Get the free Term Insurance

Show details

This document provides details about LifeTime Benefit Term insurance offered by Fidelity Life Association, explaining its purpose, benefits, features, and application process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign term insurance

Edit your term insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your term insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing term insurance online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit term insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

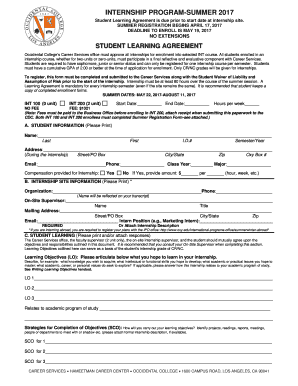

How to fill out term insurance

How to fill out Term Insurance

01

Determine the amount of coverage you need based on financial obligations.

02

Choose the term length that aligns with your financial goals and responsibilities.

03

Research and compare different insurance providers and their policies.

04

Fill out the application form with accurate personal and health information.

05

Undergo a medical examination if required by the insurer.

06

Review the policy terms and conditions before signing.

07

Make your first premium payment to activate the policy.

Who needs Term Insurance?

01

Individuals with dependents who would require financial support.

02

Homeowners with a mortgage and outstanding debts.

03

Young professionals looking for affordable insurance options.

04

Parents planning for children's education expenses.

05

Business owners wanting to protect their business and its employees.

Fill

form

: Try Risk Free

People Also Ask about

What is term insurance and how does it work?

A $1 million life insurance policy costs more than smaller policies because insurers take on greater financial risk if you die. The average cost of a million-dollar policy ranges from $62 to $271 per month, depending on term length. Your rate depends on your age, health, lifestyle and other risk factors.

Which is better, term or whole life?

The main disadvantages of a term plan include no cash value accumulation, temporary coverage, higher premiums with age, and no payout if the policyholder survives the term. These factors can limit its long-term benefits.

How much does a $1,000,000 term life insurance policy cost?

The pros and cons of term and whole life insurance are clear: Term life insurance is simpler and more affordable but has an expiration date and doesn't include a cash value feature. Whole life insurance is more expensive and complex, but it provides lifelong coverage and builds cash value over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Term Insurance?

Term insurance is a type of life insurance policy that provides coverage for a specified period of time, typically ranging from 1 to 30 years. It pays a death benefit to the beneficiaries if the insured person passes away during the term of the policy.

Who is required to file Term Insurance?

Typically, individuals seeking to obtain term insurance must fill out an application and provide necessary documentation. In some jurisdictions, insurance companies may require filings for regulatory compliance.

How to fill out Term Insurance?

To fill out a term insurance application, you need to provide personal information such as name, age, health history, lifestyle details, and sometimes financial information. It usually involves completing a form either online or on paper and may require a medical examination.

What is the purpose of Term Insurance?

The purpose of term insurance is to provide financial protection for a specific period, ensuring that loved ones have financial support in the event of the policyholder's death during the term. It is often used to cover expenses like mortgages, education, and daily living costs.

What information must be reported on Term Insurance?

Information that must be reported on a term insurance application typically includes personal details (name, age, gender), medical history, lifestyle habits (such as smoking), occupation, and details about any other life insurance policies.

Fill out your term insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Term Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.