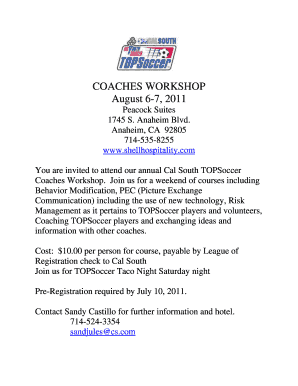

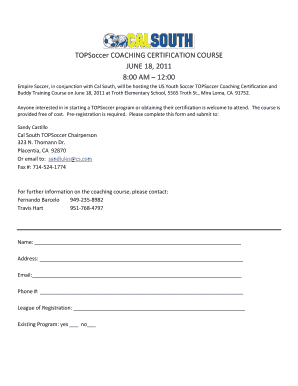

Get the free GROUP INSURANCE

Show details

Print GROUP INSURANCE According to your province of residence, please submit form to: Quebec Group Health and Dental Claims PO Box 800, Station Madison de la Post Montreal, Quebec H3B 3K5 Policy no.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group insurance

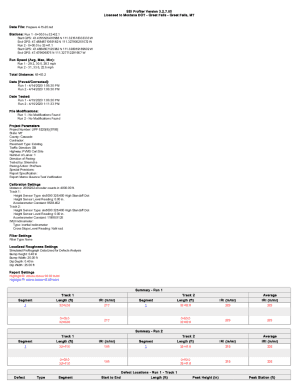

Edit your group insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group insurance online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit group insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group insurance

How to fill out group insurance:

01

Gather necessary information: Before filling out the group insurance forms, make sure you have all the required information, such as the names and contact details of all the group members, their dates of birth, social security numbers, and any other relevant personal details.

02

Choose a plan: Determine the type of insurance plan you want for your group, whether it is health insurance, life insurance, disability insurance, or any other type of coverage. Consider the specific needs of your group members when selecting a plan.

03

Contact insurance providers: Reach out to insurance providers and request quotes for group insurance. Gather information about the coverage, premiums, deductibles, and any additional benefits that each provider offers. Compare the options to find the best fit for your group.

04

Submit application forms: Once you have chosen an insurance provider, fill out the application forms for group insurance. Provide accurate information and ensure that all group members sign the necessary documents. You may need to include additional documents, such as proof of employment or eligibility for certain group insurance benefits.

05

Review the contract: Carefully review the insurance contract before signing it. Pay attention to the coverage details, limitations, exclusions, and any other terms and conditions. Make sure you understand the benefits and responsibilities of both the group and the insurance provider.

06

Pay premiums: Determine who will be responsible for paying the premiums. In some cases, the group members may have to contribute a portion of the premium costs, while the employer or organization may cover the rest. Set up a payment schedule and ensure that payments are made on time to avoid any gaps in coverage.

07

Communicate with group members: Keep your group members informed about the details of the group insurance plan. Share information about coverage, any changes or updates to the policy, and how to utilize the benefits effectively. Provide contact information for the insurance provider in case of any questions or concerns.

Who needs group insurance?

01

Employees: Group insurance is often provided by employers as part of employee benefits packages. It allows employees to access coverage for health, life, disability, or other insurances collectively as a group. It provides financial protection and peace of mind for employees and their families.

02

Small businesses: Group insurance can benefit small businesses by allowing them to provide competitive benefits to attract and retain talented employees. It helps spread the costs of insurance across a larger group, making it more affordable compared to individual insurance plans.

03

Organizations: Various organizations, such as non-profits, clubs, associations, or unions, can offer group insurance to their members. By negotiating group rates and pooling the risk of multiple individuals, organizations can provide cost-effective insurance options to their members.

04

Family or social groups: Group insurance can also be relevant for family or social groups, such as extended families, community organizations, or volunteer groups. It allows members to access insurance coverage at a potentially lower cost compared to individual plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in group insurance without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your group insurance, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit group insurance on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign group insurance right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit group insurance on an Android device?

With the pdfFiller Android app, you can edit, sign, and share group insurance on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is group insurance?

Group insurance is a type of coverage that provides protection to a group of individuals, such as employees of a company or members of an organization, under a single insurance policy.

Who is required to file group insurance?

Employers or organizations that offer group insurance benefits to their employees or members are required to file group insurance.

How to fill out group insurance?

To fill out group insurance, you need to provide the necessary information about the insured individuals, such as their names, dates of birth, and coverage details. This information is typically obtained through enrollment forms or online portals provided by the insurer.

What is the purpose of group insurance?

The purpose of group insurance is to provide affordable and accessible insurance coverage to a group of individuals who may not qualify for or afford individual insurance plans. It helps spread the risk among the group members and offers financial protection against various risks, such as medical expenses or loss of income.

What information must be reported on group insurance?

The information that must be reported on group insurance usually includes the names and details of the insured individuals, coverage start and end dates, policy details, and any changes in coverage. Additionally, any dependents covered under the policy may also need to be included.

Fill out your group insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.