Get the free 113th Congress Miscellaneous Tariff Bill Disclosure Form - waysandmeans house

Show details

This form is submitted to reflect information provided during the 112th Congress MTB comment period and the International Trade Commission’s Congressional Bill Report for consideration in the 113th

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 113th congress miscellaneous tariff

Edit your 113th congress miscellaneous tariff form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 113th congress miscellaneous tariff form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 113th congress miscellaneous tariff online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 113th congress miscellaneous tariff. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 113th congress miscellaneous tariff

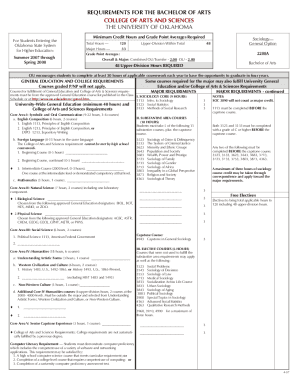

How to fill out 113th Congress Miscellaneous Tariff Bill Disclosure Form

01

Obtain the 113th Congress Miscellaneous Tariff Bill Disclosure Form.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information including name, address, and contact details.

04

Provide a description of the product for which you are requesting a tariff reduction.

05

State the Harmonized Tariff Schedule (HTS) number related to your product.

06

Include the quantity and estimated value of the goods affected.

07

Indicate any relevant customs or trade laws linked to your request.

08

Review the form for completeness and accuracy.

09

Submit the form by the specified deadline, following the submission guidelines provided.

Who needs 113th Congress Miscellaneous Tariff Bill Disclosure Form?

01

Manufacturers or importers of goods that may benefit from reduced tariffs.

02

Businesses seeking to access tariff reductions for specific products.

03

Trade associations or industry groups representing interests in tariff issues.

Fill

form

: Try Risk Free

People Also Ask about

What is a tariff and why is it bad?

Governments impose tariffs to raise revenue, protect domestic industries, or exert political leverage over another country. Tariffs often result in unwanted side effects, such as higher consumer prices.

What is the miscellaneous tariff bill?

The Miscellaneous Tariff Bill (MTB) is a law that temporarily reduces or suspends the import tariffs paid on particular products imported into the United States. Typically, companies importing the products request the duty reductions or suspensions by submitting a petition for each concerned product.

What is the meaning of tariff bill?

A tariff or import tax is a duty imposed by a national government, customs territory, or supranational union on imports of goods and is paid by the importer. Exceptionally, an export tax may be levied on exports of goods or raw materials and is paid by the exporter.

What law is Trump using to impose tariffs?

Trump also claimed unprecedented tariff authority under the International Emergency Economic Powers Act (IEEPA). On April 2, 2025, he invoked the law to impose Liberation Day tariffs on imports from all countries not subject to other sanctions. A universal 10% tariff took effect on April 5.

What is a miscellaneous tariff bill?

The Miscellaneous Tariff Bill (MTB) is a law that temporarily reduces or suspends the import tariffs paid on particular products imported into the United States. Typically, companies importing the products request the duty reductions or suspensions by submitting a petition for each concerned product.

When did MTB expire?

“We urge the House to act quickly so that we can get one step closer to getting this critical legislation to President Biden's desk.” The last MTB expired in December 2020.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

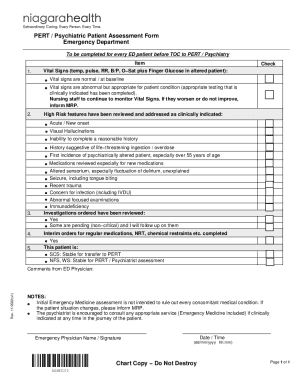

What is 113th Congress Miscellaneous Tariff Bill Disclosure Form?

The 113th Congress Miscellaneous Tariff Bill Disclosure Form is a document that must be filed to disclose certain information regarding petitions for miscellaneous tariff bills that provide relief from tariffs on specific goods.

Who is required to file 113th Congress Miscellaneous Tariff Bill Disclosure Form?

Individuals or entities that submit petitions for miscellaneous tariff relief to the U.S. Congress are required to file the 113th Congress Miscellaneous Tariff Bill Disclosure Form.

How to fill out 113th Congress Miscellaneous Tariff Bill Disclosure Form?

To fill out the form, the petitioner must provide specific information about themselves, the goods involved, the tariff relief requested, and any other required disclosures as stipulated in the form's instructions.

What is the purpose of 113th Congress Miscellaneous Tariff Bill Disclosure Form?

The purpose of the form is to ensure transparency and compliance with lobbying and disclosure laws, as well as to provide Congress with necessary information to evaluate the requests for tariff relief.

What information must be reported on 113th Congress Miscellaneous Tariff Bill Disclosure Form?

The form requires the petitioner to report information such as their contact details, the nature of the goods for which tariff relief is requested, the specific tariff codes, estimated import volume, and any financial interests related to the tariff relief.

Fill out your 113th congress miscellaneous tariff online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

113th Congress Miscellaneous Tariff is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.