Get the free Ohio IT 40P

Show details

This document provides instructions and a payment voucher for submitting Ohio income tax payments via various methods, including electronic check, credit card, and paper check or money order.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ohio it 40p

Edit your ohio it 40p form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ohio it 40p form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ohio it 40p online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ohio it 40p. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

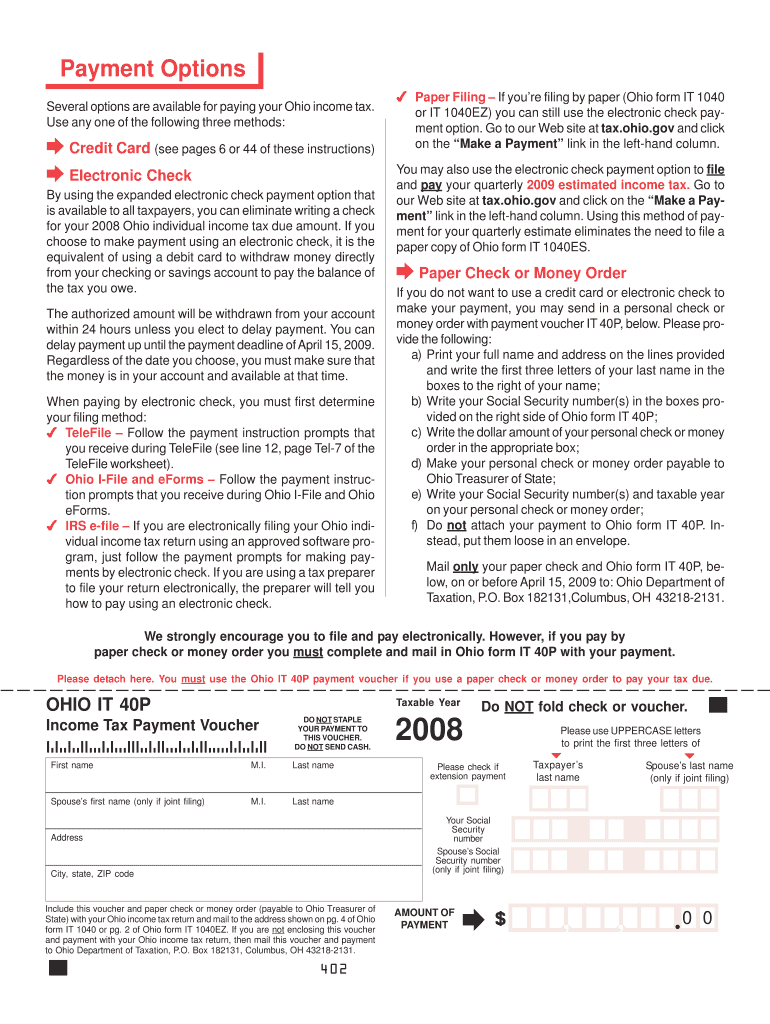

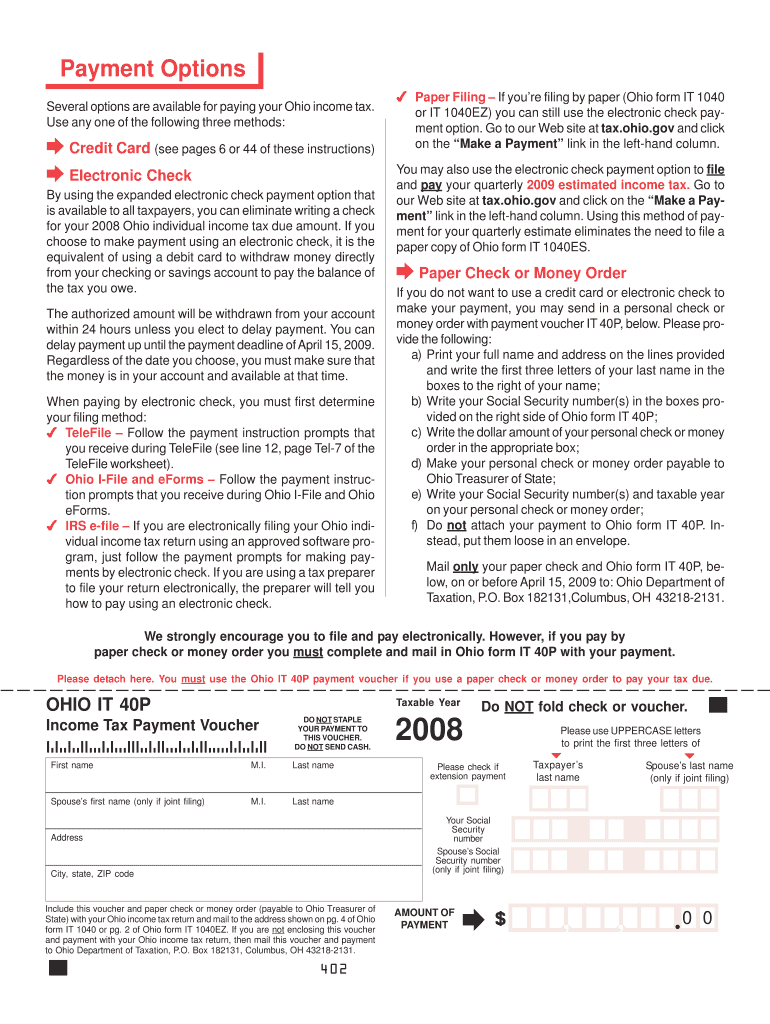

How to fill out ohio it 40p

How to fill out Ohio IT 40P

01

Start by downloading the Ohio IT 40P form from the official Ohio Department of Taxation website.

02

Fill out the personal information section, including your name, address, and Social Security number.

03

Indicate your filing status by checking the appropriate box (e.g., single, married, etc.).

04

Report your total income for the year from all sources.

05

Deduct any allowances, credits, or exemptions applicable to your situation.

06

Calculate your taxable income by subtracting deductions from your total income.

07

Use the tax tables provided to determine your tax liability based on your taxable income.

08

Fill out additional sections related to any special circumstances, like credits for taxes paid to other states.

09

Double-check all entries for accuracy and completeness.

10

Sign and date the form, then submit it to the appropriate state tax authority.

Who needs Ohio IT 40P?

01

Residents of Ohio who have income to report and need to file their state income tax returns.

02

Individuals who have tax liabilities and wish to claim refunds or credits pertaining to Ohio state taxes.

03

Taxpayers who need to report part-year residency in Ohio or other specific tax situations.

Fill

form

: Try Risk Free

People Also Ask about

What is Ohio tax form it 1040?

You should file an SD 100 if you: Lived in a taxing school district at any point during the tax year, Received any type of income while you were a resident, AND. You have a tax liability on that income (SD 100, line 8).

What is the Ohio PTE tax rate?

Ohio Form IT 1040 – Personal Income Tax Return for Residents. Ohio Form IT 10 – Income Tax Information. Ohio Form SD 100 – School District Tax Return. Ohio 529 Education Deduction Information.

Does Ohio have state income tax for retirees?

