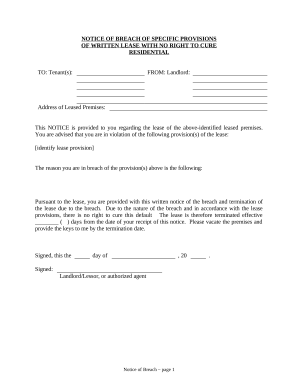

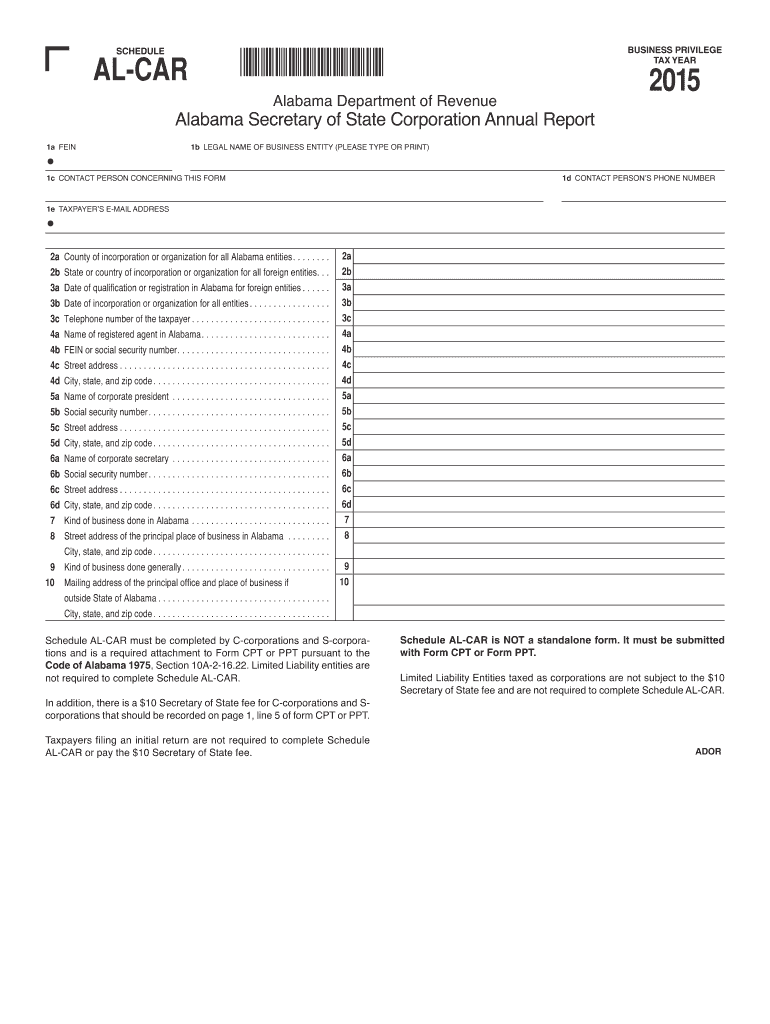

Get the free ALCAR 1a FEIN BUSINESS PRIVILEGE TAX YEAR *150005AL* SCHEDULE Alabama Department of ...

