Get the free INDIVIDUAL RETIREMENT ACCOUNT (IRA)

Show details

This document provides the necessary information and instructions for establishing a Traditional or Roth Individual Retirement Account (IRA) with BNY Mellon, including contribution limits, eligibility,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual retirement account ira

Edit your individual retirement account ira form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual retirement account ira form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit individual retirement account ira online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit individual retirement account ira. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual retirement account ira

How to fill out INDIVIDUAL RETIREMENT ACCOUNT (IRA)

01

Determine your eligibility based on age and income.

02

Choose between a Traditional IRA or a Roth IRA.

03

Select a financial institution to open your IRA account.

04

Complete the IRA application form with personal information.

05

Decide on your initial contribution amount (up to the annual limit).

06

Select your investment options within the IRA.

07

Review and sign the account agreement and disclosures.

08

Fund your IRA by making your initial deposit or transfer from another account.

Who needs INDIVIDUAL RETIREMENT ACCOUNT (IRA)?

01

Individuals looking to save for retirement.

02

People wanting tax advantages for their retirement savings.

03

Those who are self-employed or have inconsistent income.

04

Individuals with access to employer-sponsored retirement plans but want additional savings options.

05

Anyone seeking to grow their investments over time in a tax-advantaged account.

Fill

form

: Try Risk Free

People Also Ask about

Is an IRA an individual retirement account?

Individual retirement accounts (IRAs) are personal retirement savings accounts that offer tax benefits and a range of investment options. Many investors use IRAs as their common source of saving for retirement.

How does an IRA work for dummies?

The two primary ways an IRA can grow is through annual contributions and investment appreciation. However, there are limits to the annual contribution amounts allowed, and not all investments are successful in the long term.

What is IRA and how does it work?

A traditional IRA gives you a tax deduction for all contributions and you can also avoid paying taxes on all dividends and other gains on the account until you are in retirement. This enables you to build up a larger retirement portfolio because of the taxes you avoid paying along the way.

What are the disadvantages of an IRA?

Cons of a Traditional IRA Income taxes due on both contributions and gains when in retirement. No company match like in some 401(k) plans. Relatively low annual contribution limits. 10% penalty for early withdrawals (applies to all retirement accounts)

Is an IRA a good investment?

Roth and traditional IRA contribution limits Know your contribution limits. The maximum amount you can contribute to a traditional IRA or Roth IRA (or combination of both) in 2024 is $7,000. So that's about $583 a month. If you're age 50 or over, the IRS allows you to contribute up to $7,500 annually (or $625 a month).

How does an IRA make me money?

An IRA is not inherently better. They -401(k) and IRA, are both pre-tax investments dedicated for retirement. However, a 401(k), as you know allows you to contribute a higher amount than an IRA. What may make an IRA better is a broader variety of investment options within it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INDIVIDUAL RETIREMENT ACCOUNT (IRA)?

An Individual Retirement Account (IRA) is a type of tax-advantaged investment account that individuals can use to save for retirement. It allows individuals to invest in a variety of assets, including stocks, bonds, and mutual funds, while providing potential tax benefits.

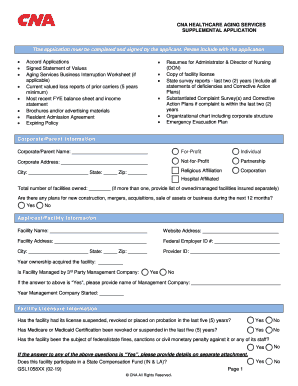

Who is required to file INDIVIDUAL RETIREMENT ACCOUNT (IRA)?

Individuals who are earning income and want to contribute to an IRA are generally required to file an application to establish one. Additionally, those who want to deduct their contributions from their taxable income must file the appropriate tax forms.

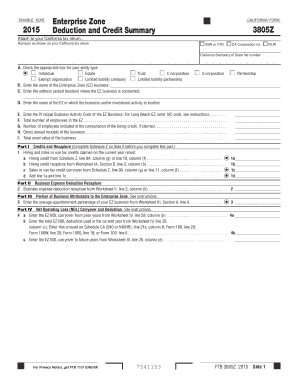

How to fill out INDIVIDUAL RETIREMENT ACCOUNT (IRA)?

To fill out an IRA application, individuals typically need to provide personal information such as their name, address, Social Security number, date of birth, and employment information. The specific forms depend on the financial institution and the type of IRA being set up.

What is the purpose of INDIVIDUAL RETIREMENT ACCOUNT (IRA)?

The primary purpose of an IRA is to encourage individuals to save for retirement by providing tax advantages. Contributions to an IRA may be tax-deductible, and the investments can grow tax-free or tax-deferred until withdrawal.

What information must be reported on INDIVIDUAL RETIREMENT ACCOUNT (IRA)?

Individuals must report their contributions to an IRA, any withdrawals made, and the performance of the account on their tax returns. Required forms can include IRS Form 5498 for contributions and Form 1099-R for withdrawals.

Fill out your individual retirement account ira online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Retirement Account Ira is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.