Get the free Auto Loan

Show details

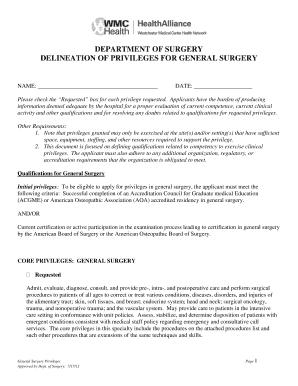

Purpose: Auto Loan Signature g Loan Quick Cash Application Fee $25.00 EU pp $50 Initial for Quick Cash Loan DATE LOAN AND SECURITY AGREEMENTS AND DISCLOSURE STATEMENT LOAN NUMBER ACCOUNT NUMBER GROUP

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign auto loan

Edit your auto loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your auto loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing auto loan online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit auto loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out auto loan

How to fill out an auto loan:

01

Gather necessary documents: Start by collecting all the required documents for your auto loan application. This typically includes your ID, proof of income, proof of residence, and information about the car you're purchasing.

02

Determine your budget: Before filling out the auto loan application, it's important to determine your budget. Calculate how much you can afford to borrow and how much you can afford to repay each month. Consider factors like down payment, interest rates, and the length of the loan.

03

Research lenders: Look for reputable lenders who offer auto loans with favorable terms. Compare interest rates, repayment options, and customer reviews. It's essential to choose a lender that suits your needs and provides competitive rates.

04

Fill out the application: Once you have chosen a lender, fill out the auto loan application accurately and completely. Provide all the necessary personal and financial information as required. Double-check for any errors or missing details before submitting the application.

05

Review loan terms: After submitting your application, carefully review the loan terms offered by the lender. Pay attention to the interest rate, loan duration, monthly payments, and any additional fees. Understand the terms and conditions thoroughly before accepting the loan.

06

Provide necessary documentation: If your loan application is approved, the lender may require additional documentation to complete the process. Common documents include proof of insurance, vehicle registration, and a signed purchase agreement. Provide these promptly to avoid any delays in finalizing the loan.

07

Sign the loan agreement: Once all the paperwork is in order, you'll be asked to sign the loan agreement. Read it carefully and make sure you understand all the terms and conditions before signing. Seek clarification from the lender if any aspect is unclear.

Who needs an auto loan:

01

Individuals looking to purchase a car: Auto loans are primarily needed by individuals who want to buy a car but don't have the full amount available for immediate payment. By taking out an auto loan, people can finance the vehicle's purchase and repay the loan over a specific period, usually with interest.

02

First-time car buyers: Many first-time car buyers, especially young adults or recent graduates, may not have sufficient savings to purchase a vehicle outright. They might require an auto loan to make the purchase, enabling them to afford a car without draining their savings entirely.

03

People with limited credit history: People who have a limited credit history or no credit history at all may find it challenging to secure an auto loan. However, some lenders specialize in providing loans to individuals with limited credit, making it possible for them to purchase a car and build credit by making timely loan payments.

04

Those seeking affordable payment plans: Auto loans allow individuals to spread the cost of purchasing a car over an extended period, usually through monthly installments. This enables borrowers to manage their budget more effectively and choose a repayment plan that suits their financial situation.

05

Individuals in need of a specific type of vehicle: Sometimes, people require a specific type of vehicle, such as a reliable family car, a fuel-efficient model, or a vehicle adapted for people with disabilities. An auto loan can help them acquire the right vehicle without a large upfront payment, making it more accessible and convenient.

Remember, it's essential to carefully assess your financial situation and choose an auto loan that aligns with your budget and repayment capabilities. Compare different lenders and loan options to find the most favorable terms for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit auto loan online?

With pdfFiller, it's easy to make changes. Open your auto loan in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit auto loan straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing auto loan right away.

Can I edit auto loan on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign auto loan right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is auto loan?

An auto loan is a type of loan provided by a lender to an individual or business entity for the purpose of purchasing a vehicle.

Who is required to file auto loan?

Individuals or business entities who wish to obtain financing for the purchase of a vehicle may apply for an auto loan.

How to fill out auto loan?

To fill out an auto loan application, you usually need to provide personal information, employment details, financial information, and details about the vehicle you intend to purchase. The specific requirements may vary depending on the lender.

What is the purpose of auto loan?

The purpose of an auto loan is to provide individuals or businesses with the necessary funds to purchase a vehicle without having to pay the full purchase price upfront.

What information must be reported on auto loan?

Typically, an auto loan application requires information such as your name, contact information, employment details, income, credit history, and details about the vehicle you intend to purchase.

Fill out your auto loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Auto Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.