Get the free An overdraft occurs when you do not have enough money in your account to cover a tra...

Show details

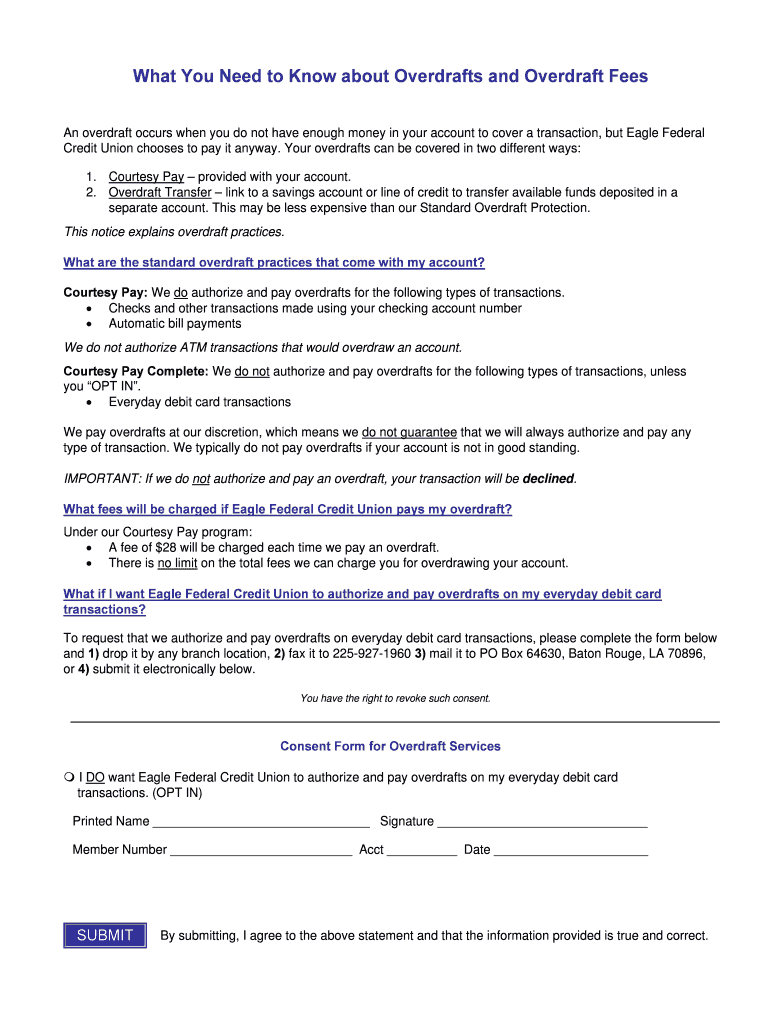

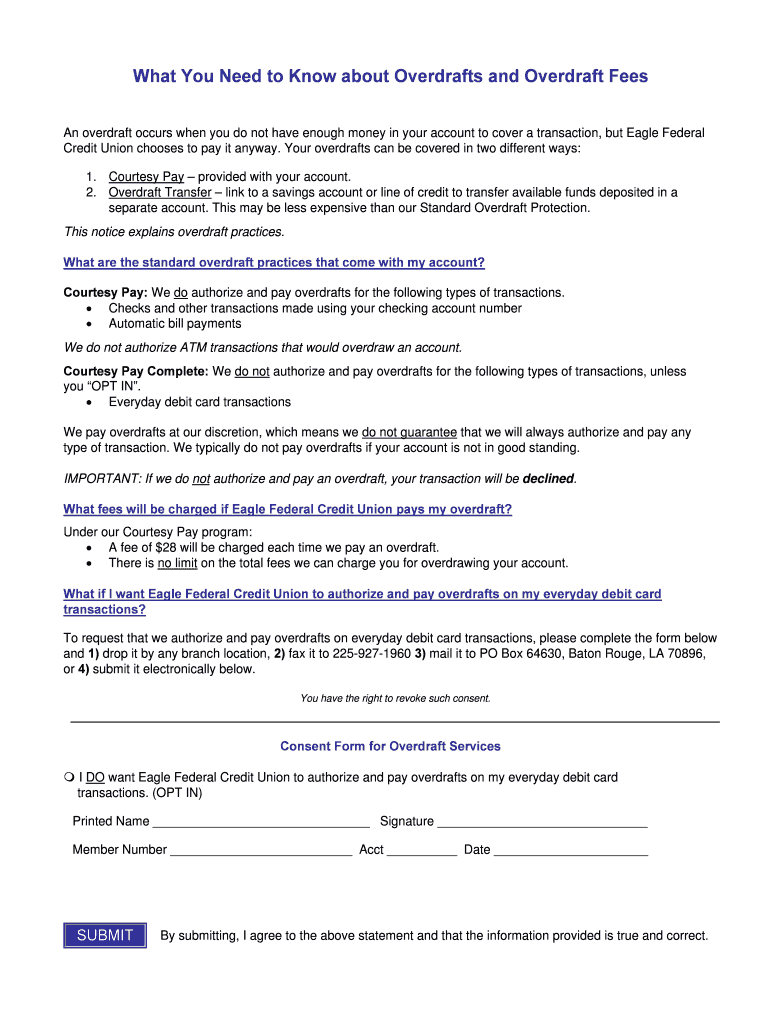

What You Need to Know about Overdrafts and Overdraft Fees An overdraft occurs when you do not have enough money in your account to cover a transaction, but Eagle Federal Credit Union chooses to pay

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an overdraft occurs when

Edit your an overdraft occurs when form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an overdraft occurs when form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit an overdraft occurs when online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit an overdraft occurs when. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an overdraft occurs when

How to fill out an overdraft occurs when:

01

Understand your financial needs and capabilities: Before filling out an overdraft application, assess your financial situation. Determine if there is a genuine need for additional funds and if you can afford to repay the overdraft amount. Consider factors such as income, expenses, and upcoming financial obligations.

02

Research different banks and financial institutions: Explore various banks and financial institutions that offer overdraft facilities. Compare their terms and conditions, interest rates, fees, and repayment options. Look for a reputable institution that aligns with your requirements and provides favorable overdraft terms.

03

Gather necessary documents: Prepare the required documents for the overdraft application process. This may include identification proof, financial statements, income proof, and any other documents requested by the bank or financial institution. Ensure that all the documents are accurate, up to date, and in the required format.

04

Fill out the application form: Obtain the overdraft application form from the chosen bank or financial institution. Carefully read the instructions and complete all sections accurately. Provide the necessary personal and financial details, ensuring that there are no errors or discrepancies.

05

Submit the application: Once you have carefully filled out the application form, submit it to the bank or financial institution as per their submission guidelines. Ensure that all required documents are attached along with the application. Double-check that you have provided all the necessary information and signatures.

06

Wait for the approval process: After submitting the application, the bank or financial institution will review your request. This may involve a credit check, evaluation of your financial stability, and verification of the provided documents. The approval process duration may vary between institutions.

07

Review and sign the overdraft agreement: If your overdraft application gets approved, carefully review the terms and conditions mentioned in the overdraft agreement. Ensure that you understand all the clauses and seek clarification for any doubts or concerns. If you agree with the terms, sign the agreement to finalize the overdraft facility.

Who needs an overdraft occurs when:

01