Social Security retirement benefits are fully exempt from state income taxes in Ohio. Certain income from pensions or retirement accounts (like a 401(k) or an IRA) is taxed as regular income, but there are credits available. Both property and sales tax rates are higher than national marks.

What is the $750 tax credit in Ohio?

Scholarship Donation Credit If you file as single or married filing separately, the maximum credit is $750. If you file as married filing jointly, the maximum credit is $1,500. You may qualify if a Pass-Through Entity (PTE) that you have ownership interest in donated money to an approved SGO.

Is Ohio eliminating state income tax?

Tax rate is 5% for the taxable year beginning January 1, 2022, and for taxable years beginning January 1, 2023, the rate is equal to the tax rate imposed on taxable business income under RC 5747.02 (A)(4)(a) (currently 3%).

What is the new tax law in Ohio?

Under the bill, 2025 non-business income tax would be reduced for the top income bracket – those making more than $102,400 – from 3.5% to 3.125%, with the bottom income bracket staying at 2.75%. In 2026, the top tax bracket is dropped further to 2.75%, matching that of the lower brackets.

What states are getting rid of income tax?

Nine states currently operate without an income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. However, except for Alaska, none of these states ever had one to begin with. (With billions in oil revenue flowing in, Alaska repealed its income tax in 1980.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Ohio IT 40P?

Ohio IT 40P is a tax form used by taxpayers in Ohio to report income and calculate their state income tax liability for the year.

Who is required to file Ohio IT 40P?

Residents of Ohio who have income and meet certain criteria, such as those with a taxable income above a specified threshold, are required to file the Ohio IT 40P.

How to fill out Ohio IT 40P?

To fill out Ohio IT 40P, gather your income information and other necessary documentation, complete all relevant sections of the form, ensure accuracy in reported amounts, and sign before submission.

What is the purpose of Ohio IT 40P?

The purpose of Ohio IT 40P is to allow residents to report their income, claim deductions or credits, and determine their tax liability to the state of Ohio.

What information must be reported on Ohio IT 40P?

Taxpayers must report their total income, adjusted gross income, deductions, exemptions, and any applicable tax credits or payments on the Ohio IT 40P form.

Fill out your ohio it 40p online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ohio It 40p is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.