Get the free Notification of filing status as a Central Tax Collector - texinfo library unt

Show details

This document serves as a notification form for a Central Tax Collector to provide their information and assignment number for tax collection purposes in Texas.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notification of filing status

Edit your notification of filing status form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notification of filing status form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notification of filing status online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit notification of filing status. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notification of filing status

How to fill out Notification of filing status as a Central Tax Collector

01

Obtain the Notification of Filing Status form from the Central Tax Collector's office or website.

02

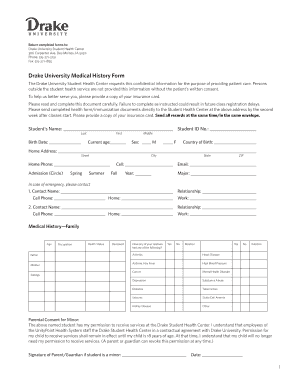

Fill in your personal information, including name, address, and contact details.

03

Provide necessary tax identification numbers as required.

04

Indicate the type of filing status you are applying for (e.g., individual, business).

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the appropriate office, either in-person or via mail, by the specified deadline.

Who needs Notification of filing status as a Central Tax Collector?

01

Individuals and businesses required to report financial activities to the Central Tax Collector.

02

Taxpayers seeking to clarify or formalize their filing status.

03

Entities that want to ensure compliance with local tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is Section 15 of the Central Goods and Services Tax Act 2017?

(1) The value of a supply of goods or services or both shall be the transaction value, which is the price actually paid or payable for the said supply of goods or services or both where the supplier and the recipient of the supply are not related and the price is the sole consideration for the supply.

What is Section 66 of the Cgst Act 2017 deals with?

Section 66 of the Central Goods and Services Tax (CGST) Act, 2017 provides for a special audit of a registered taxpayer's accounts and records if the tax authorities are not satisfied with the taxpayer's records or if the records are incomplete or not reliable.

What is the GST Amendment 2017?

• Amendment in Schedule III of the CGST Act, 2017 The amendment will specify that the supply of goods warehoused in a Special Economic Zone (SEZ) or Free Trade Warehousing Zone (FTWZ) to any person, before clearance for export or to the Domestic Tariff Area (DTA), shall not be treated as a supply of goods or services.

What is the new notification of GST 2025?

Latest Updates The most awaited 56th GST Council meeting happened 3rd September 2025. The council rationalised the GST rate structure from four GST slabs (5%, 12%, 18%, 28%) to a simplified structure: Standard rate: 18% - Applicable to most goods and services. Merit rate: 5% - For essential items and priority sectors.

What is the notification number 8 2025?

GST Notification 8/2025-Central Tax dt. 23-January-2025 Notification No. 08/2025 waives the late fee under section 47 of the Central Goods and Services Tax (CGST) Act for the annual return (FORM GSTR-9) for the financial years 2017-18 to 2022-23.

What is the GST notification for 7 2025?

GST Notification 7/2025-Central Tax dt. 23-January-2025 07/2025. The amendments include the introduction of a new rule for granting a temporary identification number (TIN) to individuals who are not liable for registration but need to make payments under the Act.

What is notification no 66 2017 dated 15.11 2017?

66/2017 dated 15.11. 2017, whereby all suppliers of goods who have not opted for composition scheme, have been exempted from the burden of paying GST on Advances received.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notification of filing status as a Central Tax Collector?

The Notification of filing status as a Central Tax Collector is a formal declaration that informs relevant authorities and stakeholders about the tax collection status of an entity appointed as a central tax collector.

Who is required to file Notification of filing status as a Central Tax Collector?

Entities that are appointed as central tax collectors, including government agencies and authorized organizations responsible for collecting central taxes, are required to file this notification.

How to fill out Notification of filing status as a Central Tax Collector?

To fill out the Notification of filing status, one must complete the designated form by providing required details such as the name of the collector, contact information, tax identification number, and relevant dates.

What is the purpose of Notification of filing status as a Central Tax Collector?

The purpose of the Notification is to establish and communicate the official tax collection authority of the entity, ensuring compliance with tax regulations and facilitating effective tax management.

What information must be reported on Notification of filing status as a Central Tax Collector?

The information that must be reported includes the legal name of the central tax collector, address, contact details, tax identification number, and any other relevant identification information as required by tax authorities.

Fill out your notification of filing status online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notification Of Filing Status is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.