Kansas law provides a form with which a subcontractor may claim a lien for labor and/or materials provided to new residential property. This Notice of Intent to Provide is filed in the office of the clerk of the district court of the county where the property is located. After the lien claimant is paid in full, the lien claimant is required to also file a form releasing the previous Notice and waiving any lien. Further, a property owner, or anyone acting for the property owner, may, after payment in full, demand in writing that the lien claimant file a release of Notice and Waiver of Lien.

Get the free Demand for Filing of Release - Corporation

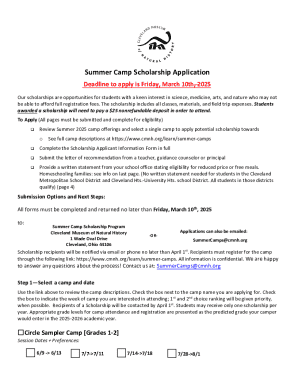

Show details

This document is a formal demand for the filing of a release and waiver of lien by a corporation that has satisfied a Notice of Intent to Perform by a subcontractor regarding a specified property.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign demand for filing of

Edit your demand for filing of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your demand for filing of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit demand for filing of online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit demand for filing of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out demand for filing of

How to fill out Demand for Filing of Release - Corporation

01

Obtain the Demand for Filing of Release - Corporation form from your state’s business filing office or website.

02

Review the instructions provided with the form to understand the requirements.

03

Complete the corporation information section, including the name of the corporation, address, and filing number.

04

Specify the reason for the demand and any relevant details related to the release.

05

Sign the form in the designated area, ensuring that the signature matches the authorized signatories of the corporation.

06

Collect any required supporting documents that may need to accompany the form.

07

Submit the completed form and any additional documents to the appropriate state office, either in person or by mail.

08

Pay any necessary filing fees associated with the demand.

Who needs Demand for Filing of Release - Corporation?

01

Corporations seeking to release a filing or to address issues related to previous filings.

02

Shareholders or other stakeholders who need to formally request a release from the corporation.

03

Legal representatives working on behalf of the corporation or its stakeholders.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to notify the IRS if I close my LLC?

Business owners should notify the IRS so they can close the IRS business account. Keep business records.

Is filing as an S corp worth it?

As a pass-through entity, one of the biggest tax advantages of the S corp business structure is that it avoids double-taxation, which means S corps don't have to pay taxes at the federal level the way C corps do. Instead, S corp profits are only taxed once, on the personal tax returns of individual shareholders.

Should I file as S corp or C corp?

As to which is better, there's no one size fits all. Electing as an S-corps may be better if your company provides a service to its customers and you have other employees. A C-corp may be better if you plan to bring on bigger investors. It's generally not a good idea to hold real estate in an entity that is an S-corp.

At what point should I file as an S corp?

Generally speaking, if it's later in the year, wait to form your S Corp until the following year, unless you expect a significant spike in income. If it's earlier in the year, talk to your tax preparer about how much you could save by switching mid-year and see if it's worth it.

How do I contact the IRS about estate taxes?

Many general estate and gift tax law questions can still be answered by calling: 800-829-1040.

How do I request a prompt assessment of estate tax?

How To Request A Prompt Assessment. To request a prompt assessment: Complete Form 4810: Provide detailed information, including the name of the decedent or taxpayer, the type of return filed (e.g., Form 1040 for individuals or Form 1041 for estates), and the periods covered by the return.

When should I start AC Corp?

When to form a C corp You want to issue stock to more than 100 shareholders. You want to issue stock to international investors or other corporations. You want to issue both common and preferred stock, which are two different classes of stock.

How do I request a tax transcript for a deceased person?

Tax transcript If you request a transcript online, it will be mailed to the deceased person's address of record. To have the transcript mailed to you, submit Form 4506-T, Request for Transcript of Tax Return. See Form 4506-T for instructions on where to send your request.

Is there a deadline to file for an S Corp?

S corporation 15th day of the 3rd month after the close of your tax year.

When should you file as AC Corp?

When do I file my corporation return? Form 100 is due on the 15th day of the fourth month after the close of the year. If the due date falls on a Saturday, Sunday, or legal holiday, the filing date becomes the next business day.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Demand for Filing of Release - Corporation?

The Demand for Filing of Release - Corporation is a formal request made by a corporation to notify the relevant authorities or parties that a previously filed document, such as a lien or encumbrance, should be released or cancelled.

Who is required to file Demand for Filing of Release - Corporation?

Generally, the corporation that is subject to the lien or encumbrance is required to file the Demand for Filing of Release - Corporation. This may also include authorized representatives or agents acting on behalf of the corporation.

How to fill out Demand for Filing of Release - Corporation?

To fill out the Demand for Filing of Release - Corporation, you should include the name of the corporation, the identification details of the original document to be released, any applicable case numbers, and the signatures of the authorized individuals. Ensure all required fields are completed accurately.

What is the purpose of Demand for Filing of Release - Corporation?

The purpose of the Demand for Filing of Release - Corporation is to formally communicate the desire to release or cancel specific legal claims against the corporation's assets, ensuring clarity and protecting the corporation's legal standing.

What information must be reported on Demand for Filing of Release - Corporation?

The information that must be reported includes the corporation's name, the original lien or encumbrance details, relevant case numbers, contact information of the filing party, and signatures of authorized individuals for validation.

Fill out your demand for filing of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Demand For Filing Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.