Get the free Commercial Lease Application

Show details

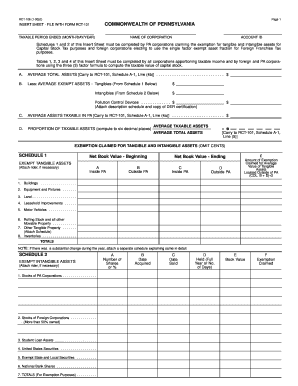

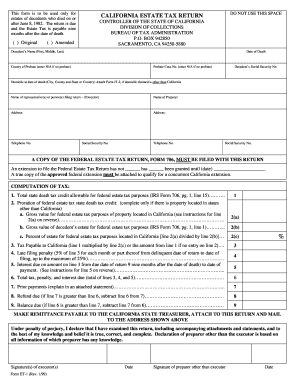

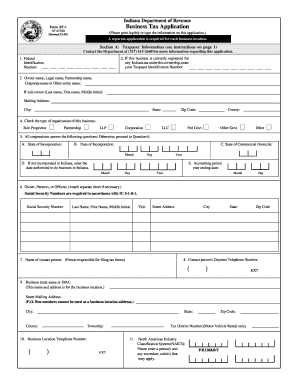

This document serves as an application for leasing commercial property, collecting essential information from the lessee and guarantors for credit assessment and lease considerations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial lease application

Edit your commercial lease application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial lease application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commercial lease application online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit commercial lease application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial lease application

How to fill out Commercial Lease Application

01

Obtain the Commercial Lease Application form from your landlord or property management.

02

Fill in your personal information, including your name, contact details, and business type.

03

Provide information about your business, such as its history, structure, and financial status.

04

List your previous rental history, including addresses, landlord contacts, and duration of leases.

05

Include references, such as professional contacts or previous landlords.

06

Attach any required supporting documents, such as financial statements or credit reports.

07

Review the application for completeness and accuracy.

08

Submit the application to the landlord or property management along with any application fees if required.

Who needs Commercial Lease Application?

01

Entrepreneurs looking to lease commercial space for their businesses.

02

Businesses expanding or relocating to new premises.

03

Independent contractors or freelancers seeking office or workspace.

04

Retailers wanting to open a brick-and-mortar store.

Fill

form

: Try Risk Free

People Also Ask about

How to write a letter of intent to lease commercial property?

How to Prepare to Write the Lease Letter of Intent Gather Information on the Space. How Do You Want to Present Your Company? Understand That the Letter of Intent is Non-Binding. Agree Internally on a Reasonable Expiry Date. A Statement Declaring Your Interest in Leasing the Space. A Description of Your Company.

How to write up a commercial lease?

Key Elements of a Commercial Lease Property Description. A clear and precise description of the property is fundamental. Lease Term. Rent and Payment Terms. Use of Property. Maintenance and Repairs. Alterations and Improvements. Insurance Requirements. Subleasing and Assignment.

What credit score do commercial lenders use?

Business credit scores and FICO scores are key considerations for lenders when taking on new customers. Without a business credit score, you'll likely need a strong personal credit history to qualify for a small business loan. Suppliers also typically review your business's credit score before providing terms.

What credit score do you need to rent a commercial property?

Unlike company credit scores, personal credit scores fall between 300 to 850, with 850 being the best score. Your applicants should have scores of at least 700 for consideration of your rental.

What are the three types of commercial leases?

3 Types of Commercial Real Estate Leases Gross Lease/Full Service Lease. In a gross lease, the tenant's rent covers all property operating expenses. Net Lease. The net lease is a highly adjustable commercial real estate lease. Modified Gross Lease/Modified Net Lease.

Can I get approved for a lease with a 600 credit score?

Anything from 670 to 740 can qualify as a “good” score, and even scores as low as 580 can qualify as “fair”. Leasing is still possible with a fair credit score–although you should expect to pay a higher-than-average interest rate–but if it gets much lower, you're going to run into trouble.

What credit score is needed for a commercial lease?

The lender will likely check both your business and personal credit score. The minimum varies but typically ranges between 660 and 680.

What credit score do you need for a commercial building?

For example, a credit score of 720 or above may be considered “good” for residential financing, while a score of 700 or above may be considered “good” for commercial financing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Commercial Lease Application?

A Commercial Lease Application is a document that potential tenants fill out to apply for a lease on commercial property. It typically collects information about the tenant's business and financial status to assist the landlord in making a leasing decision.

Who is required to file Commercial Lease Application?

Generally, any individual or business entity interested in renting commercial property will need to file a Commercial Lease Application. This includes startups, established businesses, and non-profit organizations.

How to fill out Commercial Lease Application?

To fill out a Commercial Lease Application, applicants should provide accurate information regarding their business, including details such as the business name, ownership structure, financials, references, and any prior rental history. Additionally, applicants must ensure to sign and date the application.

What is the purpose of Commercial Lease Application?

The purpose of a Commercial Lease Application is to allow landlords to evaluate the suitability of a prospective tenant. It helps landlords assess the tenant's creditworthiness, business stability, and their ability to fulfill lease terms.

What information must be reported on Commercial Lease Application?

Information that must be reported on a Commercial Lease Application typically includes the applicant's business name, contact information, type of business, financial statements, credit history, references, and any relevant legal disclosures.

Fill out your commercial lease application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Lease Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.