Get the free Year End Accounts - Walsh amp Walsh Chartered Accountants

Show details

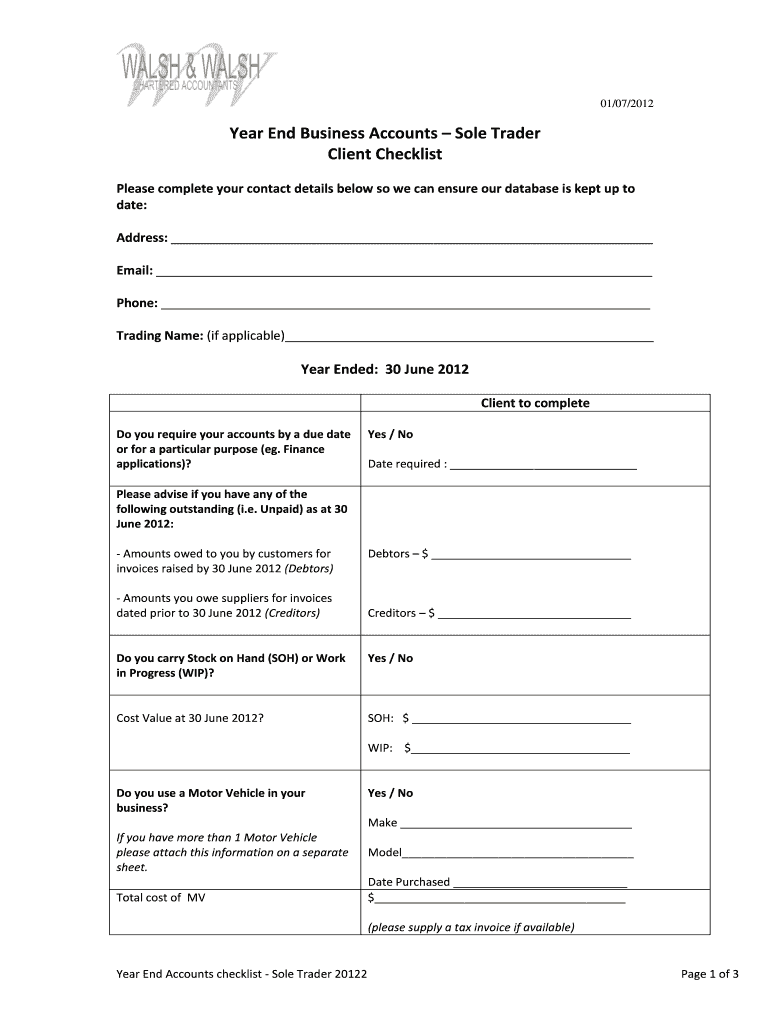

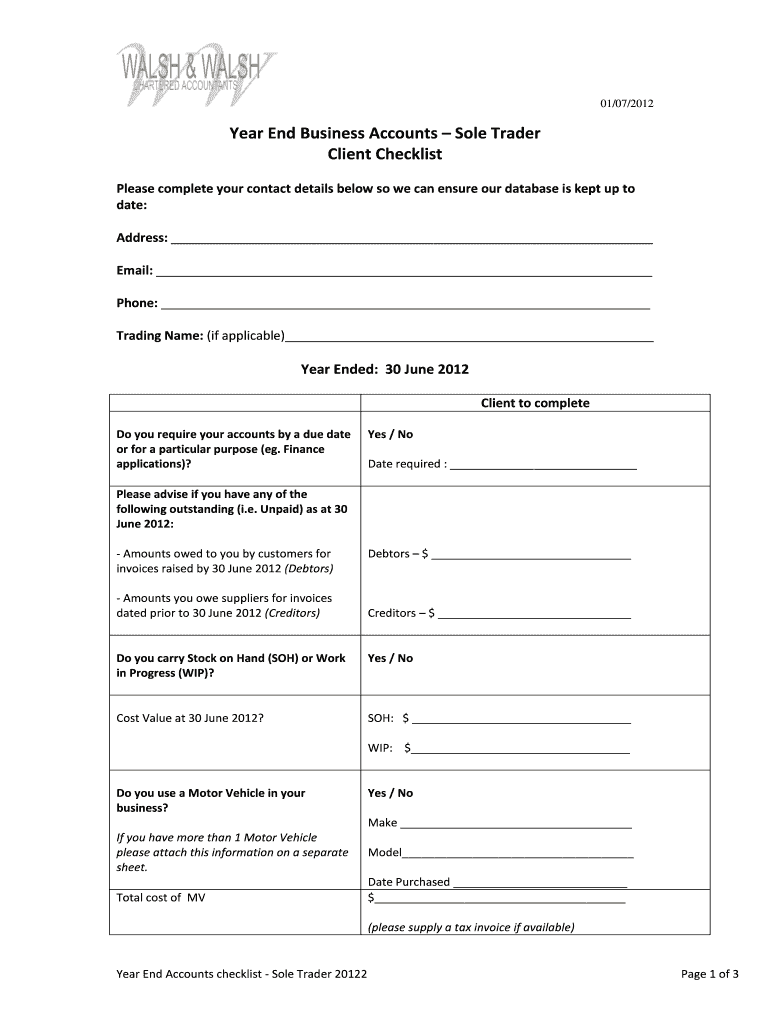

01/07/2012 Year End Business Accounts Sole Trader Client Checklist Please complete your contact details below, so we can ensure our database is kept up to date: Address: Email: Phone: Trading Name:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign year end accounts

Edit your year end accounts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your year end accounts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit year end accounts online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit year end accounts. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out year end accounts

How to fill out year end accounts:

01

Gather all financial documents: Before starting to fill out year end accounts, make sure you have all the necessary financial documents such as income statements, balance sheets, cash flow statements, and any other relevant records.

02

Reconcile bank statements: Review your bank statements and ensure that all transactions are accurately recorded and match the corresponding entries in your accounting system.

03

Organize invoices and receipts: Sort and organize all invoices and receipts throughout the year. This will help you track expenses and ensure they are deductible and properly allocated.

04

Record income and expenses: Enter all income and expenses into your accounting software or any other appropriate record-keeping system. Categorize them accordingly to make it easier to generate reports.

05

Reconcile accounts receivable and accounts payable: Confirm that the amounts owed to your business (accounts receivable) match your records, and ensure that you've paid all outstanding bills (accounts payable).

06

Calculate depreciation and amortization: If applicable, calculate the depreciation and amortization for your business assets. This will help you accurately reflect the value of your assets on your year-end accounts.

07

Prepare financial statements: Once all the financial data is accurately recorded, prepare your financial statements such as income statement, balance sheet, and cash flow statement.

08

Review and analyze financial statements: After preparing the financial statements, review them in detail to understand the financial health of your business. Analyze key metrics and ratios to identify strengths, weaknesses, and areas for improvement.

Who needs year end accounts:

01

Businesses: Year end accounts are essential for businesses of all sizes. They provide a comprehensive overview of the financial performance and position of the company, aiding in decision-making, tax planning, and attracting investors or lenders.

