Get the free Application for bTax Exempt Transferb and Registration of Firearm

Show details

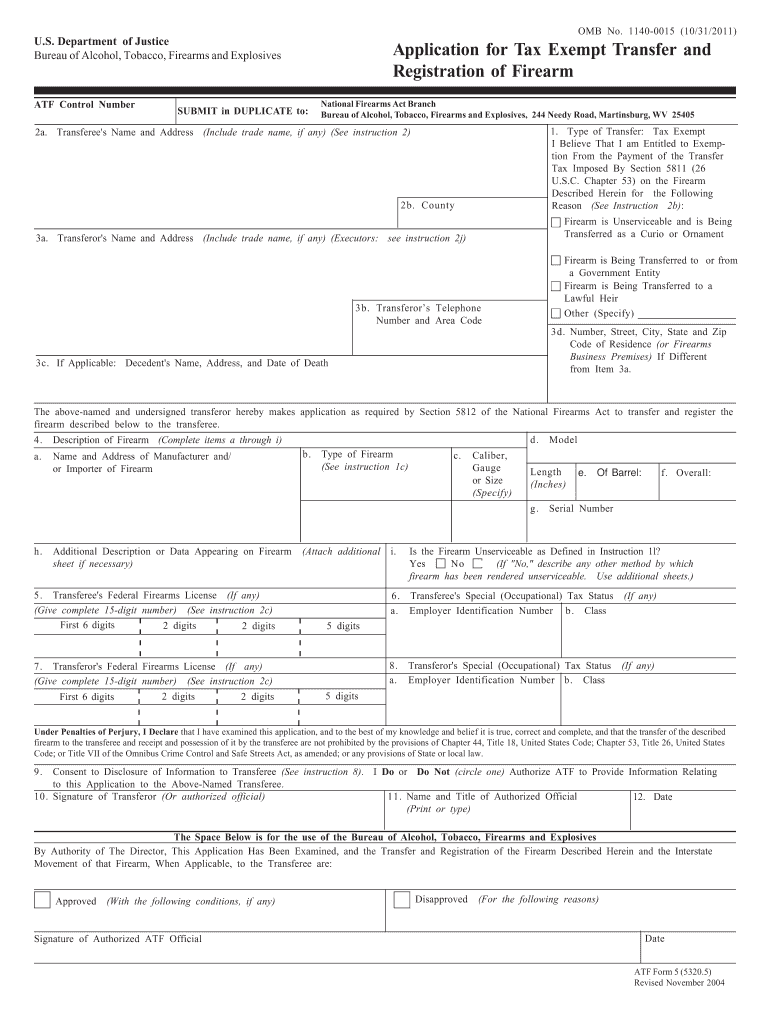

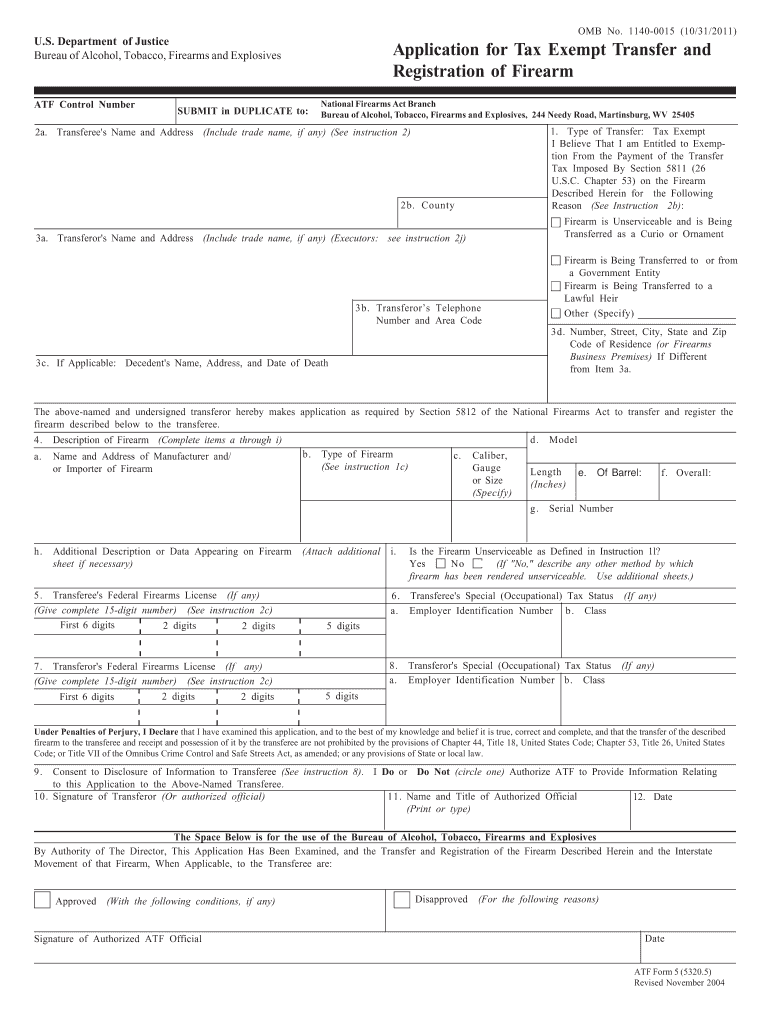

OMB No. 11400015 (10/31/2011) U.S. Department of Justice Bureau of Alcohol, Tobacco, Firearms and Explosives ATF Control Number Application for Tax Exempt Transfer and Registration of Firearm SUBMIT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for btax exempt

Edit your application for btax exempt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for btax exempt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for btax exempt online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for btax exempt. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for btax exempt

How to fill out application for btax exempt:

01

Obtain the application form: The first step in filling out the application for btax exempt is to obtain the necessary form. This can usually be done online through the relevant tax authority's website or by visiting their office in person.

02

Gather required documents: Before starting the application, gather all the necessary documents that may be required. These can include proof of non-profit status, financial statements, and any other supporting documentation that may be needed to support your request for btax exemption.

03

Fill out personal information: Begin the application by providing your personal information, such as your name, address, and contact details. This information is important for identification purposes and for the tax authority to reach out to you if necessary.

04

Provide organizational details: Next, provide details about your organization, such as its name, purpose, and structure. Include information about any previous tax-exempt status, if applicable.

05

State reasons for the exemption: In this section, clearly explain the reasons why your organization qualifies for btax exemption. Provide relevant information such as the nature of your organization's activities and how they contribute to the public good.

06

Complete financial information: In this section, you will need to provide detailed financial information, including income and expenses. It is important to accurately and comprehensively fill out this section as it will be crucial for the tax authority to assess your eligibility for btax exemption.

07

Attach supporting documents: Once you have completed the application form, make sure to attach all the necessary supporting documents. These may include copies of your organization's bylaws, articles of incorporation, and any other relevant paperwork.

Who needs the application for btax exempt?

01

Non-profit organizations: Non-profit organizations, such as charities, foundations, and religious institutions, often need to complete the application for btax exempt. This is because they may be eligible for tax exemption, allowing them to avoid paying certain taxes on their income.

