Get the free Financial Statements

Show details

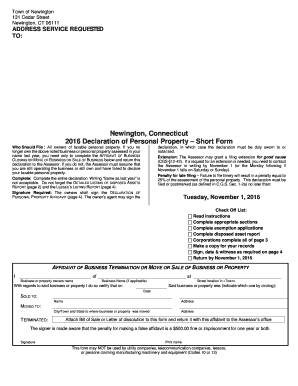

This document provides the financial statements of the Parish Constable for the year ended December 31, including an affidavit and details on cash receipts and disbursements, and a balance sheet.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements

Edit your financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial statements online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial statements. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements

How to fill out Financial Statements

01

Gather all financial records such as receipts, invoices, and bank statements.

02

Choose the correct financial statement format based on your needs (e.g., balance sheet, income statement, cash flow statement).

03

Enter your assets into the balance sheet, listing current and fixed assets.

04

List your liabilities under the balance sheet by categorizing current and long-term liabilities.

05

Calculate equity by subtracting total liabilities from total assets.

06

For the income statement, list all sources of revenue and subtract expenses to find net income.

07

In the cash flow statement, categorize cash flows into operating, investing, and financing activities.

08

Review all entries to ensure accuracy and completeness.

09

Consult with an accountant or financial advisor if needed.

10

Save and share the financial statements as required.

Who needs Financial Statements?

01

Businesses for assessing performance and financial health.

02

Investors evaluating potential investments.

03

Lenders requiring proof of financial stability for loan applications.

04

Government agencies for tax purposes.

05

Non-profit organizations for demonstrating accountability and funding requirements.

06

Management for internal decision-making and strategic planning.

Fill

form

: Try Risk Free

People Also Ask about

What is a financial statement in English?

Financial statements are a set of documents that show your company's financial status at a specific point in time. They include key data on what your company owns and owes and how much money it has made and spent. There are four main financial statements: balance sheet.

What are the 4 types of financial statements?

The major elements of the financial statements (i.e., assets, liabilities, fund balance/net assets, revenues, expenditures, and expenses) are discussed below, including the proper accounting treatments and disclosure requirements.

What are the 4 important types of financial statement?

The primary financial statements of for-profit businesses include the balance sheet, income statement, statement of cash flow, and statement of changes in equity. Nonprofit entities use a similar set of financial statements, though they have different names and communicate slightly different information.

What are the 4 basic financial statements What is the purpose of each?

They are: (1) balance sheets; (2) income statements; (3) cash flow statements; and (4) statements of shareholders' equity. Balance sheets show what a company owns and what it owes at a fixed point in time. Income statements show how much money a company made and spent over a period of time.

What are the 5 basic financial statements?

Typically, you'll need all four: the income statement, the balance sheet, the statement of cash flow, and the statement of owner equity.

What are the 4 reports of financial statements?

There are four primary types of financial statements: Balance sheets. Income statements. Cash flow statements. Statements of shareholders' equity.

What are the 4 pillars of financial statements?

Typically, they gain valuable insights about a company by using four types of financial statements, found in its Annual Report. These are the Balance Sheet, the Profit and Loss Account, the Cash Flow Statement, and the Statement of Changes in Equity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Statements?

Financial statements are formal records of the financial activities and position of a business, person, or entity, providing a summary of the financial performance over a specific period.

Who is required to file Financial Statements?

Businesses, corporations, and organizations that meet certain regulatory criteria, including public companies, private companies with significant levels of activity, and those that require financing, are typically required to file financial statements.

How to fill out Financial Statements?

Filling out financial statements involves gathering financial data, classifying and summarizing financial information according to established accounting principles, and presenting the data in predefined formats such as the balance sheet, income statement, and cash flow statement.

What is the purpose of Financial Statements?

The purpose of financial statements is to provide stakeholders—including owners, investors, regulators, and creditors—with a clear view of the financial health, performance, and cash flows of an entity, enabling informed decision-making.

What information must be reported on Financial Statements?

Financial statements must report information including revenue, expenses, assets, liabilities, equity, and cash flows, with relevant notes providing additional context and explanation of accounting policies applied.

Fill out your financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.