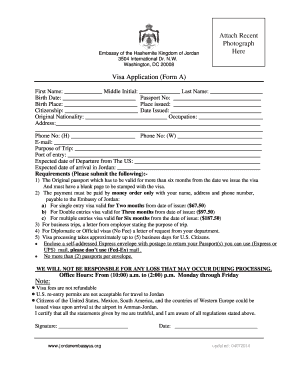

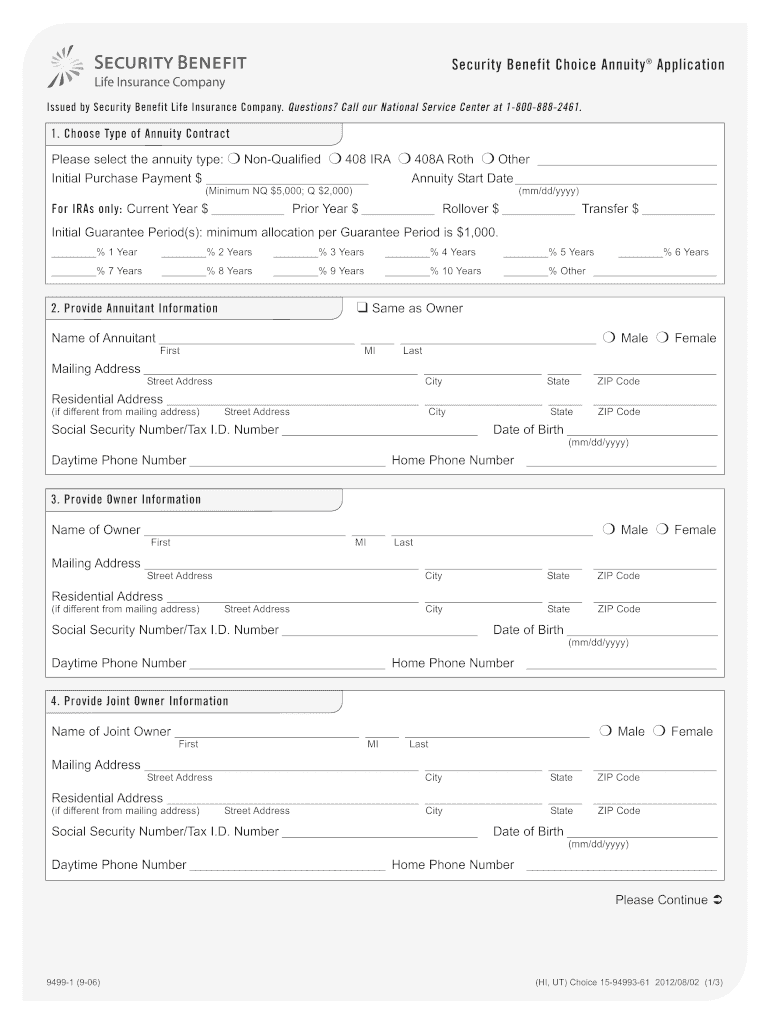

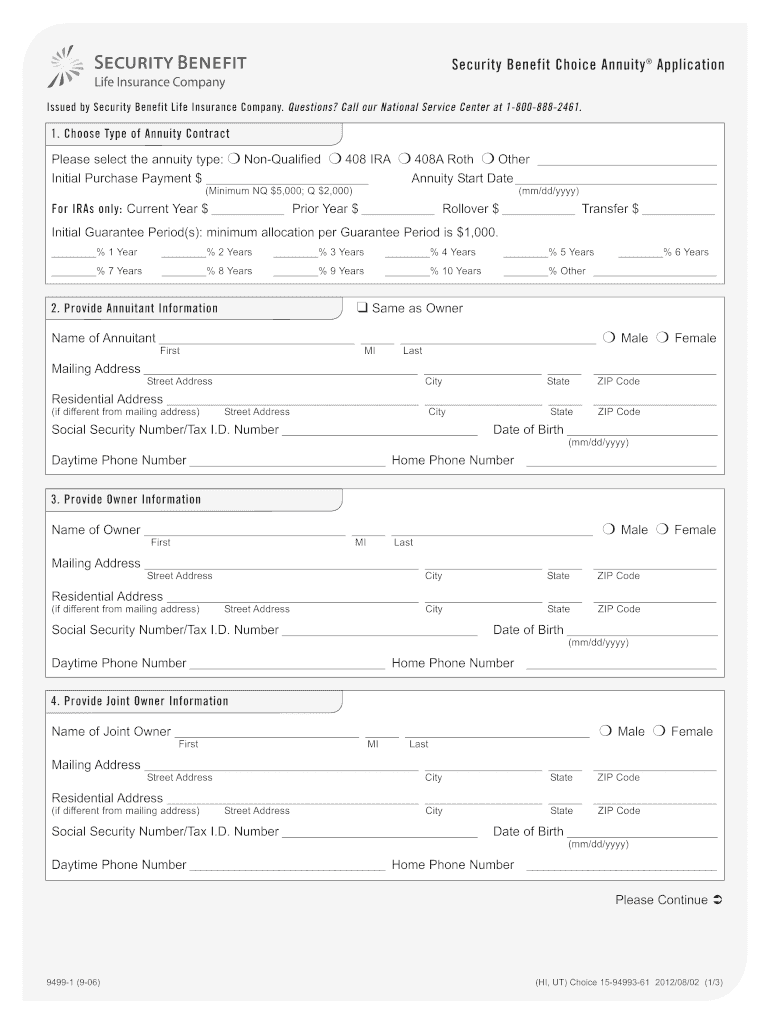

Get the free Choose Type of Annuity Contract Please select the annuity type: NonQualified 408 IRA...

Show details

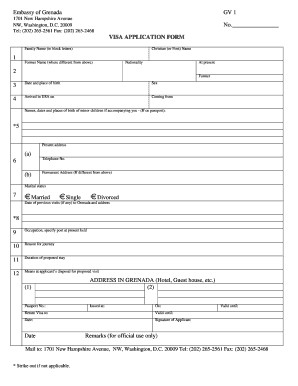

Security Benefit Choice Annuity Application Issued by Security Benefit Life Insurance Company. Questions? Call our National Service Center at 18008882461. 1. Choose Type of Annuity Contract Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign choose type of annuity

Edit your choose type of annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your choose type of annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit choose type of annuity online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit choose type of annuity. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out choose type of annuity

How to fill out and choose the type of annuity:

01

Research different types of annuities: Take the time to understand the different types of annuities available, such as fixed, variable, indexed, immediate, or deferred annuities. Each type has its own features and benefits, so it's important to find the one that aligns with your financial goals and risk tolerance.

02

Assess your financial needs and goals: Determine why you are considering an annuity. Are you looking for a steady stream of income in retirement, want to grow your investment, or have specific financial objectives? Consider factors such as your retirement timeline, desired income level, and risk preferences.

03

Evaluate the financial strength and reputation of the annuity provider: Since an annuity is a long-term contract, you want to ensure the provider is reputable and financially stable. Research the company's ratings and reviews from independent agencies, and verify their legitimacy through state insurance regulators.

04

Compare and analyze the features and associated costs: Once you have a clear understanding of your needs and the different types of annuities, compare the features and costs of various annuity products from different providers. Look for aspects such as surrender charges, fees, interest rates, investment options, death benefit provisions, and any additional optional riders.

05

Consult with a financial professional: Seeking advice from a knowledgeable financial professional, such as a financial advisor or insurance agent, can be beneficial in navigating the complexities of annuities and choosing the right type. They can provide personalized guidance based on your specific situation, goals, and risk tolerance.

Who needs to choose the type of annuity?

01

Individuals planning for retirement: Annuities can be an attractive option for those seeking a guaranteed income stream during retirement, especially if they don't have a pension or want to supplement their Social Security benefits.

