Get the free Non Profit Organization / Religious Corporation - InfoTaxSquare.com

Show details

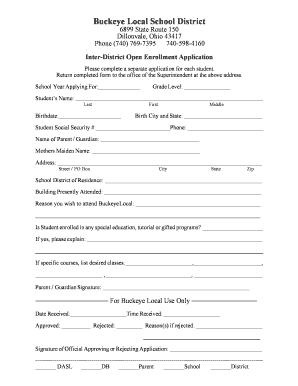

This document is intended for filing a Certificate of Incorporation for a Non-Profit Organization or Religious Corporation, including information such as company names, corporate officers, stock information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non profit organization religious

Edit your non profit organization religious form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non profit organization religious form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non profit organization religious online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non profit organization religious. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non profit organization religious

How to fill out a non-profit organization religious?

01

Research the requirements: Before filling out any paperwork, it is essential to research the specific requirements for establishing a non-profit organization with a religious focus. This typically includes understanding the legal and tax regulations that apply to religious non-profits.

02

Choose a name: Select a unique and appropriate name for your non-profit organization. Ensure that it accurately represents the religious focus and mission of your organization.

03

Draft your mission statement: Develop a clear and concise mission statement that explains the purpose and goals of your religious non-profit. This statement should reflect the core values and beliefs of your organization.

04

Complete the necessary paperwork: Obtain the required forms and applications to register your non-profit organization religiously. This usually includes filing for tax-exempt status and incorporating the organization under the appropriate religious designation.

05

Provide supporting documentation: Depending on your jurisdiction, you may need to provide supporting documentation such as a Certificate of Incorporation, Articles of Incorporation, or bylaws. These documents outline the structure and operations of your non-profit organization.

06

Obtain necessary licenses and permits: Check if any additional licenses or permits are required for your religious non-profit, such as permits for hosting events or operating religious educational programs.

07

Develop a board of directors: Assemble a dedicated and committed board of directors who share the religious vision and passion for the non-profit organization. These individuals will help guide the organization and make important decisions.

08

Create a budget and financial plan: Develop a comprehensive budget and financial plan for your religious non-profit. This should include projected income, expenses, and fundraising strategies to sustain the organization's activities.

09

Establish internal policies: Establish internal policies and procedures that adhere to the religious principles and ensure organizational transparency and accountability. This may include conflict of interest policies, fundraising guidelines, and financial management protocols.

10

Seek professional advice: Consider consulting with legal and financial professionals who specialize in non-profit organizations and religious entities. They can provide guidance, review your paperwork, and ensure compliance with all applicable laws and regulations.

Who needs a non-profit organization religious?

01

Individuals with a strong religious conviction: Those who have a deep-rooted religious belief and a desire to organize and make a positive impact within their religious community may opt to establish a non-profit organization with a religious focus.

02

Religious leaders or clergy: Spiritual leaders who want to formalize their religious work and expand their outreach may find it beneficial to establish a non-profit organization for their religious activities.

03

Religious communities and congregations: Groups of individuals who share a common religious faith and wish to collectively engage in charitable, educational, or religious activities can establish a non-profit organization religiously to facilitate their endeavors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non profit organization religious for eSignature?

Once your non profit organization religious is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I edit non profit organization religious on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign non profit organization religious right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit non profit organization religious on an Android device?

With the pdfFiller Android app, you can edit, sign, and share non profit organization religious on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is non profit organization religious?

A religious non-profit organization is an organization whose primary purpose is to promote and practice a specific religion or faith-based activities.

Who is required to file non profit organization religious?

Religious non-profit organizations are required to file with the appropriate government agency, usually the Internal Revenue Service (IRS) in the United States.

How to fill out non profit organization religious?

To fill out a religious non-profit organization filing, you will need to gather and report information such as the organization's mission, activities, financial information, and any relevant legal documentation.

What is the purpose of non profit organization religious?

The purpose of a religious non-profit organization is to provide a platform for religious worship, practice and education, as well as carry out charitable and community-serving activities based on religious principles.

What information must be reported on non profit organization religious?

Information that must be reported on a religious non-profit organization filing typically includes the organization's name, address, mission statement, financial information, details of key officers or board members, and activities undertaken.

Fill out your non profit organization religious online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non Profit Organization Religious is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.