Get the free Membership, Account and Loan Application and Account Card

Show details

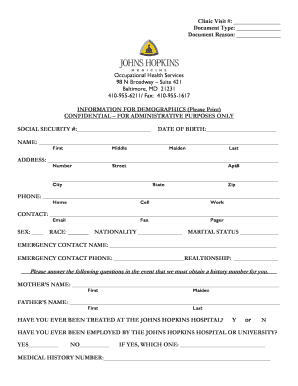

This document serves as an application for membership, account opening, and loans at Stamford Federal Credit Union, detailing personal information, account preferences, and terms of agreements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign membership account and loan

Edit your membership account and loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your membership account and loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit membership account and loan online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit membership account and loan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out membership account and loan

How to fill out Membership, Account and Loan Application and Account Card

01

Start by downloading the Membership, Account and Loan Application from the website or obtain a physical form from the institution.

02

Fill out your personal information, including your name, address, contact details, and Social Security number.

03

Specify the type of account you wish to open (checking, savings, loan, etc.) in the designated section.

04

Provide any additional required documentation, such as proof of identity and address.

05

Review the loan application part if applicable, including income details, employment information, and loan amount requested.

06

If applicable, complete the Account Card section with selections for services you wish to enroll in.

07

Double-check all entries for accuracy and completeness before submitting the application.

08

Submit your completed form in person or via the institution's online application portal.

Who needs Membership, Account and Loan Application and Account Card?

01

Individuals seeking to open a new bank account or line of credit.

02

New customers wishing to become members of the financial institution.

03

Existing members looking to update their account information or apply for a loan.

Fill

form

: Try Risk Free

People Also Ask about

What is the membership number in a bank?

A member number is a unique number that identifies you from all other Unity Bank members. An account number is a 9 digit number linked to each different account. Home Latest News What is the difference between the Member Number and Account Number?

What is a membership account in banking?

It means membership in a financial cooperative. Unlike traditional banks, where profits go to outside shareholders, Ideal Credit Union operates for the benefit of its members, who are also owners. Membership benefits include: Voting rights in board elections. Access to lower loan rates and higher savings dividends.

What is a membership number?

Membership Number means the unique number issued to each Member upon successful registration as a Member of the Network; View Source.

Is membership number the same as account number?

What's the difference between my Membership number and my account numbers? Your account numbers are a combination of your Membership number and the account-type number. A suffix is added to the end of your Membership number to indicate if it is your savings account or your checking account.

What does it mean for a credit union to be member-owned?

Unlike banks, credit unions belong to their members. This means that by joining a credit union and opening an account, you instantly become a part-owner and can participate in important decisions that guide the credit union's future.

What financial institution has a membership requirement?

Credit unions require membership to open a bank account or utilize services.

Is my member number the same as my checking account number?

Your full Account Number identifies a specific account such as a savings, checking or loan account. It is assigned as each account type is opened. You might notice that your member number is included in your account number. Account numbers are created using your member number and a unique account identifier number.

Are membership and account number the same?

Your full Account Number identifies a specific account such as a savings, checking or loan account. It is assigned as each account type is opened. You might notice that your member number is included in your account number. Account numbers are created using your member number and a unique account identifier number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Membership, Account and Loan Application and Account Card?

Membership, Account and Loan Application and Account Card is a document that individuals complete to apply for membership and open accounts or loans with a financial institution. It collects personal information, financial details, and consent for various services.

Who is required to file Membership, Account and Loan Application and Account Card?

Individuals who wish to become members of a financial institution or apply for accounts or loans must file the Membership, Account and Loan Application and Account Card.

How to fill out Membership, Account and Loan Application and Account Card?

To fill out the Membership, Account and Loan Application and Account Card, applicants should provide personal identification information, contact details, financial status, and any additional required information as specified by the institution. It is important to ensure accuracy and completeness.

What is the purpose of Membership, Account and Loan Application and Account Card?

The purpose of the Membership, Account and Loan Application and Account Card is to gather necessary information to assess eligibility for membership, to open accounts or grant loans, and to ensure compliance with regulatory requirements.

What information must be reported on Membership, Account and Loan Application and Account Card?

The information reported typically includes the applicant's full name, address, date of birth, Social Security number, employment details, income, desired services, and consent for terms and conditions.

Fill out your membership account and loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Membership Account And Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.