02

Accountants and auditors: Year end accounts are crucial for accountants and auditors who analyze and verify the financial records of companies. They use these accounts to prepare tax returns, financial reports, and ensure compliance with regulations.

03

Regulatory authorities: Regulatory authorities such as the IRS (Internal Revenue Service) and other government agencies require year end accounts to assess tax obligations, financial transparency, and compliance with accounting standards.

04

Investors and lenders: Investors and lenders use year end accounts to evaluate the financial stability and profitability of a company before making investment or lending decisions. These accounts provide essential information to assess risks and potential returns.

05

Business owners and managers: Year end accounts are valuable for business owners and managers as they provide insights into the financial performance, profitability, and efficiency of their operations. They help in identifying areas for improvement, setting financial goals, and making strategic decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send year end accounts for eSignature?

When you're ready to share your year end accounts, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I get year end accounts?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific year end accounts and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the year end accounts electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your year end accounts.

What is year end accounts?

Year end accounts are financial statements that summarize the financial activity of a business over the previous fiscal year.

Who is required to file year end accounts?

All registered companies are required to file year end accounts with the relevant government authorities.

How to fill out year end accounts?

Year end accounts can be filled out by compiling financial data such as income, expenses, assets, and liabilities, and presenting it in the required format.

What is the purpose of year end accounts?

The purpose of year end accounts is to provide an overview of a company's financial performance and financial position to stakeholders.

What information must be reported on year end accounts?

Year end accounts typically include a balance sheet, income statement, cash flow statement, and notes to the financial statements.

Fill out your year end accounts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Year End Accounts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.