Get the free Dividend Reinvestment Plan Rules and ... - Select Harvests

Show details

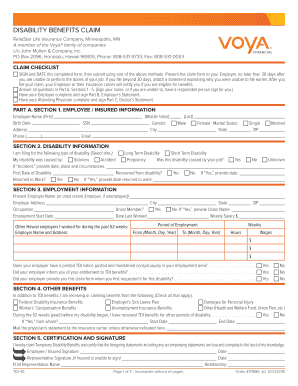

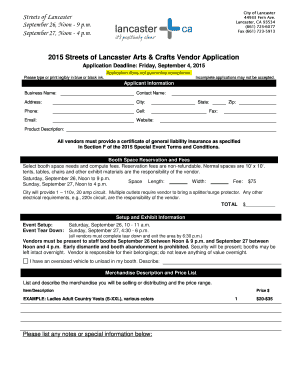

SELECT HARVESTS LIMITED ACN 000 721 380 DIVIDEND REINVESTMENT PLAN (DRP) NOTICE OF APPLICATION / VARIATION / WITHDRAWAL Name of Registered Shareholder(s): Registered Address: Postcode: I wish to:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dividend reinvestment plan rules

Edit your dividend reinvestment plan rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dividend reinvestment plan rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dividend reinvestment plan rules online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dividend reinvestment plan rules. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dividend reinvestment plan rules

How to fill out dividend reinvestment plan rules:

01

Understand the basics: Before filling out the dividend reinvestment plan (DRIP) rules, it is essential to have a clear understanding of what a DRIP is and how it works. Research and familiarize yourself with the concept of dividend reinvestment and the specific rules of the plan you are participating in.

02

Review the plan documentation: Carefully read through the dividend reinvestment plan's documentation provided by the company or broker. This will outline the specific rules and procedures for the plan, including any eligibility requirements, minimum investment amounts, and deadlines.

03

Assess your eligibility: Determine if you are eligible to participate in the dividend reinvestment plan. Some plans have specific eligibility criteria, such as being a current shareholder of the company or holding a certain number of shares. Ensure you meet these requirements before proceeding with the enrollment process.

04

Enroll in the DRIP: Follow the instructions outlined in the plan documentation to enroll in the dividend reinvestment plan. This typically involves completing an enrollment form provided by the company or broker. Provide all the necessary information, including your personal details, account information, and any additional requirements as specified by the plan.

05

Choose dividend reinvestment options: Many dividend reinvestment plans offer various reinvestment options, such as full or partial reinvestment, cash dividend receipt, or stock purchase with additional funds. Select the option that aligns with your investment goals and preferences.

06

Understand tax implications: It is crucial to be aware of the tax implications associated with dividend reinvestment. Consult with a tax professional or review relevant tax documentation to understand the potential tax consequences related to your participation in the DRIP.

Who needs dividend reinvestment plan rules?

01

Investors seeking long-term growth: Dividend reinvestment plans are often attractive to investors looking for long-term growth. By reinvesting dividends, investors can purchase additional shares of a company's stock, potentially compounding their investment over time.

02

Shareholders of dividend-paying companies: Dividend reinvestment plans are typically offered by companies that pay regular dividends to their shareholders. If you are a shareholder of such a company and wish to reinvest your dividends, understanding the dividend reinvestment plan rules is essential.

03

Individuals looking to maximize their investment: Participating in a dividend reinvestment plan allows individuals to maximize their investment by automatically reinvesting their dividends. This approach can result in the accumulation of more shares over time, potentially increasing the overall value of the investment.

04

Investors interested in cost-effective investing: Dividend reinvestment plans often come with low or no fees, making them cost-effective investment options. If you are looking for a way to invest in a company's stock without incurring significant fees, understanding dividend reinvestment plan rules can be beneficial.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dividend reinvestment plan rules?

Dividend reinvestment plan rules are guidelines that outline how shareholders can automatically reinvest cash dividends into additional shares of the company's stock.

Who is required to file dividend reinvestment plan rules?

Companies offering a dividend reinvestment plan (DRIP) are required to file the rules with the Securities and Exchange Commission (SEC).

How to fill out dividend reinvestment plan rules?

To fill out dividend reinvestment plan rules, companies must include details on how the DRIP works, eligibility requirements, fees, and any other relevant information for shareholders.

What is the purpose of dividend reinvestment plan rules?

The purpose of dividend reinvestment plan rules is to provide shareholders with the option to reinvest their dividends back into the company, which helps to increase their ownership over time.

What information must be reported on dividend reinvestment plan rules?

Dividend reinvestment plan rules must include information on how dividends will be reinvested, any fees associated with the DRIP, and eligibility requirements for participation.

How do I modify my dividend reinvestment plan rules in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your dividend reinvestment plan rules and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete dividend reinvestment plan rules online?

With pdfFiller, you may easily complete and sign dividend reinvestment plan rules online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I fill out the dividend reinvestment plan rules form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign dividend reinvestment plan rules and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your dividend reinvestment plan rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dividend Reinvestment Plan Rules is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.