02

Risk-averse investors: If you are concerned about market volatility and prefer stable returns, a fixed or indexed annuity might be suitable. These types of annuities offer predictable income and protection against market downturns.

03

Individuals with substantial savings: Annuities are often used by individuals with significant savings who want to grow their money tax-deferred and then convert it into a guaranteed income stream later in life.

04

Those concerned about outliving their savings: Annuities can provide peace of mind for individuals worried about running out of money in retirement. By choosing a lifetime annuity option, you can ensure a regular income for as long as you live.

05

Individuals looking for estate planning benefits: Annuities can also be used as part of estate planning strategies, as they often offer death benefit provisions that allow beneficiaries to receive annuity proceeds.

Remember, choosing the right type of annuity is a personal decision that should align with your financial goals and circumstances. It's essential to thoroughly research and understand the terms and provisions of any annuity contract before making a decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify choose type of annuity without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including choose type of annuity. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make changes in choose type of annuity?

With pdfFiller, it's easy to make changes. Open your choose type of annuity in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I create an electronic signature for signing my choose type of annuity in Gmail?

Create your eSignature using pdfFiller and then eSign your choose type of annuity immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is choose type of annuity?

An annuity is a financial product that provides a series of payments over a specified period of time.

Who is required to file choose type of annuity?

Individuals who have purchased an annuity are required to file.

How to fill out choose type of annuity?

You can fill out an annuity by providing your personal information, details of the annuity contract, and any other required information.

What is the purpose of choose type of annuity?

The purpose of an annuity is to provide a steady income stream for the annuitant.

What information must be reported on choose type of annuity?

Information such as the annuitant's name, address, social security number, and the amount of the annuity payments must be reported.

Fill out your choose type of annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Choose Type Of Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.