Get the free Tax Institute Tax Institute - Western New England University - assets wne

Show details

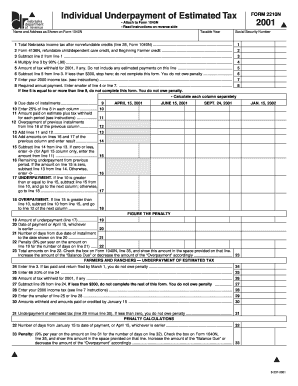

This document provides details about the 44th Annual Tax Institute hosted by Western New England College, including the schedule, topics covered, registration information, and costs involving CPE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax institute tax institute

Edit your tax institute tax institute form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax institute tax institute form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax institute tax institute online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax institute tax institute. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax institute tax institute

How to fill out tax institute tax institute:

01

Gather all necessary documents: Before filling out the tax institute tax institute, make sure you have all the relevant documents such as W-2s, 1099s, receipts, and any other financial information needed to accurately report your income and deductions.

02

Understand the tax institute form: Familiarize yourself with the tax institute tax institute form you need to fill out. Read the instructions and guidelines carefully to ensure you provide the correct information in the appropriate sections.

03

Personal information: Start by providing your personal information such as your name, address, Social Security number, and any other requested details. Accuracy is key in this step to avoid any processing errors.

04

Report your income: The tax institute tax institute requires you to report your income from various sources. Ensure that you accurately enter the amounts for each income category such as wages, self-employment income, dividends, interest, and any other taxable income you may have earned.

05

Deductions and credits: Take advantage of any deductions and credits you may be eligible for. Common deductions include expenses related to education, home mortgage interest, medical expenses, and charitable contributions. Carefully review the details and fill out the appropriate sections to maximize your tax benefits.

06

Review for accuracy: Once you have completed filling out the tax institute tax institute, take the time to review all the information you entered for accuracy. Check all calculations and ensure that you haven't missed any important sections. This step can help avoid any potential errors or delays in processing.

07

Sign and submit: After confirming that all the information is accurate, sign the tax institute tax institute form as required. Depending on your filing method, you may need to submit the form electronically or mail it to the appropriate tax authority within the specified deadline.

Who needs tax institute tax institute:

01

Individuals with taxable income: Any individual who earns taxable income is required to fill out the tax institute tax institute. This includes employees, self-employed individuals, freelancers, and those with investment income.

02

Business owners: If you own a business, whether it's a sole proprietorship, partnership, or corporation, you will likely need to complete the tax institute tax institute. This form helps report your business income, expenses, and other relevant information for tax purposes.

03

Investors and property owners: Individuals who invest in stocks, mutual funds, or other financial assets may need to fill out the tax institute tax institute to report any income or gains from these investments. Additionally, property owners who earn rental income must also complete this form to report their rental activity.

It's important to note that tax regulations and requirements can vary by jurisdiction, so it's always a good idea to consult with a tax professional or refer to the specific guidelines provided by your local tax authority.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax institute tax institute for eSignature?

When you're ready to share your tax institute tax institute, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit tax institute tax institute in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax institute tax institute, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How do I complete tax institute tax institute on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your tax institute tax institute. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is tax institute tax institute?

Tax institute tax institute refers to an organization or institution that focuses on tax-related matters such as tax research, education, and policy development.

Who is required to file tax institute tax institute?

The requirement to file tax institute tax institute may vary depending on the jurisdiction. Generally, tax institutes are not required to file taxes as they are non-profit organizations. However, individual members or employees of a tax institute may be required to file their own taxes based on their income and other relevant factors.

How to fill out tax institute tax institute?

The process of filling out tax institute tax institute depends on the specific requirements of the jurisdiction and the purpose for which the organization is filing taxes. Generally, tax institutes will need to gather financial information, such as income, expenses, and assets, and complete the necessary tax forms according to the guidelines provided by the tax authorities.

What is the purpose of tax institute tax institute?

The purpose of tax institute tax institute is to support and advance the understanding, knowledge, and application of tax laws and policies. Tax institutes often play a crucial role in providing research, education, and advocacy to improve tax systems and promote compliance with tax regulations.

What information must be reported on tax institute tax institute?

The specific information required to be reported on tax institute tax institute may vary depending on the jurisdiction and the relevant tax laws. Generally, tax institutes are required to report financial information such as income, expenses, assets, liabilities, and any other relevant financial transactions. Additionally, they may also be required to disclose details of their activities, programs, and expenses related to their tax-exempt purposes.

Fill out your tax institute tax institute online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Institute Tax Institute is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.