Get the free Group Variable Universal Life (GVUL) program for NEBA - searchpub nssc nasa

Show details

This worksheet is designed to help you calculate the estimated monthly costs of optional life insurance coverage based on your age and salary, while outlining the rates for smokers and non-smokers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign group variable universal life

Edit your group variable universal life form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your group variable universal life form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing group variable universal life online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit group variable universal life. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out group variable universal life

How to fill out Group Variable Universal Life (GVUL) program for NEBA

01

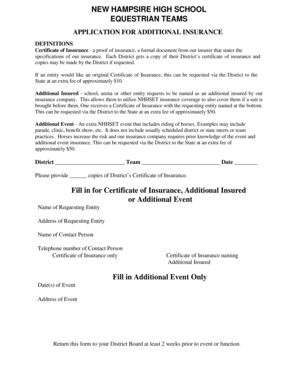

Obtain the Group Variable Universal Life (GVUL) program application form from NEBA.

02

Fill out the personal information section, including name, address, and contact details.

03

Provide information about your employment and employer details.

04

Select the coverage amount and beneficiaries for your policy.

05

Review the premium payment options and select your preferred method.

06

Complete any required health questionnaires or assessments.

07

Sign and date the application form.

08

Submit the completed application to NEBA through the specified channels.

Who needs Group Variable Universal Life (GVUL) program for NEBA?

01

Employees of companies that offer the GVUL program as part of their benefits package.

02

Individuals looking for flexible life insurance options with investment components.

03

People who want to provide financial security for their beneficiaries in case of untimely death.

04

Employees seeking additional voluntary life insurance coverage.

Fill

form

: Try Risk Free

People Also Ask about

What is group variable universal life insurance?

GVUL brings new life to life insurance with enhanced features that aren't available in traditional group term life plans. GVUL provides a life insurance benefit plus the ability to build tax-deferred cash value. That means you can provide a plan of protection for your loved ones in the event of your death.

Can I cash out my variable universal life policy?

Can you cash out a variable universal life insurance policy? You can cash out or surrender the policy. Surrender fees and any unpaid premiums will be subtracted, and you may have to pay taxes on the interest and dividends from the policy.

What is the difference between group term life and group universal life insurance?

Key Takeaways Term life insurance offers affordable, temporary coverage ideal for young families and specific financial obligations, while universal life provides lifetime protection with flexible premiums. Universal life builds cash value you can use, but borrowing from it may reduce your death benefit.

Can you withdraw money from a variable life insurance policy?

Yes, you can withdraw from the cash value of your variable life insurance policy. However, your withdrawal may incur taxes or fees, and it may reduce the amount of your plan's death benefit. Check with your insurance provider before making a withdrawal to be sure you understand the implications of cashing out.

Is VUL a bad investment?

One word, YES! VUL is a bad idea no matter what your financial goals are. If your goal is insurance, you're better off getting traditional insurance. If your goal is investment, you're better off with stocks, UITFs, mitual funds, etc.

What is the downside of variable universal life insurance?

Disadvantages of variable universal life insurance VUL is typically subject to surrender charges for a period of up to 15 years (more or less depending on the carrier) which can be very high in the early years of the policy.

What does GVUL mean in insurance?

Your Group Variable Universal Life (GVUL) policy combines valuable life insurance protection with an optional investment feature.

What is a variable universal life insurance policy?

Variable universal life (VUL) insurance is a form of permanent life insurance. It combines the main benefit of life insurance — a financial payout to your loved ones when you die — with investment subaccounts. These investment subaccounts can be used to invest the cash value of your policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Group Variable Universal Life (GVUL) program for NEBA?

The Group Variable Universal Life (GVUL) program for NEBA is a life insurance product that offers flexible premium payments and death benefits while allowing investments in various separate accounts, which can include stocks and bonds.

Who is required to file Group Variable Universal Life (GVUL) program for NEBA?

Employers or organizations that provide the GVUL program as part of their employee benefits package are required to file for the Group Variable Universal Life (GVUL) program for NEBA.

How to fill out Group Variable Universal Life (GVUL) program for NEBA?

To fill out the Group Variable Universal Life (GVUL) program for NEBA, organizations need to complete the necessary application forms, provide accurate employee and premium information, and submit it to the designated insurance provider or regulatory authority.

What is the purpose of Group Variable Universal Life (GVUL) program for NEBA?

The purpose of the Group Variable Universal Life (GVUL) program for NEBA is to provide employees with life insurance coverage that is flexible and potentially offers investment growth, tailored to meet their individual financial needs and situations.

What information must be reported on Group Variable Universal Life (GVUL) program for NEBA?

The information that must be reported on the Group Variable Universal Life (GVUL) program for NEBA includes details such as employee enrollment, premium payments, claims, and investment performance related to the separate accounts associated with the GVUL policy.

Fill out your group variable universal life online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Group Variable Universal Life is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.