02

Organizations engaged in public good: Entities that are engaged in activities aimed at benefiting the public, such as promoting education, alleviating poverty, or advancing scientific research, may also require the application for btax exempt to potentially qualify for tax exemption.

03

Entities seeking financial benefits: Organizations that wish to enjoy financial benefits, such as tax deductions for donors or eligibility for government grants and funding, may be required to fill out the application for btax exempt to establish their tax-exempt status.

In conclusion, anyone seeking btax exemption for their organization or entity should follow the step-by-step process of filling out the application form, including providing all required personal, organizational, and financial information, and attaching relevant supporting documents. This application is typically necessary for non-profit organizations, those engaged in public good activities, and those seeking financial benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for btax exempt in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your application for btax exempt and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the application for btax exempt in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your application for btax exempt and you'll be done in minutes.

Can I edit application for btax exempt on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign application for btax exempt on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is application for btax exempt?

The application for btax exempt is a form that allows certain organizations to apply for an exemption from paying certain taxes.

Who is required to file application for btax exempt?

Organizations that believe they qualify for tax exempt status must file the application for btax exempt to the appropriate tax authority.

How to fill out application for btax exempt?

The application for btax exempt usually requires organizations to provide detailed information about their mission, activities, and financial information.

What is the purpose of application for btax exempt?

The purpose of the application for btax exempt is to determine whether an organization qualifies for tax exempt status under the relevant tax laws.

What information must be reported on application for btax exempt?

The application for btax exempt typically asks for information about the organization's governance structure, sources of funding, and planned activities.

Fill out your application for btax exempt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Btax Exempt is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.