Get the free Specialty Insurance Agency & Vendors Of The U.S.

Show details

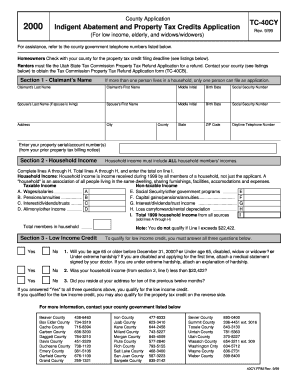

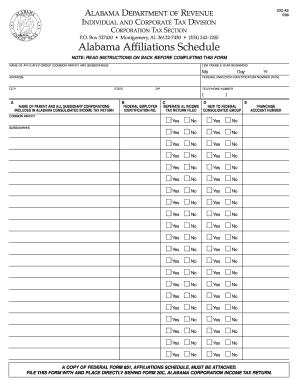

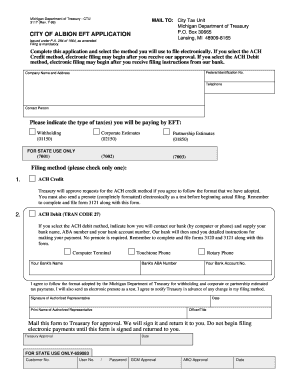

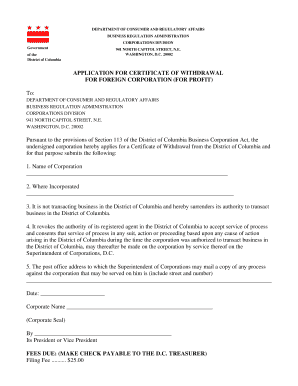

This document provides details regarding the commercial general liability insurance policy offered to vendors, including coverage limits, eligibility, and application instructions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign specialty insurance agency vendors

Edit your specialty insurance agency vendors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your specialty insurance agency vendors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing specialty insurance agency vendors online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit specialty insurance agency vendors. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out specialty insurance agency vendors

How to fill out Specialty Insurance Agency & Vendors Of The U.S.

01

Gather necessary information about your business and coverage needs.

02

Visit the Specialty Insurance Agency's website or contact them for their application form.

03

Fill out the application form with accurate details, including business name, address, and type of coverage required.

04

Provide information on any past claims or relevant losses.

05

Review your application for completeness and accuracy.

06

Submit the application along with any required documentation to the agency.

07

Await a response or quote from the agency regarding your coverage options.

Who needs Specialty Insurance Agency & Vendors Of The U.S.?

01

Businesses operating in niche markets or industries requiring specific coverage.

02

Professionals seeking protection against unique risks associated with their work.

03

Companies that require specialized insurance due to governmental or regulatory requirements.

04

Entrepreneurs starting businesses that have specialized operational risks or liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is specialty line underwriting?

Specialty lines underwriting focuses on unique or complex risks that require specialized knowledge. Underwriters in specialty lines often develop expertise in specific niche markets or emerging risks. The goal is to provide tailored coverage and accurate pricing for risks not typically covered by standard policies.

What are the main lines of insurance?

Types of insurance Buying insurance for your mobile phone. Household contents insurance. Buildings insurance. Income protection insurance. Travel insurance. Vehicle insurance. Illness insurance. Critical illness insurance.

What is an insurance line?

An insurance line is a type of insurance business that is grouped according to the reporting categories used when filing an insurer's statutory reports.

What are the examples of specialty insurance lines?

For those not in the know, Specialty Lines are a group of products available through Commercial Insurance and includes coverages like Directors & Officers insurance (D&O), Mergers & Acquisitions (M&A), Accident & Health (A&H), Cyber and Surety.

What is a specialty insurance company?

Specialty lines insurance provides tailored coverage for risks that standard property and casualty (P&C) insurance does not address. From professional liability and environmental insurance to pet insurance and embedded coverage, specialty lines protect businesses and individuals from complex and evolving risks.

What is the largest insurance agency in the US?

The 10 Largest P&C Insurance Companies in the US State Farm. Direct Premiums Written: $109.0bn. Progressive. Direct Premiums Written: $75.9bn. Berkshire Hathaway. Direct Premiums Written: $63.3bn. Allstate. Direct Premiums Written: $55.9bn. Liberty Mutual. Direct Premiums Written: $44.1bn. Travelers. USAA. Chubb.

What are the different types of insurance companies in the US?

There are two primary types of insurance companies: personal insurance providers and commercial insurance providers. Personal providers offer coverage to individuals for various essentials, while commercial providers offer coverage for business-related necessities.

What are specialty insurance lines?

For those not in the know, Specialty Lines are a group of products available through Commercial Insurance and includes coverages like Directors & Officers insurance (D&O), Mergers & Acquisitions (M&A), Accident & Health (A&H), Cyber and Surety.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Specialty Insurance Agency & Vendors Of The U.S.?

Specialty Insurance Agency & Vendors Of The U.S. is an organization that deals specifically with niche insurance products and services tailored to unique industries and risks, often serving specialized markets within the insurance landscape.

Who is required to file Specialty Insurance Agency & Vendors Of The U.S.?

Entities operating within specialized insurance markets or those engaging in activities related to specialty insurance services are typically required to file with Specialty Insurance Agency & Vendors Of The U.S.

How to fill out Specialty Insurance Agency & Vendors Of The U.S.?

To fill out the Specialty Insurance Agency & Vendors Of The U.S. form, collect required information regarding your insurance operations, provide accurate details as per the guidelines, and submit the completed forms to the appropriate office or online portal.

What is the purpose of Specialty Insurance Agency & Vendors Of The U.S.?

The purpose of Specialty Insurance Agency & Vendors Of The U.S. is to ensure compliance, provide oversight, and facilitate the functioning of the specialty insurance market, protecting both consumers and providers.

What information must be reported on Specialty Insurance Agency & Vendors Of The U.S.?

Information that must be reported typically includes the agency's details, types of specialty insurance offered, state regulations compliance, and any relevant financial data pertaining to the agency's operations.

Fill out your specialty insurance agency vendors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Specialty Insurance Agency Vendors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.