Individuals facing temporary cash flow issues: An overdraft can be beneficial for individuals who are experiencing short-term cash flow problems. It provides a convenient way to access funds when needed, without having to apply for a traditional loan or increase credit card debt.

02

Small business owners or self-employed individuals: Overdrafts can be useful for small business owners or self-employed individuals who may have irregular income streams. It allows them to manage unexpected expenses or bridge gaps in cash flow, helping to maintain business operations smoothly.

03

Individuals with unpredictable expenses: Some individuals may have irregular or unpredictable expenses, such as medical emergencies or home repairs. An overdraft can provide a safety net to cover these unforeseen costs until personal finances stabilize.

In summary, filling out an overdraft occurs when you understand your financial needs, research different institutions, gather necessary documents, fill out the application form accurately, submit the application, wait for approval, review and sign the overdraft agreement. An overdraft can be useful for individuals facing temporary cash flow issues, small business owners, and individuals with unpredictable expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the an overdraft occurs when electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your an overdraft occurs when in seconds.

How do I edit an overdraft occurs when straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing an overdraft occurs when right away.

Can I edit an overdraft occurs when on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign an overdraft occurs when right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is an overdraft occurs when?

An overdraft occurs when a withdrawal from a bank account exceeds the available balance and creates a negative balance.

Who is required to file an overdraft occurs when?

Individuals or businesses who have experienced an overdraft in their bank account are not required to file any specific documentation. However, they should rectify the negative balance by depositing sufficient funds to cover the overdraft.

How to fill out an overdraft occurs when?

Filling out an overdraft report is not necessary since it is not a formal filing process. Instead, individuals or businesses should address the negative balance by making a deposit to cover the overdraft or contacting their bank for assistance.

What is the purpose of an overdraft occurs when?

The purpose of an overdraft occurs when is to alert individuals or businesses of a negative balance in their bank account, indicating that withdrawals have exceeded the available funds.

What information must be reported on an overdraft occurs when?

There is no specific information to report on an overdraft occurrence since it is primarily seen as a negative balance situation in a bank account. However, individuals may need to provide their account details and transaction history to address the overdraft with their bank.

Fill out your an overdraft occurs when online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Overdraft Occurs When is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.