Show details

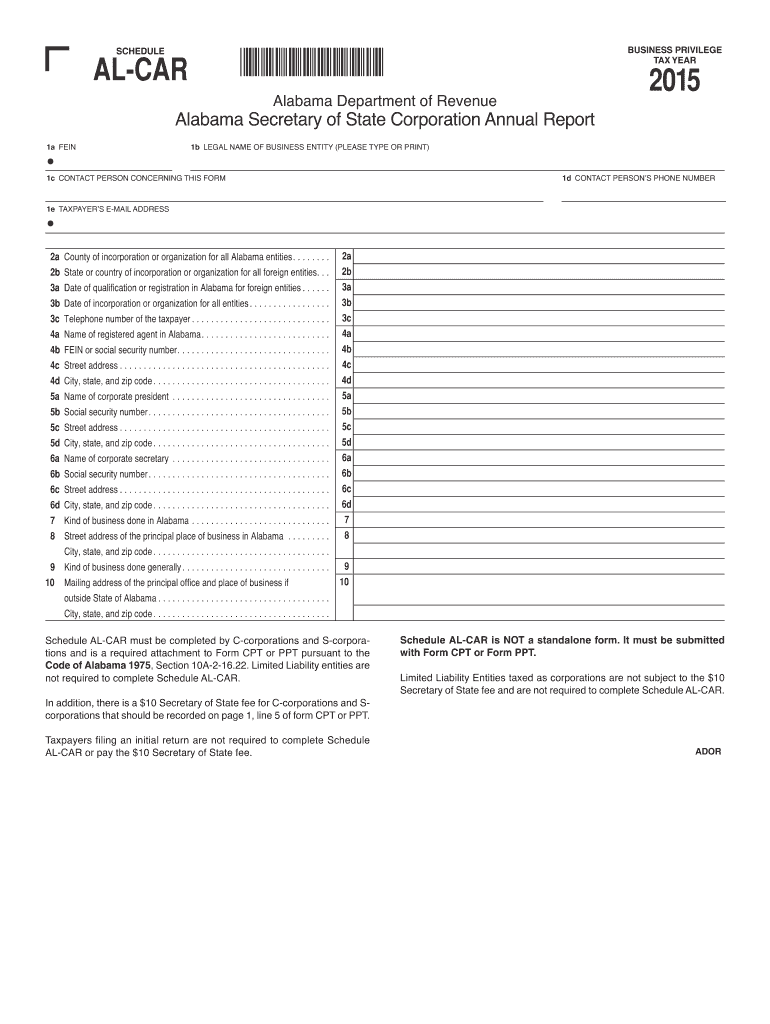

ALTAR 1a VEIN BUSINESS PRIVILEGE TAX YEAR *150005AL* SCHEDULE Alabama Department of Revenue Alabama Secretary of State Corporation Annual Report 2015 1b LEGAL NAME OF BUSINESS ENTITY (PLEASE TYPE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alcar 1a fein business

Edit your alcar 1a fein business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alcar 1a fein business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing alcar 1a fein business online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit alcar 1a fein business. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alcar 1a fein business

How to fill out alcar 1a fein business:

01

Start by gathering all the necessary information and documentation required for the application process. This may include your personal identification details, business information, and any relevant financial records.

02

Access the official website or platform where you can submit the alcar 1a fein business form. Ensure that you are using the correct and up-to-date version of the form.

03

Begin by providing your personal information, such as your name, address, contact details, and social security number. Make sure to enter accurate and complete information to avoid any delays or complications.

04

Move on to filling out the business information section. Include details about your company's name, address, type of business, and any additional registration or license numbers that may be required.

05

Provide any necessary financial information, such as income or revenue details, profit and loss statements, and other relevant financial documentation. This will help establish the financial eligibility of your business for the alcar 1a fein business status.

06

Review all the information you have provided to ensure its accuracy and completeness. Double-check for any spelling errors or missing data that may affect the processing of your application.

07

Submit the completed alcar 1a fein business form as instructed on the website or platform. Take note of any confirmation number or receipt provided to track the progress of your application.

08

Wait for the confirmation or approval of your alcar 1a fein business application. This process may take some time, so be patient and follow up if necessary.

09

Once you have obtained the alcar 1a fein business status, make sure to maintain compliance with any ongoing requirements or obligations to retain this designation.

Who needs alcar 1a fein business:

01

Freelancers or self-employed individuals who operate their own businesses can benefit from obtaining alcar 1a fein business status. It helps establish a distinct legal entity for taxation and legal purposes.

02

Small business owners or entrepreneurs who wish to separate their personal assets from their business liabilities may find alcar 1a fein business beneficial. It provides a level of liability protection and allows for accurate financial tracking and reporting.

03

Startups or new businesses that are looking to establish themselves as official entities can apply for alcar 1a fein business status. It allows them to operate legally and gain credibility with customers and clients.

04

Individuals or businesses that engage in professional services, such as consultants, accountants, or lawyers, may require alcar 1a fein business. It ensures compliance with professional licensing and regulatory requirements.

05

Companies or organizations that want to access certain business benefits or opportunities, such as government contracts or grants, may need to have alcar 1a fein business. It may be a requirement to qualify for specific programs or incentives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find alcar 1a fein business?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific alcar 1a fein business and other forms. Find the template you need and change it using powerful tools.

How do I edit alcar 1a fein business in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your alcar 1a fein business, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit alcar 1a fein business on an iOS device?

Create, modify, and share alcar 1a fein business using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is alcar 1a fein business?

Alcar 1a fein business refers to the initial tax form filed by a business to obtain an Employer Identification Number (EIN) from the IRS.

Who is required to file alcar 1a fein business?

Any business entity operating in the United States that pays employees or withholding taxes is required to file alcar 1a fein business to obtain an EIN.

How to fill out alcar 1a fein business?

Alcar 1a fein business can be filled out online through the IRS website or by submitting a paper form SS-4 to the IRS.

What is the purpose of alcar 1a fein business?

The purpose of alcar 1a fein business is to assign a unique identification number to a business entity for tax purposes and reporting.

What information must be reported on alcar 1a fein business?

The information reported on alcar 1a fein business includes the business name, address, type of entity, responsible party, and reason for applying.

Fill out your alcar 1a fein business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alcar 1a Fein Business is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.