Get the free Form 990 Schedules G to K

Show details

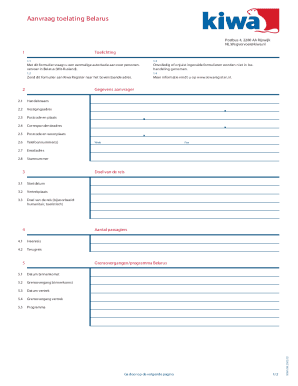

This document contains supplemental schedules related to fundraising activities, community benefit reporting, and compensation disclosures for organizations required to file Form 990 in 2008.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 990 schedules g

Edit your form 990 schedules g form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 990 schedules g form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 990 schedules g online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit form 990 schedules g. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 990 schedules g

How to fill out Form 990 Schedules G to K

01

Start by obtaining the Form 990 and review the general instructions for filling it out.

02

For Schedule G, gather information regarding professional fundraising services, including contracts and fees.

03

In Schedule H, provide details on hospitals and the governing body's decisions regarding community benefits.

04

For Schedule I, disclose information about grants and assistance provided to individuals, including eligibility criteria.

05

Complete Schedule J by listing the compensation of the highest paid employees and independent contractors.

06

Fill out Schedule K by detailing the organization's cost-sharing arrangements and any group returns.

07

Double-check each schedule for accuracy, ensuring that all required fields are completed.

08

Finally, compile Schedules G to K with the main Form 990 and submit it to the IRS by the due date.

Who needs Form 990 Schedules G to K?

01

Charitable organizations that engage in fundraising activities.

02

Hospitals that need to report community benefits and charitable care.

03

Organizations that provide grants or assistance and need to disclose eligibility criteria.

04

Nonprofits with high compensation for employees or contractors that must report their pay.

05

Organizations involved in cost-sharing arrangements or filing group returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of schedule G?

The new Schedule G authority allows agencies to classify and appoint individuals to noncareer positions of a policy-making or policy-advocating nature, filling a long- standing gap in the federal appointment structure.

What is a Schedule G on a 990?

Purpose of Schedule Schedule G (Form 990) is used by an organization that files Form 990 or Form 990-EZ to report professional fundraising services, fundraising events, and gaming.

What is the Schedule K for 990?

Purpose of Schedule Schedule K (Form 990) is used by an organization that files Form 990 to provide certain information on its outstanding liabilities associated with tax-exempt bond issues.

Does a 990 have a depreciation schedule?

If you are filing Form 990-PF Return of Private Foundation or Section 4947(a)(1) Trust Treated as Private Foundation, attach a schedule containing depreciation information instead of Form 4562. Per IRS Instructions for Form 990 Return of Organization Exempt From Income Tax, page 47: Line 22.

What needs to be included in Form 990?

The Form 990 is designed to increase financial transparency and includes revenue, expenditure, and income data in addition to information used to assess whether a nonprofit aligns with federal requirements for tax-exempt status.

What is the appendix G on a 990?

Schedule G mandates a detailed breakdown of financial information related to fundraising events, activities, and gaming activities. This includes reporting on revenues generated, associated expenses, and the resulting net income.

What is the Schedule K on a tax return?

The Schedule K-1 is the form that reports the amounts passed to each party with an interest in an entity, like a business partnership or an S corporation. The parties use the information on the K-1 to prepare their separate tax returns.

What is a Schedule G on a tax return?

Generally, a corporation must complete Schedule G if it: The corporation must report any individual or estate that owns directly 20% or more, or owns, directly or indirectly, 50% or more of the total voting power of all classes of the corporation's stock entitled to vote.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 990 Schedules G to K?

Form 990 Schedules G to K are additional schedules that non-profit organizations must complete as part of the Form 990 filing with the IRS, providing detailed information about various aspects of the organization's operations.

Who is required to file Form 990 Schedules G to K?

Organizations that meet certain criteria set by the IRS, including those with specific types of revenue, investments, or activities that require additional disclosures, are required to file these schedules.

How to fill out Form 990 Schedules G to K?

To fill out Form 990 Schedules G to K, organizations must gather financial data and operational details as required for each schedule and complete the forms according to the IRS instructions, ensuring accuracy and completeness.

What is the purpose of Form 990 Schedules G to K?

The purpose of these schedules is to provide transparency and additional information to the IRS and the public regarding the organization's financial health, governance, compensation, and specific operations.

What information must be reported on Form 990 Schedules G to K?

Information reported on these schedules may include compensation information for top officials, details on fundraising activities, governance policies, related organization transactions, and financial metrics related to investments.

Fill out your form 990 schedules g online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 990 Schedules G is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.