form used by businesses to apply for credit from a financial institution or supplier.

Who is required to file commercialcreditapplication?

Businesses or companies seeking credit from a financial institution or supplier are required to file a commercial credit application.

How to fill out commercialcreditapplication?

To fill out a commercial credit application, the applicant needs to provide information about the business, its financial history, and other relevant details requested on the form.

What is the purpose of commercialcreditapplication?

The purpose of a commercial credit application is to assess the creditworthiness of a business and determine if it qualifies for credit from a financial institution or supplier.

What information must be reported on commercialcreditapplication?

Information such as business name, address, contact information, financial statements, bank references, trade references, and other relevant details must be reported on a commercial credit application.

Fill out your commercialcreditapplication online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercialcreditapplication is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.