Get the free MORTGAGE PURCHASE AGREEMENT

Show details

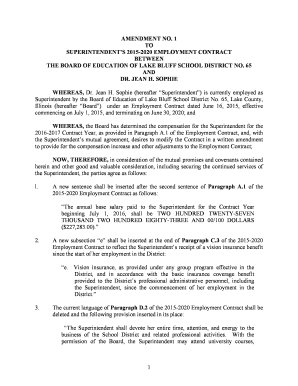

This document outlines the terms and conditions under which a licensed mortgage lender (Company Name) agrees to purchase certain residential mortgage loans from a seller, detailing obligations, definitions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage purchase agreement

Edit your mortgage purchase agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage purchase agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage purchase agreement online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage purchase agreement. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage purchase agreement

How to fill out MORTGAGE PURCHASE AGREEMENT

01

Begin by filling out the name of the buyer(s) and seller(s).

02

Include a detailed description of the property being purchased.

03

Specify the purchase price and the amount of the deposit.

04

Outline the terms of financing, including the type of mortgage and interest rate.

05

State any contingencies, such as inspections or financing approval.

06

Mention the closing date and any other important dates relevant to the agreement.

07

Ensure all parties sign and date the agreement to make it legally binding.

Who needs MORTGAGE PURCHASE AGREEMENT?

01

Individuals or couples looking to purchase real estate with a loan.

02

Real estate agents representing buyers or sellers in a transaction.

03

Lenders requiring a formal agreement when financing a property purchase.

Fill

form

: Try Risk Free

People Also Ask about

Can I write my own purchase agreement for a house?

Writing your own contracts is perfectly possible, and legal. But it's also an incredibly bad idea. There's two reasons for this: Property law is complicated. Because it's such a fundamental part of legislation, it's often lots and lots of different laws layered on top of each other.

What is a mortgage purchase agreement?

A real estate purchase agreement clearly and concisely spells out the agreed-upon terms under which a buyer and seller agree to a real estate transaction. The completion and signing of a purchase agreement effectively places both the buyer and seller (as well as the property in question) “under contract.”

Can anyone write a purchase agreement?

Can I write my own purchase agreement? In theory, yes: You're free to do so, given that a buyer or seller is allowed to draft their own real estate purchase agreement.

Can I make my own written agreement?

Yes you can write your own contracts. A written contract is only a written record of something that has already been agreed in speech. So to start with write down in simple terms what has been agreed already, that is a good starting point.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MORTGAGE PURCHASE AGREEMENT?

A Mortgage Purchase Agreement is a legally binding contract between a buyer and a seller outlining the terms and conditions under which the buyer will purchase a property, which is to be financed through a mortgage.

Who is required to file MORTGAGE PURCHASE AGREEMENT?

Typically, the buyer or their agent is responsible for filing the Mortgage Purchase Agreement as part of the home buying process, often required by lenders to finalize financing.

How to fill out MORTGAGE PURCHASE AGREEMENT?

To fill out a Mortgage Purchase Agreement, you need to provide details such as the buyer's and seller's names, property description, purchase price, financing terms, and any contingencies or special provisions.

What is the purpose of MORTGAGE PURCHASE AGREEMENT?

The purpose of a Mortgage Purchase Agreement is to establish the terms of the property sale and financing arrangements, protecting both the buyer's and seller's interests during the transaction.

What information must be reported on MORTGAGE PURCHASE AGREEMENT?

Information that must be reported includes the property address, parties involved, sale price, deposit amount, financing terms, contingencies, closing date, and any specific conditions agreed upon by both parties.

Fill out your mortgage purchase agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Purchase Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.