Get the free Fixed Term Income Fund Series XI

Show details

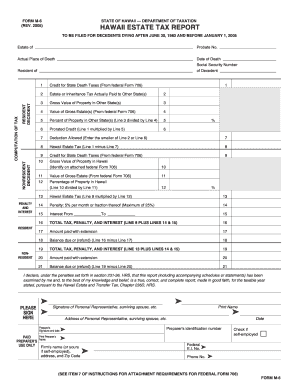

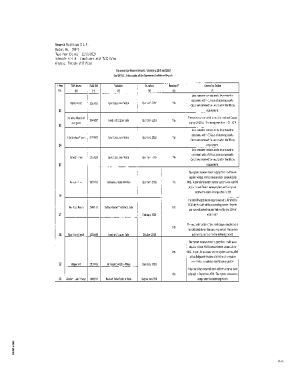

CMYK APPLICATION FORM Offer of Units of 10/- per unit for cash during the New Fund Offer Sr. No. 2012/ Registrar Sr. No. (PLEASE READ INSTRUCTIONS CAREFULLY TO HELP US SERVE YOU BETTER) DISTRIBUTOR

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fixed term income fund

Edit your fixed term income fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fixed term income fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fixed term income fund online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fixed term income fund. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fixed term income fund

How to fill out fixed term income fund:

01

Obtain the necessary forms: Start by obtaining the application forms for a fixed term income fund from the financial institution offering the fund. These forms can usually be found on the institution's website or can be requested from their customer service department.

02

Provide personal information: Fill out the application forms with accurate personal information, including your full name, address, contact details, and social security number. This information is necessary for identification and communication purposes.

03

Determine investment amount: Decide on the amount of money you would like to invest in the fixed term income fund. Consider your financial goals, risk tolerance, and investment horizon when determining the investment amount.

04

Choose the term length: Fixed term income funds typically come with various term lengths, ranging from a few months to several years. Select the term length that aligns with your investment objectives and time horizon. Keep in mind that longer term lengths generally offer higher interest rates but may limit access to your funds during the term.

05

Review the fund's prospectus: Carefully read through the prospectus of the fixed term income fund. The prospectus contains important information about the fund's investment strategies, risks, fees, and historical performance. This will help you make an informed investment decision.

06

Complete the investment section: Fill out the investment section of the application form, specifying the investment amount and term length you have chosen. Double-check for any errors or omissions before proceeding.

07

Provide banking information: If you are not investing with cash, you will need to provide your banking information. This typically includes your bank account number and routing number for the funds to be transferred electronically.

08

Submit the application: Once you have completed all the required sections of the application form and reviewed it for accuracy, submit the form to the financial institution. You can usually do this online, by mail, or by visiting a branch in person.

Who needs fixed term income fund?

01

Individuals seeking stable returns: Fixed term income funds are suitable for individuals who prioritize stable returns over the potential for high, but uncertain, gains. These funds invest in fixed-income securities such as bonds, government securities, and money market instruments, providing a predictable income stream.

02

Conservative investors: Fixed term income funds are often considered a conservative investment option as they aim to preserve capital and generate income. If you prefer minimizing risk and volatility in your investment portfolio, a fixed term income fund can be a suitable choice.

03

Investors with short-term goals: Due to their fixed term nature, these funds can be an ideal investment for individuals with short-term financial goals. Whether you are saving for a down payment on a house or planning a major expense in the near future, a fixed term income fund can help you save and earn interest while preserving your principal.

04

Retirement savers: Fixed term income funds can also serve as a component of a diversified retirement portfolio. They provide a more stable income stream compared to equities and can act as a cushion during market downturns. This can be particularly beneficial for retirees who rely on their investment income to cover living expenses.

Remember, it's always important to consult with a financial advisor or do thorough research before investing in any financial product, including fixed term income funds.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fixed term income fund without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your fixed term income fund into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an electronic signature for signing my fixed term income fund in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your fixed term income fund right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out fixed term income fund using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign fixed term income fund. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is fixed term income fund?

Fixed term income fund refers to an investment fund that invests in fixed-income securities with a predetermined maturity date and aims to provide a steady income stream for investors.

Who is required to file fixed term income fund?

The individuals or entities required to file a fixed term income fund are typically fund managers, investment companies, or custodians who manage or hold assets on behalf of investors.

How to fill out fixed term income fund?

To fill out a fixed term income fund, the required information and documentation will typically include details about the fund's investments, income distributions, fees, expenses, and compliance with regulatory requirements. It is recommended to consult with a professional or refer to the specific guidelines and forms provided by the relevant regulatory authorities.

What is the purpose of fixed term income fund?

The purpose of a fixed term income fund is to provide investors with a secure and predictable source of income by investing in fixed-income securities, such as bonds, certificates of deposit, or money market instruments, that have a predetermined maturity date.

What information must be reported on fixed term income fund?

The information that must be reported on a fixed term income fund typically includes details about the fund's investment holdings, duration, income distributions, expenses, and compliance with regulatory requirements. Additionally, information regarding the fund manager and custodian may also be required.

Fill out your fixed term income fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fixed Term Income Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.