Get the free Specialty Insurance Agency Performers of the US &

Show details

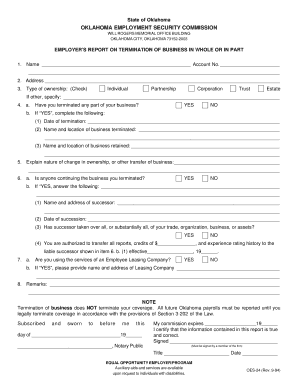

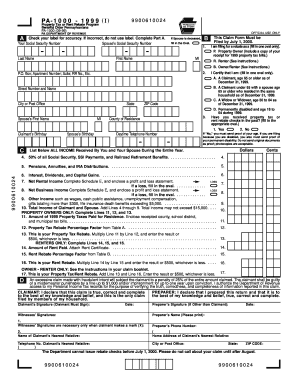

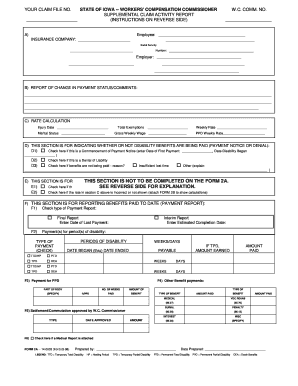

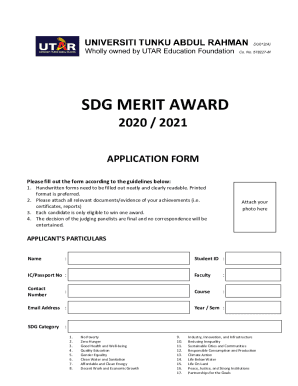

This document serves as an application for the commercial general liability policy for entertainers in the U.S., outlining coverage details, eligibility, premiums, and membership code of ethics.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign specialty insurance agency performers

Edit your specialty insurance agency performers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your specialty insurance agency performers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit specialty insurance agency performers online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit specialty insurance agency performers. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out specialty insurance agency performers

How to fill out specialty insurance agency performers:

01

Determine the specific needs of your insurance agency. Assess what types of performers are required to meet your unique insurance needs. This could include agents specialized in specific insurance products, risk assessment experts, claims adjusters, or sales representatives.

02

Research specialty insurance agencies and performers. Look for reputable insurance agencies that specialize in the type of coverage you offer. Research their performers and their expertise to ensure they align with your agency's needs and standards.

03

Contact and interview potential performers. Reach out to specialty insurance agencies and performers to inquire about their availability and suitability for your agency. Conduct thorough interviews to assess their qualifications, experience, and compatibility with your agency's goals and values.

04

Evaluate performers' qualifications and track record. Review performers' credentials, licenses, and certifications to ensure they have the necessary qualifications to perform effectively. Consider their experience and track record in the insurance industry, particularly in relation to the types of coverage your agency handles.

05

Assess performers' performance metrics. Inquire about performers' past performance metrics, such as their sales figures, claims settlement ratios, and customer satisfaction ratings. This will help you gauge their effectiveness and potential contribution to your agency's success.

06

Consider performers' compatibility with your agency's culture. Determine how well performers align with your agency's values, mission, and work culture. Assess their communication skills, teamwork capabilities, and ability to adapt to your agency's processes and policies.

07

Negotiate and finalize agreements. Once you have selected suitable specialty insurance agency performers, negotiate their terms of engagement, including compensation, contractual obligations, and performance targets. Ensure all legal and regulatory requirements are met during the agreement process.

Who needs specialty insurance agency performers?

01

Insurance agencies specializing in unique or niche markets. These agencies may require performers with specialized knowledge and expertise to cater to specific clientele and coverage needs.

02

Insurance agencies experiencing growth or expansion. As agencies grow, they may require additional performers to manage increased business volumes, provide enhanced customer service, or handle more complex insurance products and risks.

03

Agencies seeking to improve performance and competitiveness. Specialty insurance agency performers can bring fresh perspectives, new skills, and innovative strategies to help the agency stay competitive and achieve higher levels of success in the market.

04

Insurance agencies dealing with complex or high-risk coverage. For agencies handling complex or high-risk coverage, specialty performers with the necessary expertise and experience can ensure accurate risk assessment, precise underwriting, and effective claims management.

05

Insurance agencies aiming to enhance customer satisfaction. By hiring specialty performers who excel in customer service and relationship management, insurance agencies can improve customer satisfaction rates, retain existing clients, and attract new ones.

Overall, specialty insurance agency performers are valuable assets for insurance agencies looking to thrive in their respective markets and provide exceptional coverage and services to their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find specialty insurance agency performers?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the specialty insurance agency performers in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute specialty insurance agency performers online?

pdfFiller has made it simple to fill out and eSign specialty insurance agency performers. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the specialty insurance agency performers in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your specialty insurance agency performers and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is specialty insurance agency performers?

Specialty insurance agency performers refer to individuals or organizations that specialize in providing insurance coverage for unique or nonstandard risks. They offer specialized insurance policies tailored to specific industries or activities.

Who is required to file specialty insurance agency performers?

Specialty insurance agency performers are typically required to file their documentation and reports with the relevant regulatory authorities. These could include insurance regulatory bodies or government agencies responsible for overseeing the insurance industry.

How to fill out specialty insurance agency performers?

Filling out specialty insurance agency performers typically involves providing detailed information about the agency's operations, financials, policies, and any other relevant data. The specific requirements may vary depending on the regulatory body or agency requesting the information.

What is the purpose of specialty insurance agency performers?

The purpose of specialty insurance agency performers is to ensure transparency and accountability in the insurance industry. It allows regulatory authorities and stakeholders to assess the financial stability, compliance, and performance of specialty insurance agencies.

What information must be reported on specialty insurance agency performers?

The information reported on specialty insurance agency performers typically includes financial statements, policy details, premium income, claims history, agency structure, corporate governance, risk management practices, and any other required data specified by the regulatory authorities.

Fill out your specialty insurance agency performers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Specialty Insurance Agency Performers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.