Get the free 1099-MISC

Show details

Este formulario se utiliza para reportar ingresos diversos, como rentas, regalías, compensación a no empleados, y otros tipos de ingresos según lo exigido por el IRS.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1099-misc

Edit your 1099-misc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1099-misc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

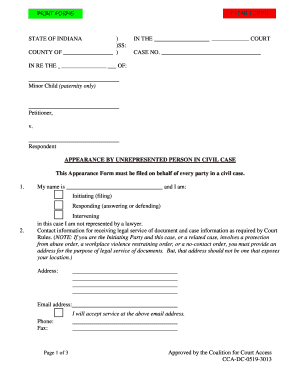

Editing 1099-misc online

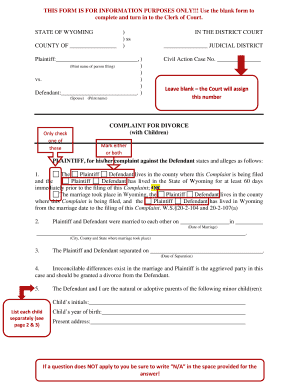

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 1099-misc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1099-misc

How to fill out 1099-MISC

01

Gather the necessary information: Obtain the recipient's name, address, and taxpayer identification number (TIN).

02

Check the applicable box: Determine if you need to report non-employee compensation, rents, royalties, etc., and select the appropriate box.

03

Fill out the payer's information: Include your name, address, and TIN in the designated fields.

04

Enter payment amounts: Input the amounts paid in the appropriate boxes for the recipient.

05

Complete any state information: If required, provide state information and withholding amounts.

06

Provide copies: Prepare three copies of the completed form (Copy A for IRS, Copy B for the recipient, and Copy C for your records).

07

Submit the form: Send Copy A to the IRS and provide Copy B to the recipient by the deadline.

Who needs 1099-MISC?

01

Businesses that paid $600 or more to non-employees (independent contractors) for services during the tax year.

02

Landlords receiving rental income.

03

Attorneys receiving payment for legal services.

04

Businesses making payments to corporations for certain services, such as medical and healthcare.

05

Any individual or business that made certain types of payments, typically exceeding $600, in the tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is the English of 1099?

1099 in English words is read as “One thousand ninety-nine.”

Does a 1099 form mean I owe money?

Yes, you'll need your 1099 to accurately report your income on your tax return. A copy of this form is also sent to the IRS, so you can be sure the agency knows about this income. However, simply receiving a 1099 tax form doesn't necessarily mean you owe taxes on that money.

Does a 1099 mean I owe taxes?

This reports payments a company makes of $600 or more to a non-employee. Employers must issue these forms to contractors or freelancers. Receiving a 1099 form doesn't necessarily mean you owe taxes on that income. But it does mean that the IRS is aware of it and that you'll need to report it on your tax return.

Is 1099-MISC proof of income?

Most landlords, lenders, and government institutions will accept a 1099 form as proof of income. In addition, it'll help you find any discrepancies in your reported income, which is necessary when dealing with the IRS.

How badly does a 1099 affect my taxes?

When you work on a 1099 contract basis, the IRS considers you to be self-employed. That means that in addition to income tax, you'll need to pay self-employment tax. As of 2024, the self-employment tax is 15.3% of the first $168,600 in net profits, plus 2.9% of anything earned over that amount.

What is the 1099-MISC form used for?

A Form 1099-MISC is used to report payments made in the course of a trade or business to another person or business who is not an employee. The form is required among other things, when payments of $10 or more in gross royalties or $600 or more in rents or compensation are paid.

How much do I owe on 1099?

If you're a 1099 contractor, no taxes are withheld from your payments. You're responsible for paying self-employment tax (15.3%) and making quarterly estimated tax payments to the IRS.

What happens when you are 1099?

Answer: If payment for services you provided is listed on Form 1099-NEC, Nonemployee Compensation, the payer is treating you as a self-employed worker, also referred to as an independent contractor. You don't necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 1099-MISC?

The 1099-MISC is a tax form used to report miscellaneous income paid to non-employees, such as independent contractors, freelancers, and rental payments.

Who is required to file 1099-MISC?

Businesses or individuals who have paid $600 or more in a calendar year to a non-employee for services or rent are required to file a 1099-MISC form.

How to fill out 1099-MISC?

To fill out a 1099-MISC, gather the recipient's name, address, and taxpayer identification number (TIN), then report the appropriate payment amounts in the designated boxes of the form.

What is the purpose of 1099-MISC?

The purpose of the 1099-MISC is to report various types of income other than wages, such as payments made to independent contractors, rents, and other income as required by tax regulations.

What information must be reported on 1099-MISC?

The 1099-MISC must report the recipient's name, address, TIN, the total amount paid in the applicable income categories (like nonemployee compensation, rent, royalties), and any federal income tax withheld, if applicable.

Fill out your 1099-misc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1099-Misc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.